MISO unveiled a first look at possible long-range transmission projects Wednesday, igniting testy exchanges between stakeholders over the necessity of extensive grid expansion.

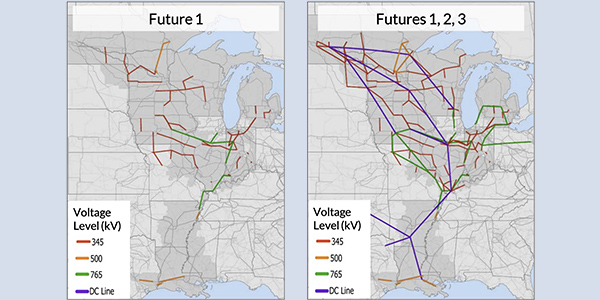

The RTO released an indicative map of solutions meant to give stakeholders a rough idea of project needs that might be pursued later this year under its long-range transmission package. The portfolio included more than a dozen 345-kV additions and a few 500-kV and 765-kV projects. Some stakeholders during Wednesday’s Planning Advisory Committee (PAC) argued against the expansion, while others said it was long overdue.

Staff said they may recommend some of the outlined transmission needs in the 2021 Transmission Expansion Plan (MTEP 21) later this year, but only if analysis can provide business cases for the projects.

Representatives from the Mississippi Public Service Commission led stakeholder questioning of MISO’s planning assumptions for the first round of long-range projects, which rely on a 20-year future planning scenario. The grid operator has said for months that it would use Future I — assuming 100% of utility integrated resource plans and 85% of utility announcements and state targets, with load growth consistent with current trends — as a starting point for long-range transmission planning. (See Long-term Tx Plan Edges Out MISO GI Coordination.)

MISO designed the future scenario to resemble member’s carbon goals, renewable generation additions and thermal generation retirements. It is one of three futures developed with stakeholders’ input in 2019 and early 2020. Staff gave notice late last year that they would rely on the three futures scenarios to model long-range transmission solutions.

Alongside new 345-kV lines across the Midwest, the draft map calls for a large 765-kV line spanning Iowa, Illinois, and Indiana, and a second that begins in Indiana and links MISO Midwest with MISO South. The map also shows 500-kV solutions across Manitoba, Canada, and Minnesota and an oft-constrained area in East Texas and western Louisiana.

When MISO adds Futures II and III assumptions — with wind and solar penetration of 30% and 50%, respectively, by 2039 — the map indicates a need for several more 500-kV and 765-kV lines and a massive footprint-wide network of DC lines. Staff said some HVDC lines could be developed first as 765-kV lines and later adapted to DC with converters.

Mississippi PSC staffer Bill Booth said it was the first time that he heard MISO might pursue HVDC lines as part of the long-range plan.

“It seems a little bit like we’re making this up as we go along,” Booth said. He asked MISO to develop a “logical, strategic plan” that can be implemented “over time.”

MISO’s executive director of system planning, Aubrey Johnson, said staff must perform more analysis before it advances any proposals as preferred solutions.

WEC Energy Group’s Chris Plante criticized the first future scenario as not completely in line with utilities’ integrated resource plans, especially during the next five to eight years. He said MISO’s urgency could be exaggerated.

“I don’t think that Future I represents my company’s near-term resource plans,” Plante said.

But Clean Grid Alliance’s Natalie McIntire said it will be a challenge to get necessary transmission lines up within the next five to eight years to bring planned renewable generation online.

“As far as we’re concerned, this planning process is already behind schedule,” McIntire said. “We’ve been through all of this already, and I don’t think it’s useful … for stakeholders to rehash futures assumptions.”

McIntire argued that Future I, which originally predicted a 40% carbon reduction from 2005 levels by 2040, quickly morphed into a 60% reduction based on members’ new and updated goals.

“Future I is becoming faster all the time,” she said.

Stakeholders Invoke Southern Blackouts

“We had major blackouts a month ago in MISO South, and to take this long to figure out that we need more power to get to MISO South is absurd,” Southern Renewable Energy Association Director Simon Mahan said. “We’ve got people down here that have been without power and water, and to litigate this over five years? This is taking too long. Let’s not do this, especially in sight of what happened last month.”

Sustainable FERC Project Counsel Lauren Azar said she’s seen firsthand the fallout from an under-planned grid when she was a Wisconsin Public Service Commissioner.

“Back in the 1990s, Wisconsin’s grid almost collapsed due to the lack of transmission,” Azar said. “The grid is evolving … whether we like it or not. We’re going to see a rapid transformation. And we also saw in the South, laid bare … that we don’t have a resilient system down there.”

Azar was referencing the summer of 1997, when two of Wisconsin’s nuclear stations were offline for repairs and inadequate transmission system upgrades left the state flirting with widespread blackouts.

Johnson said MISO believes there’s strength in a more interconnected system that can deliver renewable energy to load centers. He said increasing electrification also compounds MISO’s sense of urgency.

“The electric sector has not had to respond to demand growth anything like this in the past decade,” Johnson said.

Booth asked whether the RTO envisions all solar generation in MISO South being deliverable to MISO Midwest and conversely, all wind generation in MISO Midwest being able to move into the South.

“I think we’re saying there’s a level of interconnectedness,” Johnson said. “I don’t think it’s a case where everything from the South has to go North.”

Though MISO has a rough idea of some routes, it does not have a cost-sharing method for the projects.

Jarred Miland, senior manager of system planning coordination, said if the stakeholder-led cost-allocation working group cannot settle on a new allocation mechanism for long-range projects by the end of the year, MISO will use the methods under its existing project categories.

Stakeholders again asked staff for more frequent updates on the long-term planning effort.

WPPI Energy’s Steve Leovy said the long-term planning effort deserves more than quarterly presentations to stakeholders.

“We’ve heard that recurring crescendo from the stakeholders,” Senior Director of Transmission Planning Jeff Webb said. MISO has no problem delivering monthly updates at PAC meetings, he said. However, Webb warned that some updates could be brief if there are few developments to report.

Plante asked for more detailed discussions beyond those in the PAC and separate stakeholder workshops on long-term planning.

“Those of us that are transmission planning geeks want to know the end-point substations. … What are the constraints these projects are hoping to solve,” Plante said. “That’s the level of transparency we’re looking for. The PAC’s agendas are simply too full to have this kind of fulsome discussion. Time just doesn’t allow for it.”