By Michael Kuser, Rory Sweeney, Amanda Durish Cook and Tom Kleckner

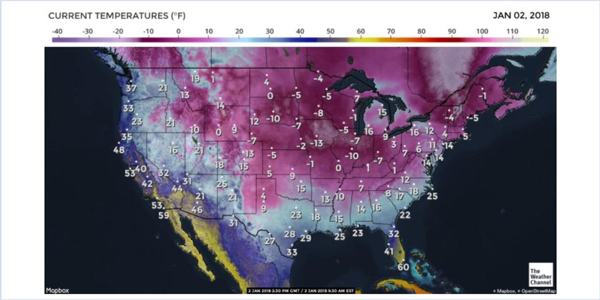

Power prices surged along with demand across much of the U.S. on Tuesday as a blast of Arctic air sent temperatures plunging to record lows in an area extending from the Great Plains to the Deep South.

ISO-NE Internal Hub real-time prices pushed past $170/MWh during the RTO’s evening peak load, occurring around 6 p.m. At about the same time, PJM’s RTO zone price hit $160/MWh, while the Eastern and New Jersey hubs broke $200/MWh. ERCOT said it might break its record for winter demand on Wednesday.

So far, the grid operators have managed to endure the cold weather and pinched fuel supplies, thanks in part to rule changes and winter preparations put in place after the cold snap of 2013/14.

Northeast Fuel Switch

The New England grid was operating normally Tuesday despite an unusually high level of oil-fired generation due to a spike in natural gas prices, according to ISO-NE spokesperson Marcia Blomberg. Gas-fired plants normally account for about half the region’s generation but on Tuesday comprised only 25% of the fuel mix.

With the cold weather forecast to stretch into next week, the RTO expects to continue relying heavily on oil-fired generators, some of which are operating around the clock and are already running short on fuel. In addition, some of the plants are reaching air emissions limitations, Blomberg said.

Each of the six states comprising New England sets its own emissions standards. Massachusetts, for example, set 2018 CO2 emissions limits from power plants at 7.45 million metric tons for existing facilities and 1.5 million metric tons for new ones.

Nuclear power, coal, LNG and dual-fuel units running on oil are also helping the grid endure the squeeze on natural gas pipelines.

“ISO-NE will increase the frequency of generator fuel surveys and continue its close communication with oil-fired power plants, natural gas pipeline operators and neighboring power systems,” Blomberg said.

NYISO

The deep freeze in New York caused the ISO’s marginal cost of energy to spike to $229.62/MWh on Tuesday, up from $15.87/MWh on Dec. 24. NYISO’s real-time LMP zonal map showed power from Hydro-Québec priced at $226.87/MWh, compared with $15.41/MWh a week earlier, while ISO-NE shot up to $278.14/MWh from $36.56/MWh.

NYISO had sufficient generation capacity and reserves to meet Tuesday’s projected peak demand of 24.5 GW, said ISO spokesman David Flanagan. Rising demand pushed natural gas prices higher, resulting in increased wholesale electricity prices and leading some dual-fuel units in New York to switch to oil, he said.

PJM Prep Pays Off

PJM said it has been preparing for cold weather since the fall when the National Weather Service in the fall noted a dip in the polar vortex, which caused an unseasonably mild August, would likely return during the winter. Chris Pilong, who manages PJM’s dispatch, said the long-range forecast called for a mild winter overall with periods of extreme cold.

The RTO started issuing cold-weather alerts prior to the holiday break to ensure generators and transmission operators were prepared for frigid conditions. Communication is central to PJM’s response, Pilong said.

Tuesday’s expected peak demand of 134.31 GW remained outside of PJM’s top 10 winter daily peaks, he said, but was “getting close” to the 10th-place peak of 135.06 GW on Jan. 22, 2014. Wednesday’s peak is expected to be 130.53 GW.

“We’re seeing temperatures starting to moderate a little bit,” Pilong said.

Four of the 10 highest winter peaks — including the all-time record of 143.13 GW — occurred in 2015. The remaining six are from 2014, when a similar dip in the polar vortex caused even colder temperatures, resulting in supply issues when 22% of the RTO’s generation capacity failed to respond to dispatch signals.

Pilong said changes implemented since then, including Capacity Performance and fuel-switching procedures, have been effective.

“We’re seeing from a generator performance perspective outage rates are cut in half,” he said.

Gas-fired generation made up about 25% of PJM’s fuel mix Tuesday, down from about one-third during normal operations. Pilong attributed the decline to fuel switching. At one point, more than 8,000 MW of oil-fired generation was online, almost all of which represented gas units that had been switched.

The RTO’s LMP hovered around $175/MWh near its peak. Pilong attributed the jump to “competition for natural gas.”

