ICSA Vote Delayed

PJM delayed a vote on a proposal for changes to the pro forma interconnection construction service agreement (ICSA) after stakeholders at last week’s Planning Committee meeting asked the RTO to take more time and use clearer language.

Mark Sims, PJM manager of infrastructure coordination, reviewed the proposed problem statement, issue charge and tariff revisions addressing the RTO’s concerns associated with the ICSA’s lack of language on supersedure and its current automatic termination provision. Sims presented the issue in March at the PC meeting and later brought it to the Markets and Reliability Committee for a first read. (See “Interconnection Construction Service Agreement,” PJM MRC/MC Briefs: March 29, 2021.)

Sims said the growing interconnection queue volume has created the need for dealing with the issue. PJM wants to “remain focused on efficiency,” Sims said, and have identified improvements in two areas of tariff Attachment P that deal with ICSAs.

Section 1 does not contain pro forma language that considers when an ICSA supersedes an already effective agreement, Sims said, causing “increased administrative burden” for PJM.

The tariff provides for automatic termination of an ICSA upon the occurrence of certain conditions, he said, which can occur without PJM’s knowledge. The conditions include completion of construction of all interconnection facilities, a transfer of title, final payment of all costs or delivery of final as-built drawings to the transmission owner. Sims said PJM wants TOs to notify them when the conditions have been met.

PJM received little feedback regarding the supersedure language, Sims said, but stakeholders had several comments regarding the termination provision. Sims said PJM is “revisiting” the tariff language and have engaged in several conversations with stakeholders.

“Our goal is to make it as unburdensome as possible, quick and easy, straightforward and accomplish a solution for the problem we’re trying to fix,” Sims said.

Pulin Shah, director of transmission strategy and contracts for Exelon, asked if there was an “urgent need” by PJM to make the changes. Shah said the language in the issue charge would benefit from another month to discuss its implementation and details, making stakeholders “more comfortable” with the proposed solution. “We need to fully understand what this is going to entail.”

Sims said PJM didn’t see an urgent need for endorsement and was open to a delay.

Carl Johnson of the PJM Public Power Coalition said he would like to see the RTO have more discussions with TOs and “accommodate” any concerns with the language. Johnson said TOs will ultimately be the stakeholders filing comments with FERC if they aren’t satisfied with the tariff language that’s endorsed, so it was important to address problems up front.

Alex Stern, director of RTO strategy for PSEG Services, had provided a friendly amendment to the proposed tariff language at the March MRC meeting. The amendment proposed that the notification obligation be “reciprocal” so that PJM would provide written notice to the interconnected TO and customer generator that the ICSA has been canceled with FERC.

PSEG has been working with PJM to come up with a compromise, Stern said, but they haven’t been able to reach an agreement. “If we can fix this by taking a little bit more time, that would make sense.”

CIR Issue Charge Endorsed

Stakeholders endorsed an issue charge aimed at addressing the capacity interconnection rights (CIRs) of variable resources. The measure passed with 99% support, as only one member voted “no” on the issue charge.

Jonathan Kern of PJM reviewed the problem statement and issue charge. Kern said the RTO made extensive revisions to both documents after receiving “significant stakeholder feedback” when the issue was first presented at the February PC meeting. (See “Capacity Interconnection Rights,” PJM PC/TEAC Briefs: Feb. 9, 2021.)

The RTO engaged in one-on-one discussions with several different stakeholders, who said several items in the key work activities of the issue charge were out of scope and recommended further modifications, Kern said.

Changes include making the effective load-carrying capability (ELCC) analysis, other than those required to incorporate CIRs as inputs to the ELCC calculations, as an out-of-scope item. Kern said the primary reason for the change was to clarify that the bulk of the ELCC analysis will be out of scope in discussions and to specify which portions of the analysis will be in scope.

A second change was making alterations to how PJM conducts its market and operation functions out of scope in the issue charge. Kern said direct inputs that are provided by and processes that are overseen by System Planning to support the market and operation functions will be considered in scope.

