MISO this week said it will need to pause its long-range transmission modeling effort and correct two errors so that it has the clearest picture of future grid performance.

Staff said the work will delay the release of reliability and economic models by a few weeks as they prepare a long-range transmission package.

“Modeling is the most significant effort, and it takes time to get that right,” Jarred Miland, senior manager of system planning coordination, told stakeholders during a Wednesday Planning Advisory Committee teleconference.

MISO said its power flow modeling contained duplicate generation projects with signed interconnection agreements. Miland said the double counting and resource owners’ self-reporting was “significant enough” to justify another reliability model run.

“It’s an easy fix, but it will cause us to redispatch those models,” he said.

The RTO is also fine-tuning load-level modeling predictions based on transmission owners’ input. The grid operator said it needs to better align its local system load level predictions with its regional projections. Through the modeling, MISO is trying to determine when increasing wind and solar generation will strain its transmission system in future years.

Miland said staff will debut long-range models in early June.

TOs have also asked MISO to update some transmission line ratings and line configurations in the modeling. Miland said unlike the other modeling changes, those amendments are routine.

The longer-than-expected modeling phase is holding up a reliability analysis on the long-range transmission-planning work, Miland said. As a result, MISO cancelled its Friday long-term planning workshop. The next workshop is scheduled for June 25.

WEC Energy Group’s Chris Plante said he was disappointed in the decision to cancel the workshop.

“This is an unprecedented … magnitude of study,” he said. “Given the unprecedented amount of work that needs to be done, I was very disappointed that you cancelled the workshop.”

Plante said MISO planners shouldn’t feel pressured to prepare a formal presentation outlining new developments in order to host a workshop. He said about 50 stakeholders have been meeting informally outside of the stakeholder process and without slides to discuss the long-range plan.

“I also want to support more conversation than less,” agreed the Union of Concerned Scientists’ Sam Gomberg.

Multiple stakeholders also questioned MISO’s use of its 2020 Transmission Expansion Plan (MTEP 20) as the basis for its long-range modeling. MTEP 20 models don’t include the transmission projects approved at the end of 2020.

Miland said waiting on completed MTEP 21 models — which do contain the 2020 crop of projects — would have further held up the long-range transmission plan. He said staff will review the impacts of the MTEP 20’s higher voltage projects and may apply them in modeling, if they’re deemed substantial enough.

“If there are significant additions that are really material, let us know,” Miland told stakeholders.

Earlier in May, MISO executives said the long-range plan was essential because it’s the RTO’s only planning that looks more than 20 years into the future. They said without the planning, the grid will buckle under pressure in likely future fleet mixes. (See MISO Stresses Importance of Long-range Tx Plan.)

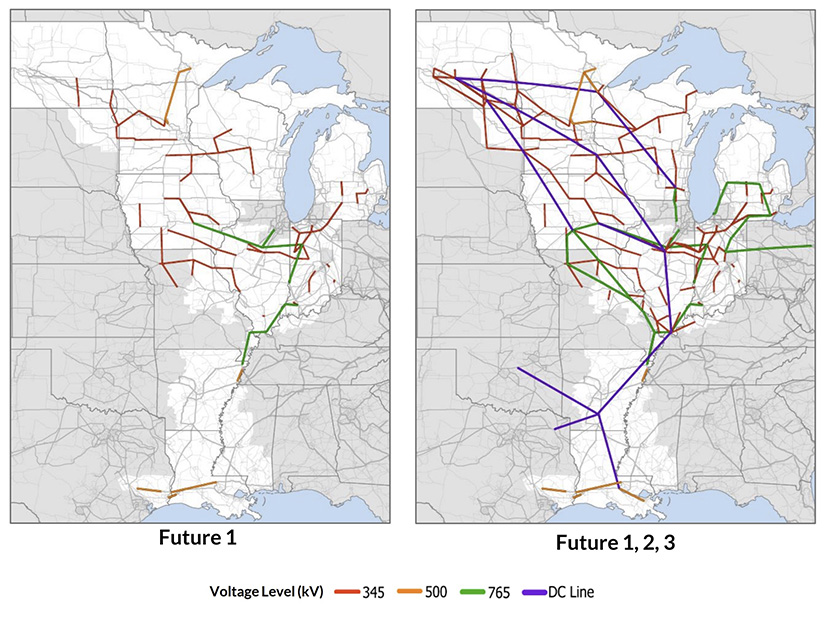

MISO has said it may need more than a dozen 345-kV additions, a handful of 500 kV and 765 kV lines, and even a massive footprint-wide network of DC lines as part of the long-term planning package. Staff estimates the long-term transmission package could cost anywhere from $30 billion to $100 billion. (See MISO Reveals Contentious Long-range Tx Project Map.)

The RTO’s executives and planners have stressed that the footprint needs new transmission to maintain reliability through an onslaught of renewable grid interconnections.

During a Tuesday interconnection working group teleconference, MISO’s Jesse Phillips, manager of resource utilization, said early indications show that 2021’s batch of interconnection queue entrants “may be at least as large” as the record-breaking 2020 cycle.

MISO currently has 552 projects and about 83 GW of capacity in its queue, down from 2020’s highs of more than 100 GW. Solar generation accounts for 65% of the megawatts in the current queue.

MISO will open the queue to new project applications just once this year. Hopefuls have until July 22 to submit project proposals and documentation.

Cost Allocation Debates Continue

While MISO planners chart the possible routes new transmission could take, stakeholders are still deliberating over how the buildout’s costs will be divvied up.

Stakeholders attending a teleconference on cost allocation Thursday mulled the long-range plan’s ability to help avoid future emergencies during increasingly extreme weather and how that reliability benefit might be measured and translated into cost-sharing.

Members also considered how they could quantify the added reliability benefits from the system’s expanded ability to move huge volumes of power long distances and ease generation’s unfolding shift to renewables.

Distaste remains for a systemwide postage stamp allocation, though some stakeholders continue to argue that it might be necessary to capture widespread reliability advantages.

Stakeholders are divided on whether MISO should use NERC reliability standards to measure transmission reliability benefits beyond a five-year planning horizon. Multiple stakeholders said NERC standards are no longer an adequate benchmark for system reliability, especially in the long term. Many said the standards have not kept pace with the energy industry’s seismic changes.

“The last time we saw system change like this, the Korean War was going on. … It was well before NERC was thought of. Those [standards] were never designed to contemplate the kind of system change we’re seeing today,” Xcel Energy’s Drew Siebenaler said.

“Our power is freaking going out now. … It’s a crisis the South has right now,” Southern Renewable Energy Association Director Simon Mahan said. “For the people down here, we can’t go on like this. If the NERC standards are ‘good enough,’ and the load-shed standards are ‘good enough,’ I’m sorry, I don’t agree with that.”

Mahan said NERC reliability standards were followed during the arctic event, and the system still came up short.

MISO leadership has repeatedly said the added transfer capability of MISO’s last long-range transmission portfolio, approved a decade ago, helped the footprint dodge a more devastating emergency during mid-February’s arctic event.

LS Power’s Pat Hayes said increasing transfer capability between MISO Midwest and MISO South is vital for future system reliability.

Mississippi Public Service Commission consultant Bill Booth argued that weatherization and resource diversity will do more to help avoid serious winter emergencies.

“I don’t think the solution to everything is long-haul transmission,” Booth said.

“Trying to build a system on what is known today is not going to give us the system of tomorrow,” Sustainable FERC Project counsel Lauren Azar countered.