By Jason Fordney

CAISO market participants have many opinions on how the ISO should prioritize the many complex and urgent tasks on its plate for 2018.

The ISO recently announced major initiatives to become a Reliability Coordinator in the West, expand its day-ahead market into the EIM, and implement a new package of resource adequacy enhancements, among a slew of other ongoing market changes listed in the grid operator’s policy initiatives catalog. Renewable integration issues such as flexible capacity needs and regional markets and transmission planning are other topics on the minds of market participants who commented on the CAISO roadmap laying out the schedule for policy initiatives.

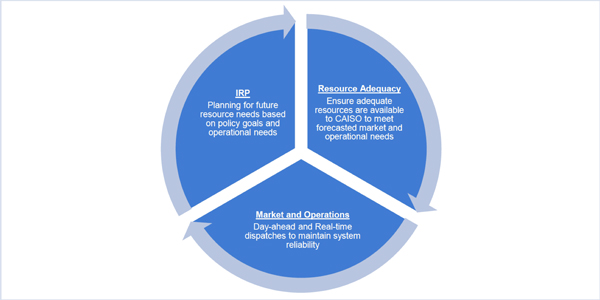

The spate of initiatives is emerging as CAISO and California regulators look to overhaul their resource adequacy (RA) programs in the face of rising reliability-must-run (RMR) payments to gas generators. Misalignments in RA procurement between the ISO and the California Public Utilities Commission has increased the ISO’s reliance on backstop processes such as RMR and capacity procurement mechanism (CPM) contracts.

Pace of RMR Overhaul Questioned

In comments filed with CAISO, some stakeholders said they want the ISO to combine and accelerate timelines for initiatives such as its RMR/CPM overhaul, while others questioned whether the ISO is taking on too many issues at one time given the complexities and interplay of the many initiatives already underway going into this year.

Pacific Gas and Electric’s Matt Lecar urged quicker action on the RMR/CPM initiative, which kicks off with a Jan. 30 meeting. The company wants CAISO to combine proposed Phases 1 and 2 of the effort into a concurrent process and move on an accelerated timeline to prevent a wave of RMR contracts.

“PG&E is deeply concerned that this schedule and framing of the issue [do] not rise to the level of current challenges in the backstop procurement arena,” he said. The timeline does not allow for policy changes until 2019, leaving little time for FERC approval before the 2020 RMR designations go into effect, he said.

“The CAISO has proposed a timetable that may condemn PG&E customers to bear hundreds of millions of dollars of new RMR contract costs for a minimum of three more years and likely longer. There is no justification for this delay,” Lecar said.

The RMRs and other backstop procurements have become more urgent issues since the CAISO Board of Governors reapproved three RMRs in 2017, which PG&E referenced in its roadmap comments. The CPUC responded by soliciting contracts that would replace the three RMRs with Calpine last year, with a fast-track vote set for Jan. 11. CAISO also last month assigned a CPM designation to more gas-fired plants. (See CPUC Targets CAISO’s Calpine RMRs.)

PG&E, the CPUC, and others have opposed the RMRs, each for their own reasons, and CAISO officials have also expressed they would rather procurements result from market signals than out-of-market mechanisms. The debate also has implications for ratepayers and other market participants such as community choice aggregators, which the CPUC is proposing be brought under its RA procurement requirement.

NRG Director of Market Affairs Brian Theaker said, “The increased use of RMR and CPM is a sign of the growing failure of the RA program to identify and compensate the resources needed to maintain reliability.” NRG also said the RA problems and RMR/CPM initiatives should not be fixed sequentially.

“The perpetual limbo for lesser items must be addressed,” said Theaker.

Carrie Bentley, representing the Western Power Trading Forum (WPTF), said CAISO should take full responsibility for the RA program, which holds the ISO accountable for local and flexible capacity requirements.

“Concurrently, RA reform is being taken up by the CPUC, and the CAISO has stated [it] will need to be coordinated with this effort,” she said. “WPTF believes that both efforts are very large and worthwhile and therefore asks the CAISO to make transparent how [it] will allocate resources to each process.”

EIM Participants Look to Day-Ahead

Other commenters are focused on CAISO’s Western Energy Imbalance Market (EIM) and regional issues, such as transmission planning and the ISO’s announced expansion of its day-ahead market into the EIM.

The Public Generating Pool (PGP), an association of 10 consumer-owned utilities in the Pacific Northwest with more than 6,000 MW of generation, said CAISO should publish an issue paper on its EIM expansion soon and mentioned the many other initiatives the ISO has underway. PGP thinks CAISO should extend its time frame for working on the day-ahead market enhancements.

“PGP finds the timeline for these initiatives to be very aggressive and is concerned about the impact and unintended consequences implementing these initiatives on such a constricted schedule will have,” PGP said in its comments. While PGP acknowledged the constraints on the ISO’s priorities and resources, it also said “there is currently little transparency around how and when the ISO makes those changes.”

The American Wind Energy Association’s California Caucus said it was concerned that CAISO’s roadmap is focused too much on operational efficiencies and not enough on transmission planning to access renewables. The group said it “implores the CAISO to immediately begin studying transmission expansion to access low-cost renewable resources outside of the current CAISO footprint.”

The Bonneville Power Administration said it was encouraged that the roadmap includes CAISO’s Flexible Resource Adequacy and Must Offer Obligations (FRACMOO2) initiative, which is important to all Northwest hydroelectric producers and can provide fast-acting response to help manage intermittent renewables. (See Power Sellers Urge Action on CAISO Flex Capacity.)

“We look to this initiative in 2018 to explain the objectives driving any limitations for external resources providing flexible RA,” BPA said. It also asked CAISO to prioritize changes to the default energy bid option that address opportunity costs for hydro units.

Clean energy interests in jointly filed comments urged CAISO to prioritize the expansion of the day-ahead market into the EIM and begin outreach to stakeholders this month. They include the Western Grid Group, Islands Energy Coalition, Natural Resources Defense Council, Northwest Energy Coalition, and Vote Solar.