The problem with building large interregional transmission lines is that the benefits of these projects may be spread over a range of stakeholders but, at the same time, be difficult to monetize, which is why — a new report argues — the energy industry needs a federal investment tax credit specifically for transmission.

“Private developers of transmission currently see little price signal to invest in large-scale regionally beneficial lines, as many of the economic, reliability, resilience and carbon-reduction benefits of transmission do not accrue to them,” says the report released Thursday by the American Council on Renewable Energy. “Since cost allocation policies do not capture many of the benefits of interregional transmission, a tax credit is the simplest way to capture and spread the cost as widely as possible.”

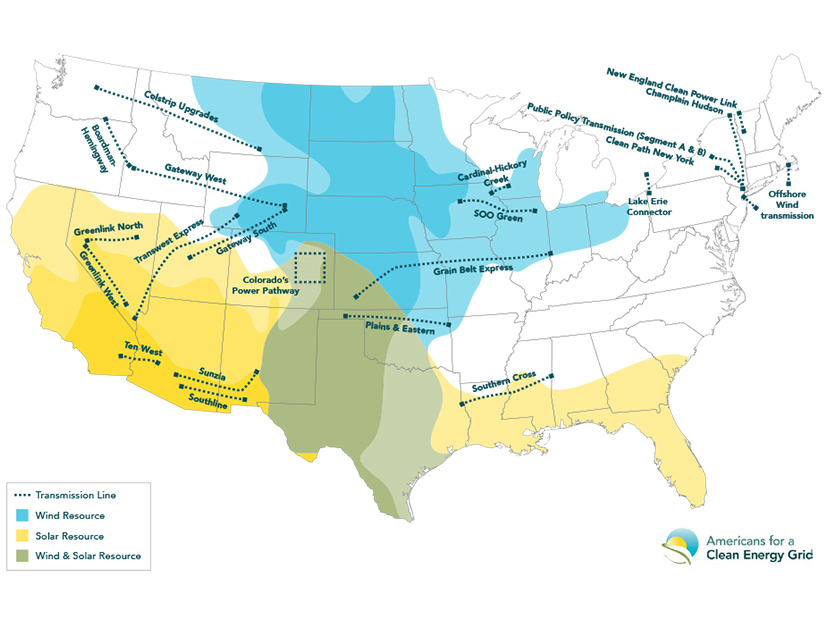

The study looks at 22 “regionally significant” transmission projects currently in various stages of development across the U.S. that could benefit from the 30% federal ITC that the report advocates for as part of President Biden’s $2 trillion infrastructure plan. Reaching Biden’s ambitious goal of decarbonizing the U.S. grid by 2035 will require a massive, and fast, buildout of new high-voltage transmission, and a transmission ITC is “the right tool for the job,” said Rob Gramlich of power industry consultant Grid Strategies and one of the authors of the ACORE report.

“Tax credits are well known to the electricity business,” said Gramlich, one of several speakers at a Thursday webinar to launch the report. “Developers know how to use them; investors know how to finance projects with them. It works for the type of regionally significant, large-scale, regional and interregional lines that are not really getting built today.”

He defined “regionally significant” as a project of 275 kV or more, which “significantly influences the regional power flow.” As outlined by the White House, Biden’s American Jobs Plan calls for a transmission ITC but does not specify a percentage or any other details on projects that would qualify.

While the ACORE report admits that only about half of the 22 projects mentioned might actually get built, those lines could add 20.6 GW of capacity to the U.S. power system and support the interconnection of another 30 GW of renewable energy capacity. New jobs created would include 330,000 in transmission and another 320,000 in renewable energy, the report says.

But the strongest selling point for a transmission ITC may be the need for improving grid reliability and resilience. “It shouldn’t take extreme winter storms in Texas for us to see that our transmission infrastructure and electrical grid are in desperate need of an update and an overhaul,” said Sen. Martin Heinrich (D-N.M.), who first introduced a bill for a 30% transmission ITC in 2019 and reintroduced an updated version (S.B. 2016) this year.