“It really just has to do with fuel prices,” he said.

MISO Exceeds Winter Peak Outlook

The extended cold snap prompted MISO on Tuesday to issue a conservative operations order until Jan. 5. A cold-weather alert will remain in place until Sunday “due to very cold temperatures, high system load and uncertainties in gas pipeline fuel supplies.” An unofficial Tuesday peak load of 104.6 GW exceeded the RTO’s winter forecast by 1.2 GW.

“As we have throughout the past several days, MISO continues to work closely with members and neighboring system operators to prepare and take appropriate steps to protect the bulk electric system,” spokesperson Mark Brown said.

MISO’s all-time winter peak demand was 109.3 GW on Jan. 6, 2014.

During a winter readiness workshop in November, MISO predicted a 103.4-GW winter peak would be handled easily by 142 GW of projected capacity. The forecast relied on National Oceanic and Atmospheric Administration projections, which predicted a warmer-than-normal winter in the Central and South regions and normal to below-normal temperatures in the North region. (See MISO in ‘Good Shape’ for Winter Operations.)

MISO has placed more weight on winter preparations since the 2013/14 winter, issuing winterization guidelines for generators and introducing heightened communication with gas pipeline operators. (See FERC Approves MISO Plan to Share Generator Gas Data.)

“As part of lessons learned from the polar vortex, MISO increased communications and coordination with gas pipeline operators. MISO has a complete database of pipeline connections and dual-fuel capability for all gas generators,” Brown said.

On Tuesday, coal generation comprised a 48% share of MISO’s fuel mix, with natural gas supplying 22% and nuclear and wind generation contributing about 14% each. The RTO’s mix is typically 34% coal, 41% gas, 8% nuclear and 14% renewables.

SPP, ERCOT Manage Response

SPP, whose 14-state footprint reaches from East Texas to the Dakotas, issued a cold-weather alert for Dec. 29 to Jan. 4. RTO spokesman Dustin Smith said member companies are experiencing “slower-than-normal” start times and other temperature-related start-up issues at some units.

While the cold temperatures have had some impact, SPP has not “encountered anything unmanageable,” Smith said.

Some SPP gas units have been unable to procure fuel, resulting in outages and switches to more costly oil, Smith said.

The cold weather has reached as far south as the Texas Gulf Coast. Houston is expecting a freeze Wednesday morning and has seen temperatures in the 20s since New Year’s Eve.

ERCOT, the grid operator for 90% of Texas, said it has managed the winter weather so far and has sufficient generation and transmission resources available to keep up with the frigid forecasts. Demand Tuesday peaked at slightly more than 59 GW between 11 a.m. and 12 p.m. and is expected to approach 62 GW Wednesday morning, which would break the winter record of 59.65 GW set in January 2017.

The ISO issued a notice before the cold snap asking generators to take necessary steps to prepare their facilities for the expected cold weather by reviewing fuel supplies and planned outages, said ERCOT spokesperson Leslie Sopko.

“We also worked with transmission operators to minimize outages that impact generation,” Sopko said.

TVA Asks Customers to Conserve

Early Tuesday morning, the Tennessee Valley Authority reported an average temperature of 10 F across its footprint, about 20 degrees lower than average. The government agency reported that the frigid temperatures pushed power demand to 32 GW on Jan. 2, TVA’s highest level since 2015.

“Power demands are high. Help us maintain a reliable supply of energy ― and help yourself save money on your next power bill ― by lowering your thermostat 1-2 degrees during the peak hours of 6 am to 9 am,” TVA tweeted.

Testing the Limits of Fuel Switching

While fuel switching has helped grid operators in the short run, the possibility of exceeding oil supplies and air emissions limits is a particular concern in New England.

“They’re burning a lot of oil out there,” Northeast Gas Association CEO Thomas M. Kiley told RTO Insider.

The gas association’s market outlook for this winter predicted such a scenario.

“The rising demand for natural gas within the region’s electric market has not been sufficiently matched by a commitment to securing adequate reliable natural gas supplies and firm pipeline capacity contractual obligations,” the report said. “The electric power sector has not participated sufficiently in terms of investments in securing natural gas supplies for their generating units.”

Kiley said nothing has changed since the group issued that report in October, but the grid operator’s winter reliability program is helping to keep generators operating. The reliability program provides incentives for oil-fired units to buy adequate oil supplies before winter begins and to restock their fuel regularly throughout the season.

“Our organization has been monitoring this with ISO New England since the middle of last week and they’ve done a good job with the fuels program,” Kiley said.

A Thaw?

Some relief should come in the second half of January when NOAA is calling for above-average temperatures across much of the continental U.S.