PJM stakeholders endorsed an issue charge aimed at addressing regulation for virtual combined cycle units as some questioned whether the work will ultimately prove too complex.

The issue charge, brought forward by Vistra, won 91% support, with 203 members voting in favor and 20 voting against at last week’s Market Implementation Committee meeting. The issue was first brought to the committee at last month’s MIC meeting. (See “Virtual Combined Cycles,” PJM MIC Briefs: April 7, 2021.)

Becky Robinson of Vistra reviewed the problem statement and issue charge, saying units that are modeled virtually by PJM can sometimes receive regulation awards from the market clearing engine that vary, which Vistra has been experiencing with some of its units.

The issue charge proposed education on the operational and technical difficulties of operating virtually modeled combined cycle units with different regulation assignments and brainstorming possible solutions to ensure that regulation awards are consistent.

Robinson said a few edits resulting from stakeholder feedback were made to the issue charge after it was first introduced at the MIC. In the key work activities, Robinson said, some members wanted to highlight how regulation awards for virtual combined cycles are different than regulation awards for combined cycles that are modeled.

The start date of work on the issue was also pushed from June until the middle of July. Work is expected to take between three and six months.

Independent Market Monitor Joe Bowring asked Robinson whether the work would be better conducted by the Modeling Generation Senior Task Force instead of the full MIC because of the technical nature of the issue.

Robinson said she didn’t have “strong feelings” about moving it to the task force, but she said the committee doesn’t currently have regular monthly meetings on the PJM schedule. With an already full work calendar schedule for PJM stakeholders, Robinson said, Vistra didn’t want to have to schedule another meeting and thought a more efficient way to address the issue was to keep it in the MIC.

“We think of this as a pretty targeted issue, although a technical one,” Robinson said.

Bowring said he agrees that the problem needs to be addressed, but he sees the potential for the discussion to be weighed down with its complexity.

“As much as I wish this really was a narrow, targeted issue, I think we’re going to find out that it’s a lot more complicated to solve,” Bowring said.

Paul Sotkiewicz of E-Cubed Policy Associates said he asked PJM at the previous MIC meeting for any documentation on virtual unit modeling, including how dispatch and settlements are done with the units but was told that no such documentation exists.

He called pseudo-unit modeling an “extremely complex” issue to solve and said the scope of the work should be expanded to get to the core of the problem. He said he foresees a “much bigger problem” in a discussion about an issue for which there is no documentation and no rules for settlement. He asked how there will be education on virtual combined cycles when documentation doesn’t exist.

“I agree this is something that needs to be addressed, but I think the even bigger problem is we have absolutely zero information, visibility or documentation into pseudo-unit modeling of combined cycles,” Sotkiewicz said.

Bowring said he agreed with Sotkiewicz’s charge and that there’s “definitely a risk in doing things that aren’t documented.”

Lisa Morelli of PJM said she understood stakeholder concerns and desires to “dig further into the modeling” and to look at the existing rules related to the issue. She suggested adding an education item in the key work activities on virtual combined cycle modeling and how it is handled in energy and ancillary service dispatch and settlements.

Robinson said she thought the additional education piece would be valuable, and the issue charge was ultimately amended to include Morelli’s suggestion.

Reactive Supply Proposal Vote Delayed Again

A vote on a proposal addressing compensation for reactive supply and voltage control service was put on hold for another month as Dominion Energy and the Monitor agreed to combine two separate issue charges. The delay means the issue will be brought to the MIC for a fourth time. (See “Reactive Power Discussed,” PJM MIC Briefs: April 7, 2021.)

Jim Davis, regulatory and market policy strategic adviser for Dominion, reviewed the problem statement and issue charge, saying PJM transmission customers pay for reactive power as an ancillary service under Schedule 2 of the tariff, and generation owners must submit a filing to FERC under Federal Power Act Section 205 to seek compensation.

Davis said the existing rate mechanism is time-consuming for generation owners, developers and transmission customers, and it exposes them to litigation costs in the defense or challenge of the requested rates.

“We thought the existing processes are somewhat costly for all market participants,” Davis said. “And we thought this issue was ripe for discussion.”

Davis said an addition to his issue charge presented at the April MIC meeting included examining PJM’s market mechanisms that would recover reactive rates as part of the key work activities. He also said the timing of the educational activities to be completed by August was amended as a “flexible” date and could last longer.

Bowring reviewed the Monitor’s own problem statement and issue charge addressing the matter. Bowring said the key work activities between the two issue charges are “entirely consistent.”

The Monitor’s issue charge raised some additional level of detail in the key work activities, Bowring said, but there’s nothing precluded from what’s contained in Dominion’s. He asked if Davis would object to incorporating the two issue charges into one document.

“I don’t think there’s any fundamental conflict between the two issue charges,” Bowring said.

Davis asked about one of the key work activities in the Monitor’s issue charge seeking to identify and clarify how to treat reactive capital costs and revenues in the capacity market. Davis said Dominion wouldn’t want to open up discussion on any existing FERC-approved reactive schedule rates.

Bowring said he didn’t see a reason to do so, so he was fine with that exclusion.