One of the projects referenced in the report, Pattern Energy’s Southern Cross transmission line, would provide a 500-kV, 2,000-MW connection between SERC Reliability’s territory and ERCOT, and is targeting 2022 to begin construction according to a project fact sheet.

Under Heinrich’s bill, projects eligible for the ITC would have to be over 275 kV and a minimum capacity of 500 MW, and be able to deliver power produced in either a rural area or offshore. Both AC and DC projects would be covered.

Who Wants to Pay?

Financing large-scale, interregional transmission can be particularly challenging for merchant developers, said Shashank Sane, senior vice president and head of transmission at Invenergy. “The beneficiaries of these projects can be diverse, and so in order to monetize the value of those lines, we have to find the stakeholder who is willing to pay for a certain benefit and create those links,” Sane said. “That’s really not the right model.”

For example, he said, Invenergy’s Grain Belt Express project now under development is aimed at bringing wind power from Kansas across Missouri, Illinois and ultimately to Indiana, providing a connection to MISO and PJM.

“The ITC is the key tool that will enable [the project] because it addresses the cost allocation problem and paying for those multiple benefits a single beneficiary is not willing to pay for,” Sane said.

Gramlich said the ITC could help both merchant developers and RTOs stand up more large-scale, interregional transmission. “There’s no RTO tariff to recover the costs,” he said. “What we have is a current environment where everybody sits around these RTO stakeholder tables and says, ‘I don’t want to pay for this. Do you want to pay for it?’ And they kind of stare at each other, and nothing gets planned.”

The report notes that, despite FERC Order 1000 and other policies aimed at stimulating transmission planning, very few large-scale RTO projects have been built in the past decade, and with the notable exception of PJM, investment in regional transmission has fallen off in the past five years. If the ITC can help draw investors to even half the projects mentioned in the report, the total capital involved could top $15 billion, the report says.

But as negotiations begin on Biden’s infrastructure plan, whether a transmission ITC will emerge as part of any compromise remains uncertain. ACORE CEO Gregory Wetstone is optimistic that the jobs and reliability benefits that large-scale transmission projects offer will help “bridge the partisan divide,” he said in an email to RTO Insider.

Permitting Reform

Even if it does pass, a transmission ITC does not address the complex, expensive and time-consuming challenges of getting large-scale transmission projects permitted. According to Christina Hayes, vice president for federal regulatory affairs at Berkshire Hathaway Energy, the company’s Gateway West project, which would bring Wyoming wind power to the Pacific Northwest, has been in development since 2007.

The project’s final segments may not come online until 2030, according to PacifiCorp, the Berkshire Hathaway utility building the line with Idaho Power.

Meanwhile, Grain Belt is currently stalled in Missouri, where the company’s potential use of eminent domain to secure the land it needs for the project has resulted in opposition from landowners and lawmakers. A bill introduced Thursday in the state legislature would require the project to get statements of support from every county commission in the counties it would cross.

Heinrich recently introduced another bill (S. 1501) that, he said, would “direct FERC to improve its interregional transmission planning process.” He also pointed to Biden’s proposal to establish a new Grid Authority Office at the Department of Energy as a step in the right direction.

However, the report says, “compared to a tax credit, an overhaul of federal regulations takes years to be developed, enacted and implemented. The policy will have to meet cost allocations established by courts to demonstrate that every entity that pays receives benefits.”

Other kinds of federal assistance, such as DOE grants, could trigger the need for an environmental impact analysis under the National Environmental Protection Act — also expensive and time consuming, the report says.

ACORE COO Bill Parsons said a transmission ITC answers the need for urgency in ramping up renewable energy at the rate needed to decarbonize the U.S. grid by 2035. “This is not a time to be penny wise, pound foolish,” he said. “This is a time for a policy response on the order of the magnitude of the challenge.”