ICSA Endorsed

Stakeholders last week endorsed PJM’s proposal for changes to the pro forma interconnection construction service agreement (ICSA).

The nearly unanimous endorsement at the May 11 Planning Committee meeting followed several months of delays as members requested that PJM clarify language in the “quick fix” proposal. (See “ICSA Vote Delayed,” PJM PC/TEAC Briefs: April 6, 2021.)

Mark Sims, PJM manager of infrastructure coordination, reviewed the proposed problem statement, issue charge and tariff revisions addressing the RTO’s concerns associated with the ICSA’s lack of language on supersedure and its current automatic termination provision.

Sims said PJM and stakeholders changed the proposal to address the growing interconnection queue volume, identifying improvements in two areas of tariff Attachment P that deal with ICSAs.

“We’ve had some good discussions and answered some questions as far as implementation, and I think we’re in a good place,” Sims said.

No changes were made to the ICSA superseding language from previous meetings, Sims said, but PJM did restructure the automatic termination provision into two separate sections covering conforming and non-conforming agreements. Sims said the resulting language in the sections is an “easier read” and “much clearer” as far as what PJM expects from transmission owners and what the RTO will do in return for cancellation of certain agreements with TOs.

Sims said stakeholder discussions and feedback also led to clearer ideas for the notification process for TOs. He said PJM is still determining the future format of the notification document and method of communication, but for now the RTO has developed a “straightforward” PDF form with all the tariff requirements.

PJM plans to bring the issue charge and tariff language for a first read at the May 26 Markets and Reliability Committee meeting and an endorsement in June.

“We’re going to continue to work on all the parallel implementation issues,” Sims said.

Alex Stern, director of RTO strategy for PSEG Services, thanked PJM for its work on the issue and for not rushing through the stakeholder process.

“I know the quick fix took a few months longer than PJM wanted, but I do think the extra time helped us get clearer and better language,” Stern said.

Manual 14F and 14B Updates

Members unanimously endorsed changes to Manual 14B and 14F resulting from work completed by the Market Efficiency Process Enhancement Task Force (MEPETF) last year. (See PJM Stakeholders Debate Market Efficiency Proposals.)

Nick Dumitriu of PJM provided a review of Manual 14B and Manual 14F conforming language for the MEPETF capacity driver docket filed with PJM MRC Briefs: Aug. 20, 2020.)

In the October MRC vote on capacity drivers benefits, stakeholders approved the PJM proposal that uses a single-draw Monte Carlo simulation, with simulations for both Reliability Pricing Model (RPM) and Regional Transmission Expansion Plan (RTEP) years. Members also approved a PJM proposal on the window for capacity drivers and to clarify when capacity benefits of market efficiency projects are calculated.

Dumitriu said the Manual 14B conforming language included adding RPM constraints to the list of constraints that also have an economic impact and to clarify the definition for the total annual enhancement benefit. Manual 14F changes included adding information regarding the window type and duration for RPM economic constraints in the proposal window overview and adding language regarding the expected in-service date for projects that address RPM constraints in the reliability criteria project evaluation section.

The manual changes will go to the May MRC meeting for a first read and a final endorsement at the June meeting.

Manual 21 Updates Endorsed

Stakeholders unanimously endorsed minor changes to Manual 21 as part of the biennial review.

Jerry Bell of PJM’s resource adequacy planning department provided a review of the updates to Manual 21: Rules and Procedures for Determining Generating Capability.

Bell said the manual changes included a minor restructuring, moving provisions for testing units that were mothballed or existing units that want to enter the markets from the capability verification testing section (1.3.3) to the capacity modification (CAPMOD) testing section (1.3.2).

A new section on generator site conditions and weather data was also added to the manual (2.1.1). Some of the points include mandating that all generators at the same plant are to use the same weather data source and that both observed and rated generator site conditions are to be based on plant weather station records or local weather bureau records.

Bell said stakeholder feedback expanded a bullet point that local weather bureau records can be attained from organizations such as NOAA, universities, colleges and commercial weather services. The added language said that “the weather station selected should be a good surrogate for the conditions at the plant; it does not necessarily need to be the weather station that is closest in proximity to the plant.”

PJM will seek endorsement of the manual updates at the May MRC meeting.

2021 RRS Assumptions

Jason Quevada of PJM’s resource adequacy planning department presented a first read of the 2021 reserve requirement study (RRS) assumptions developed in the Resource Adequacy Analysis Subcommittee.

Quevada said the study results will reset the installed reserve margin (IRM) and the forecast pool requirement (FPR) for the 2022/23, 2023/24, 2024/25 delivery years and establish the initial IRM and FPR for the 2025/26 delivery year.

The 2021 RRS assumptions are similar to those in the 2020 RRS except for the modeling of effective load-carrying capability (ELCC) resources. Quevada said all variable resources, including wind, solar, hydro, landfill gas, and storage-type resources such as pumped hydro, batteries, hybrids and generic limited-duration resources, will be excluded from the RRS.