PJM also removed items related to winter CIRs and energy and capacity market considerations.

Kern said PJM will now hold a series of monthly discussions with the PC to develop and propose changes to the applicable manuals and governing documents by the end of the year. He said PJM will hold educational sessions and discuss and develop proposals from April to October and present a proposal to the MRC in November.

Interconnection Process Reform Endorsed

Members unanimously endorsed PJM’s proposal to address challenges caused by the increasing interconnection queue volume.

Jason Connell, director of infrastructure planning for PJM, reviewed the problem statement and issue charge first brought to the PC last month. (See “PJM Proposes Effort to Respond to Interconnection Volume,” PJM PC/TEAC Briefs: March 9, 2021.)

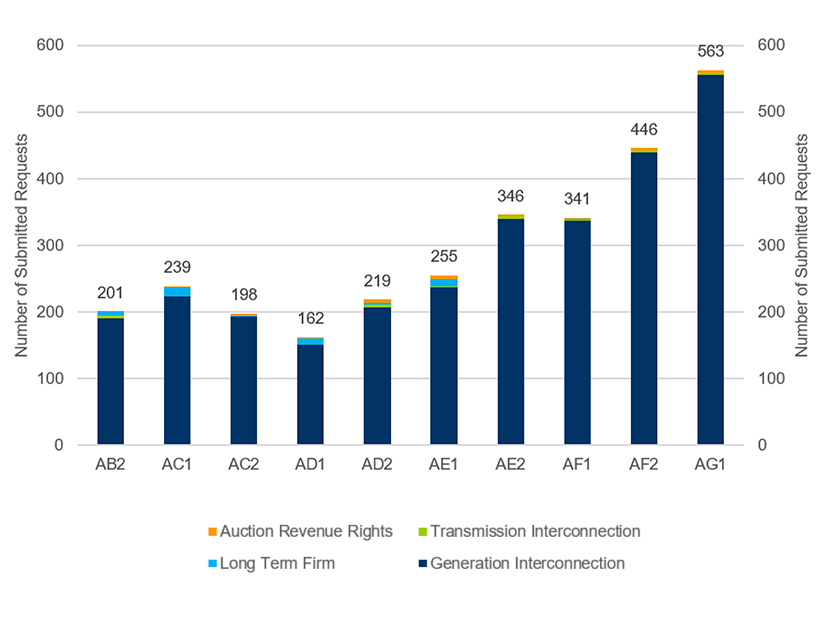

Connell said the interconnection queue volume has more than tripled over the past three years, with PJM going from accepting around 400 projects per year to more than 1,000 in 2020 and even more slated for 2021.

The on-time rates of feasibility and system impact studies have continually improved, Connell said, but the backlog of requests has increased, causing concern for PJM and its stakeholders as the RTO has had to divert resources to finish studies by deadlines.

PJM proposed several key work activities in the issue charge, including interconnection studies, cost responsibility, interim operation and agreements, requirements for new service requests and other opportunities that can “positively impact” the current and future interconnection queue backlog.

Stakeholders suggested a clearer delineation of the “cost responsibility” key work activity at last month’s PC meeting, Connell said, describing it instead as “cost concerns” and splitting discussions between project cost estimates and the cost responsibility for network upgrades.

A suggestion of incorporating a target date for having the issue completed was also added to the issue charge. Connell said PJM would like to have the issue finalized by the end of 2021 and have a FERC filing by January 2022.

Ken Foladare of Tangibl said he would “strongly” recommend against having a set deadline and timeline to complete the issue. Foladare said FERC has not given PJM a deadline, so it shouldn’t arbitrarily be rushed.

The interconnection process needs to be examined carefully, Foladare said.

“This is going to affect way too many things,” Foladare said, “and at the end of the day, there’s a lot of dollars involved as well.”

Connell said the concept of having a target date was to give PJM and stakeholders a goal to work toward but that it is not firm. He said PJM is still deciding whether to use a task force for reporting to the PC or scheduling special sessions of the PC to deal with the interconnection issue.

