By Tom Kleckner

FERC’s Dec. 21 order requiring SPP to help fast-start resources set LMPs added one more to-do for the RTO in what is shaping up to be a busy 2018.

SPP’s integration of the Mountain West Transmission Group drew much of the RTO’s attention in 2017. But it also has been working to solve underfunding issues in its financial transmission rights market, address stakeholder concerns over transmission cost allocations, identify seams transmission projects that can be built and incorporate the constantly increasing amounts of wind energy. And as they have for the last several years, stakeholders and SPP officials spent countless hours attempting to unravel the Z2 transmission project accounting mess.

Fast-Start Order

FERC gave SPP and stakeholders 45 days to file initial briefs in the Section 206 proceeding it created to drive Tariff changes to benefit fast-start resources. The commission found SPP’s approach “inconsistent with minimizing production costs” and ordered it to allow the commitment costs of fast-start resources (start-up and no-load costs) to be reflected in prices. SPP said it will decide its plan for responding to FERC’s fast-start order in early January. (See FERC Drops Fast-Start NOPR; Orders PJM, SPP, NYISO Changes.)

Working out the details will likely fall to SPP’s Market Working Group (MWG).

Congestion Hedging

The MWG has been spending the last few months working on improvements to SPP’s congestion-hedging process.

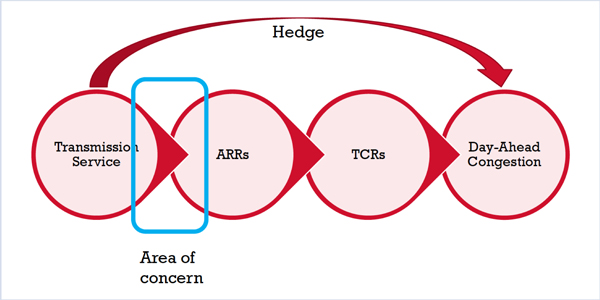

SPP’s Integrated Marketplace rules are intended to allow load-serving entities to translate firm transmission service reservations (TSRs) into a product that allows them to obtain credits to hedge daily congestion costs.

The RTO allocates auction revenue rights based upon firm network or point-to-point transmission reservations. But market participants have complained they are not receiving sufficient hedges.

Keith Collins, executive director of SPP’s Market Monitoring Unit, says the main area of concern is the initial transition from a physical transmission right (the TSR) to a financial right (the ARR).

Because ARRs are allocated months in advance of the day-ahead market, congestion patterns can change in the interim because of transmission outages, derates and upgrades and unexpected generation outages.

The MMU also notes that many prevailing-flow ARRs are not nominated, leaving hedges “on the table.” In addition, the availability of prevailing-flow ARRs is limited because most counterflow ARRs are not nominated.

Charles Cates, SPP’s manager of transmission services, told the Board of Directors in December that the RTO’s congestion market is about portfolios, not single-path entitlements and awards.

Staff say total congestion revenues continue to increase, with the revenues shifting from LSEs to financial entities (the non-ARR holders). Candidate ARRs associated with redispatch are contingent on completion of transmission upgrades, they say.

“Building transmission to help [create] more ARRs is an expensive answer to the problem,” Collins said.

The MMU has suggested hedging congestion from the physical day-ahead flow, taking the emphasis off day-ahead congestion prices.

Among the options SPP is considering are obligating the LSEs to nominate counterflow, reducing percentages in the annual transmission congestion rights auction, and limiting first-round ARR nominations by source and path.

The MWG will provide an update on its progress during the January board and Markets and Operations Policy Committee meetings. If the MWG can’t find a better mechanism, a task force could be created to take up the issue.

Mountain West Integration

The biggest to-do on SPP’s list is completing the integration of Mountain West, which primarily services Colorado, Wyoming and Nebraska. Mountain West announced its intention to join the RTO in January, but it had been holding discussions with SPP’s management team for almost a year prior. In September, Mountain West said it would begin public negotiations. (See SPP, Mountain West Integration Work Goes Public.)

SPP has established a Members Forum and State Commission Forum to assist with its due diligence effort. SPP’s Strategic Planning Committee spent the last quarter of 2017 conducting numerous executive sessions with Mountain West representatives. The discussions are expected to continue well into 2018.

Mountain West said it has had “significant success” resolving issues concerning rate design and cost-shift mitigation. Any changes to governing documents, such as SPP’s Tariff, bylaws and membership agreement, must go through the RTO’s stakeholder process for review before they are considered by the board. The Regional Tariff Working Group (RTWG) has primary responsibility for Tariff changes, while the Corporate Governance Committee will consider changes to the membership agreement and SPP bylaws.

SPP and Mountain West are working on an Oct. 1, 2019, target date for membership but will begin the regulatory approval process this year. FERC filings could come as soon as October, assuming the SPP board approves the integration at its July or October meetings. The RTO expects FERC review to take 60 to 180 days.

The Colorado Public Utilities Commission will play a key role in the process. The commission has jurisdictional authority over Xcel Energy’s Public Service Company of Colorado and Black Hills Energy, two of the eight Mountain West members seeking to join SPP. The PUC held three informational sessions on the merger last year and could hold as many as three more in 2018. (See Colo. Regulators Talk Governance with SPP, Mountain West.)

When it’s all over, SPP will have expanded its current 14-state footprint into the Rocky Mountains, adding Colorado, most of Montana and portions of Arizona and Utah. The new SPP will grow by 165,000 square miles, adding 16,000 miles of transmission lines and 21 GW of generating capacity.

Mountain West will eliminate the pancake transmission rates that led to its search for RTO membership, while SPP members will see 10-year net present value benefits of about $209 million, according to the RTO.

Z2

In October, the board approved a cleanup of Tariff language that it hopes will help it resolve long-standing problems with Attachment Z2 of SPP’s Tariff, which details how financial credits and obligations are assigned for sponsored transmission upgrades. (See “Z2 Fix Allows Short-Term Service Agreements to Expire,” SPP Board of Directors/Members Committee Briefs: Oct. 31, 2017.)