Davis said he would work with Bowring before the next meeting to merge the issue charges and bring it back for a vote at the June MIC meeting.

“I think we can merge the two so we have some greater detail that Joe’s provides ,as well as the higher-level, broad description in our issue charge,” Davis said.

Regulation Mileage Ratio

Michael Olaleye, senior engineer with PJM’s real-time market operations, provided a first read of a problem statement and issue charge addressing the regulation mileage ratio in a “quick fix” solution.

Regulation mileage is the measurement of the amount of movement requested by the regulation control signal that a resource is following. It’s calculated for the duration of the operating hour for each regulation control signal.

PJM’s performance-based regulation market splits the dispatch signal in two: RegA for slower-moving, longer-running units; and RegD for faster-responding units like batteries that operate for shorter periods. If a signal is “pegged” high or low for an entire operating hour, Olaleye said, the corresponding mileage would be zero for that hour.

PJM has seen increased frequency of RegA signal pegging, Olaleye said, and has noticed that there are times the RegA signal is pegged for extended periods. He said while it is not causing any reliability concerns, the pegging highlights a potential problem in the regulation mileage ratio calculation.

There’s a potential for the RegA mileage to be zero for a given hour, Olaleye said, indicating the signal has not moved for the entire hour and setting up a divide-by-zero error in the calculation of the mileage ratio.

PJM is proposing to set the floor RegA mileage at 0.1 instead of zero, Olaleye said, which would allow for a “valid solution” for mileage ratio and still maintain market design objectives. He said there would be no impact to the regulation signal design, operations or regulation market clearing.

Bowring said PJM should consider setting a different rate for the RegA mileage, saying 0.1 makes the mileage ratio artificially high and “doesn’t reflect reality.” Bowring said the change could cause overpayments to RegD and that it would make more sense to floor the ratio rather than capping the RegA mileage because of the way regulation markets work.

He said he would provide the Monitor’s perspective in a presentation at the next MIC meeting.

“We don’t want to slow this down, but we don’t think that PJM’s solution is the best solution for a quick fix,” Bowring said.

Market Suspension Proposal

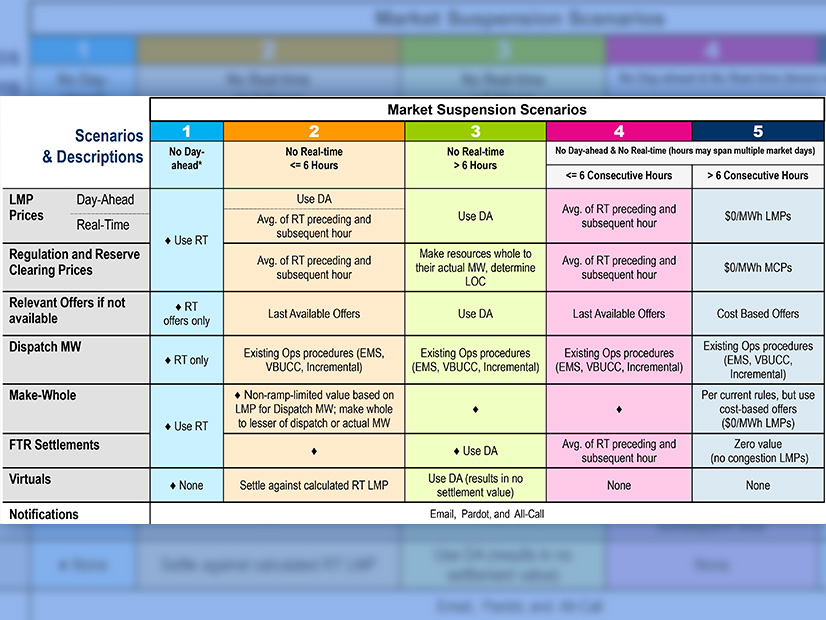

Stefan Starkov, senior engineer with PJM’s day-ahead market operations, provided a first read of a proposal addressing market suspensions. The issue charge was originally endorsed at the September MIC meeting. (See “Market Suspension Guidance Endorsed,” PJM MIC Briefs: Sept. 2, 2020.)

Starkov said that in the event of a market suspension for which market results and clearing prices cannot be determined, there are currently limited business rules regarding how to handle settlements and other PJM processes. Starkov said the limited existing business rules can create an increased risk to PJM and stakeholders.

Work to address market suspension rules was done by stakeholders over a six-month period. Starkov said the proposal represents a compromise that provides a clear definition for a market suspension along with the settlement impacts.

To define market suspension, the proposal calls for using the status quo for real-time markets, from Section 1.10.8(d) of the tariff: an “inability by dispatch to provide markets with economic (zonal) dispatch results where at least a total of seven five-minute intervals are missing within a market hour.”

If less than seven intervals have no dispatch rates, Starkov said, then the hourly integrated value would be determined by the average of the remaining intervals for which there is data. That scenario would not be considered a market suspension hour.

Stakeholders will vote on the proposal at the June MIC meeting, and PJM will seek final endorsements at the July 28 Markets and Reliability Committee meeting and the Sep. 29 Members Committee meeting.