“We are not going to compromise a good process for a time limit,” Connell said.

New Service Reviewed Again

Connell also provided a second first read of the problem statement and issue charge and reviewed draft tariff language outlining the RTO’s proposed “quick fix” to extend its deadline for responding to new service requests. PJM received several comments from stakeholders at the March PC meeting and worked to address issues, Connell said. (See “New Service Requests,” PJM PC/TEAC Briefs: March 9, 2021.)

“We think we’ve arrived at a good solution to be agreeable to all folks,” Connell said.

PJM processes new service requests under several parts of the tariff, Connell said, with the RTO administering two new queue windows each year: one from April 1 to Sept. 30, and another from Oct. 1 to March 31.

Connell said the tariff currently establishes “tight time frames” requiring PJM to review a new service request and issue a notice of any deficiencies within five business days. In turn, he said, interconnection customers are required to respond to a deficiency notice within 10 business days, and PJM is provided an additional five business days to review the response to the deficiency notice.

PJM typically receives 50% or more of the total number of new service requests during the last month of a queue window, Connell said, with most of the requests submitted during the last week or on the last day of the window. He said the short window impacts the ability of PJM employees to perform reviews on time, leading the RTO to seek waivers from FERC to extend the deadline.

In the queue window that ended in September, Connell said, 340 of the 563 new service requests were filed in the last week, including 247 on the last day. Connell said the latest queue window that ended March 31 will have about 700 new service requests.

PJM’s proposed solution is to change the five-day deadline to 15, Connell said, or to “use reasonable efforts to do so as soon thereafter as practicable.”

Stakeholder feedback from the March PC meeting included moving up the closing of the new service queue by about three weeks to allow more review time of the applications by PJM. Impacted stakeholders indicated the new deadline would not affect the model build cycle and analysis of TOs.

Connell said the proposed solution would also provide PJM 15 business days to review the interconnection customer’s response to the deficiency notice.

Stern said he appreciated PJM incorporating stakeholder feedback into the issue charge. He said the previous proposal could have created more backups.

“This revised approach seems like a win-win-win,” Stern said. “It’s probably a win for the queue applicants, those with queue study responsibilities and for PJM.”

PJM will seek endorsement at the May PC meeting.

Transmission Expansion Advisory Committee

Offshore Transmission Study Update

Matthew Bernstein, state policy solutions analyst for PJM, provided an update on the offshore transmission scenario study during last week’s Transmission Expansion Advisory Committee meeting. Bernstein first updated the committee of the work being done to analyze the regional transmission solutions to accommodate state offshore wind goals. (See PJM States Exploring 6 Scenarios in OSW Tx Study.)

PJM was originally looking at six different scenarios for analysis, Bernstein said, but settled on five during the final analysis process.

Scenario 1 is being called a “short-term scenario,” Bernstein said, with a timeline extending to 2027 and includes an OSW injection set of 9,020 MW at various locations on the system. It also includes modeling that factors in generator deactivations and state policy goals through 2027.

Scenarios 2 to 5 have a timeline extending to 2035, Bernstein said, and include injection ranges between 17,620 and 19,620 MW. The four scenarios also include increased locational variability in the injection points.

Bernstein said the injections for the scenarios are “slightly higher” than the currently announced state policies for OSW generation. He said the study will allow PJM to model what the system can handle in addition to what has already been announced.

Based on the initial study findings and feedback from states, Bernstein said, PJM may study up to five additional scenarios. He said the RTO will present results of the scenario studies when they’re completed, which is anticipated in the second half of 2021.

Generation Deactivation Notification

Phil Yum, of PJM’s system planning modeling and support department, provided an update on recent generation deactivation notifications, including a request to deactivate the Martins Creek Power Plant Unit 4, a 17.3-MW oil and gas generation unit on the Delaware River in Northampton County, Pa., in the PPL transmission zone. The deactivation is scheduled to take place by May 31, 2022.

Yum said both PJM and PPL did not identify any reliability impacts or violations from the deactivation of the unit, which Talen Energy owns.