Quevada said the capacity value of ELCC resources will be calculated with the ELCC model, which is largely consistent with the RRS.

“This change will cause a negligible impact on both the IRM and FPR,” Quevada said.

Stakeholders will vote on an endorsement of the study assumptions at the June PC meeting. The final RRS report will be presented to the RAAS and PC in September, Quevada said, and PJM will seek approval in October.

Transmission Expansion Advisory Committee

NEET Project Update

Kshitij Shah, director of development for NextEra Energy Transmission (NEET), presented the updated needs for a proposed supplemental project in Indiana. Shah first presented the proposed solution at the March TEAC meeting. (See “NEET Supplemental Project,” PJM PC/TEAC Briefs: March 9, 2021.)

The supplemental project is NEET MidAtlantic IN, a 20-mile, 345-kV double-circuit transmission line in northwest Indiana consisting of 115 galvanized steel lattice structures. NEET purchased the transmission line from Commonwealth Edison in October, becoming a transmission owner in PJM.

Shah said the transmission lines were built in 1958 and that increased failures are expected because of the age of the components. The potential solution calls for rebuilding the line with monopoles and new conductor on the existing right-of-way. Shah said the projected in-service date is proposed for January 2023.

Shah said NEET is presenting a “slightly different approach” from the March project update to achieve the exact same proposed solution through splitting the needs of the project.

NEET engineers found that the northern circuit on the line is a “little complicated” and requires some issues that need to be addressed, Shah said, including conductor selection based on the existing grid characteristics and coordination with neighboring TOs ComEd, American Electric Power and Northern Indiana Public Service Co.

The updated project includes rebuilding the 20-mile-long southern double-circuit line with monopoles and new conductor using existing rights-of-way. Shah said NEET is looking to address the needs of both the northern and southern lines “simultaneously for efficient cost management” and because of a “time crunch to schedule some of the long-lead items.”

Shah said by splitting up the needs of the project, NEET can continue to progress through the M-3 process and procure some of the needed structures and other needed materials.

“This is the most comprehensive solution, which ensures adherence to our operational strategy and posted end-of-life assumptions,” he said.

NEET plans to bring a solution for the northern circuit to an upcoming TEAC meeting after discussing coordination issues with the neighboring TOs.

The estimated project cost is $51.9 million, down from the initial $63.4 million cost proposed at the March TEAC meeting.

“Addressing these separately is not good engineering, nor is it economic,” Shah said. “Doing nothing is not an option, not feasible and it does not fit our risk parameters.”

Generation Deactivation Notification

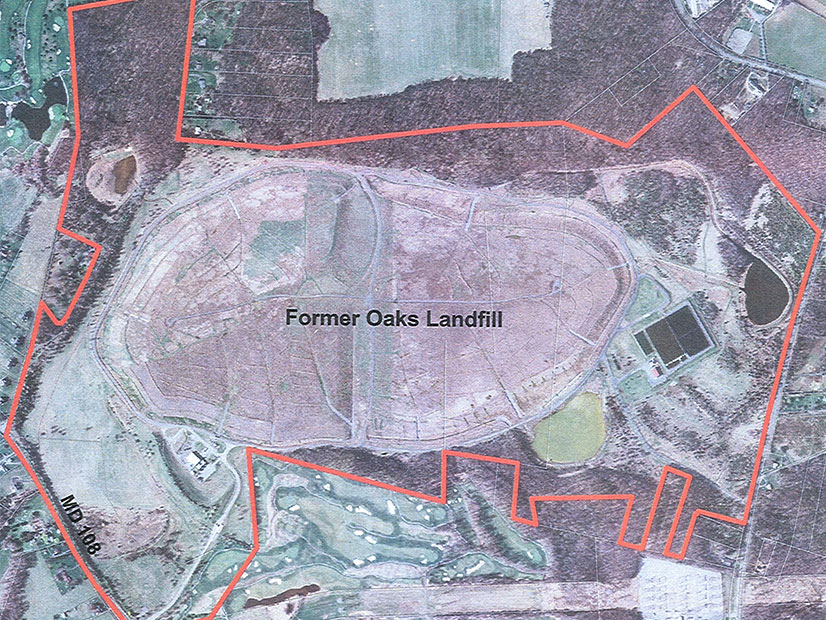

Phil Yum of PJM provided an update on recent generation deactivation notifications, including the Oaks Landfill in the Pepco transmission zone in Montgomery County, Maryland.

According to Montgomery County records, the Oaks Landfill is approximately 545 acres with a waste disposal footprint of 170 acres. The county-owned site received mixed municipal solid waste beginning in June 1982 and closed in 1997, containing more than 7 million tons of waste.

A 2.2-MW landfill gas-to-energy facility started operation at the property in mid-2009. The requested deactivation date is July 16, Yum said, and Pepco is currently conducting a reliability analysis.