RENSSELAER, N.Y. — Soaring natural gas prices, customer satisfaction and credit requirements were all on the agenda during a meeting of NYISO’s Management Committee on Wednesday.

The committee also approved several measures recommended by the ISO’s Business Issues Committee, including modifying price correction deadlines to use business rather than calendar days in the period calculation, and changing the Tariff to recover costs related to acquiring solar forecasts for front-of-the-meter, utility-scale solar facilities in New York. (See NYISO Business Issues Committee Briefs: Jan. 17, 2018.)

Cold Snap Spikes Natural Gas Prices 1,374%

This winter’s cold snap saw New York City’s Transco Zone 6 natural gas prices surge to an average $47.34/MMBtu during a 13-day period, a 1,374% increase over the average for the period in December before the deep freeze hit on Christmas Day.

But grid operations were largely unhindered by the price jump, according to NYISO Vice President of Operations Wes Yeomans, who presented a cold weather operations report to the committee.

“Transmission was really excellent this time around, and transmission owners rescheduled maintenance outages to after the cold snap,” Yeomans said. “The two Ramapo [phase angle regulators] really provided value. We saw full utilization of the 500-kV line, which definitely wouldn’t have been possible without the replacement of the second PAR last fall.”

Yeomans noted that the Central East interface was the primary binding constraint — as predicted in the ISO’s winter preparedness report. Load-weighted electric locational-based marginal prices averaged $135.96/MWh during the cold snap, a 297% increase over December’s pre-Christmas average of $34.27/MWh. Power prices did not increase in line with gas prices because NYISO market systems selected lower-cost resources, primarily dual-fuel units capable of operating on lower-cost oil.

The recent cold snap differed from the January 2014 polar vortex in occurring over 13 consecutive days rather than spread over a month of fluctuating temperatures, Yeomans said. New York City went two weeks with temperatures never rising above freezing, but interstate and local delivery company gas pipelines all remained in service.

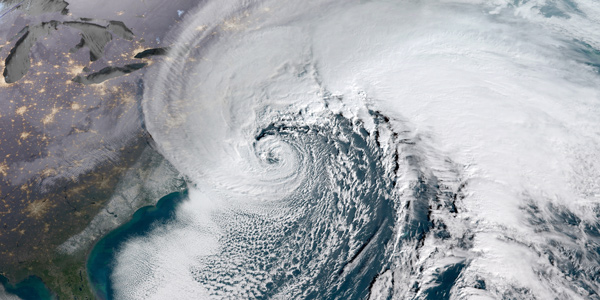

The period of extreme cold ended with a Jan. 4-6 blizzard that “originated in Florida, which is hard to believe, but that’s what the weatherman said,” Yeomans said.

NYISO’s load peaked at 25,081 MW on Jan. 5, exceeding the seasonal forecast of 24,365 MW but falling short of the high of 25,738 MW recorded in January 2014. Hydro-Québec registered a new all-time peak of 39,710 MW on Jan. 6, Yeomans said, noting that Montreal relies heavily on electric baseboard heating.

FERC early last month granted NYISO’s request to waive incremental energy offer caps for Jan. 4 through Feb. 8, allowing generators to recover minimum costs in excess of $1,000/MWh. As of Jan. 24, the ISO had not received any such cost recovery requests, Yeomans said. (See FERC Grants NYISO ‘Cold Snap’ Offer Cap Waiver.)

Customer Satisfaction and Performance Assessment

Don Levy, director of the Siena College Research Institute, presented a full-year 2017 survey of customer satisfaction and assessment of NYISO performance showing respondents are satisfied overall with the ISO.

NYISO has now completed two full cycles of the program, with about 27% of market participants responding to the survey, Levy said.

“I’d love to get up to a full third, and would be doing cartwheels if we got to 35%, but the participation we get is a statistically significant response. When we did it monthly, the fatigue was palpable,” Levy said. The new method entails surveying market participants twice a year.

The satisfaction survey comprises three platforms: a customer inquiry survey, a market participant survey and a CEO strategic outreach survey. An “assessment of performance” combines the CEO survey and the performance portions of the market participant surveys, which have stayed consistent throughout the year.

Respondents said they liked the professionalism of NYISO personnel and saw the ISO and its procedures as fair and efficient, but the results suggested the ISO could improve on how it explains policies and procedures and how it conducts long-term planning for New York’s electric power system.

Projected True-Up Exposure Enhancement

The Management Committee approved changes to the ISO’s credit requirements implemented in February 2015 after the 2014 polar vortex. The changes, recommended earlier in the month by the BIC, are slated to be deployed in June following approval by the board in April and FERC in May.

Corporate Credit Manager Sheri Prevratil presented the proposed filing under Section 205 of the Federal Power Act, which would revise Attachment K of the Tariff.

Under the current methodology, NYISO calculates the projected true-up exposure credit requirement for all market participants in the energy and ancillary services markets. A market participant is required to post credit support in the amount of its projected true-up exposure if its four-month true-up shows an average credit exposure greater than 10% of the initial settlement, or if the participant is no longer active in the markets but will still be subject to unsettled true-up obligations.

The alternate methodology would still retain the 10% trigger and require market participants to post credit support in the amount of the projected true-up exposure, but it would simplify the method for calculating the true-up to better align the credit requirement with market risk.

— Michael Kuser