By Michael Kuser

New York’s Integrating Public Policy Task Force (IPPTF) on Monday debated a proposal seeking to align the state’s effort to price carbon with the Regional Greenhouse Gas Initiative. It also discussed an alternative to NYISO’s capacity market.

Representatives from the Long Island Power Authority (LIPA) and National Grid made presentations as part of the ongoing process to develop a straw proposal for pricing carbon into the state’s wholesale electricity market, a joint effort by NYISO and the state’s Department of Public Service (17-01821) that aims to deliver a workable plan by year’s end.

The IPPTF’s work plan includes five issue tracks: 1) straw proposal development; 2) wholesale energy market mechanics and interaction with other wholesale market processes; 3) policy mechanics, such as setting the carbon charge; 4) interaction with other state policies; and 5) customer impacts. (See NYC, Goals Dominate Talk on Carbon Pricing.) The effort is still in the first track, slated to conclude March 19.

Regional Circuit Breaker

During his presentation, LIPA Director of Power Markets Policy David Clarke asked that “NYISO and DPS think about the carbon abatement cost curve throughout the RGGI region, what it might look like, what it might cost to buy and retire allowances along the curve and how far we might go to narrow differences by doing so, especially considering the roles of the cost-containment reserve.” The RGGI reserve contains allowances only released if allowance prices exceed predefined levels.

New York could reduce its carbon emissions at a lower cost by drawing on the broader region and a wider geographic set of abatement alternatives, Clarke said.

“RGGI has a 10-million-ton reserve, priced in 2025 a little over $17 a ton. Essentially, it’s a circuit breaker,” Clarke said. “So RGGI states have agreed to this circuit breaker, a price increase they can live with if the market’s carbon price went too high.”

LIPA considers the state’s Clean Energy Standard (CES) goals — principally, an 80% emissions reduction by 2050 — as a starting point for pricing carbon and wants NYISO to consider an approach that increases the state’s carbon prices to the RGGI cost-containment reserve price. The power agency noted that the draft 2017 Policy Scenario Overview, prepared by ICF International for RGGI in June 2017, pointed to a “wide range” of projected 2025 allowance prices, “the lowest of which accompany high renewable build-out scenarios, but most are well below $17/ton for 2025.”

Clarke noted that, in The Brattle Group’s report on the social cost of pricing carbon in New York, the “starting point was a $40 adder above the assumed $17 price, so they were looking at $57-58/ton as the carbon adder.”

“The Brattle proposal is to take the carbon price and raise it into the marketplace and get some marketplace reductions, and it raises it quite a lot,” said Mark Reeder of the Alliance for Clean Energy New York. “And [LIPA] seems to be proposing as an alternative to that — [that] New York retires RGGI allowances and raises the price in the market for carbon that New York sees. But it’s not just New York; it’s everybody else [that sees a higher price], and it’s an alternative way of getting the market to see a higher price of carbon.”

Clarke agreed that was “a more or less” accurate summary of LIPA’s thinking.

“We observe that the RGGI prices are likely to trade well below the cost-containment reserve level if nothing changes,” Clarke said. “And from a loads perspective, buying and retiring allowances below this price can be significantly less expensive than the average cost loads would pay under an approach that sets a carbon adder at the social cost of carbon.”

Under current regulations, any entity, including a state or load-serving entity, can set up an account to buy allowances. RGGI regulations also provide for retiring allowances from voluntary reductions, so there are a couple mechanisms to buy or retire allowances up to the cost-containment reserve price, Clarke said.

Alternative Market Design

Ben Carron, National Grid’s senior analyst for regulatory strategy and integrated analytics, presented the company’s Dynamic Forward Clean Energy Market (DFCEM) concept, an alternative to the capacity and renewable energy credits markets in New York. Under the idea, the state would use an auction to procure the clean energy attribute from a resource, but not the energy itself. The model is designed to incentivize development of new clean energy resources and retain existing ones in order to reduce emissions.

Carron noted that “the concept is being discussed in the [Integrating Markets and Public Policy] process in New England,” but he emphasized that he was speaking on behalf of National Grid and not the other consortium members that created it. (See NECA Panelists Talk Carbon Pricing, Northern Pass.)

“We share similar concerns to those presented last week by the city of New York, which is that this needs to be considered on an economy-wide scale,” Carron said.

While the task force is only addressing how to harmonize wholesale energy markets with public policies in the energy sector, Carron said a wider approach could avoid creating perverse incentives and ensure that stakeholders understand how it is going to interact with other components of the state’s energy plan.

“Doing some upfront work to establish the cost of carbon abatement in each sector would be a useful exercise for policymaking in all sectors and would inform the potential for leakage across sectors in this effort,” Carron said.

Reeder said the DFCEM appeared similar to New York State Energy Research and Development Authority auction processes for obtaining renewable resources, in which one Tier 1 REC represents the energy production of 1 MWh.

“Ostensibly, that achieves a similar outcome if I think about the CES objective [of] around 50% renewables by date X,” Reeder said. “So how would this interplay with what NYSERDA does right now? Is it a complement? Is it a supplement? Would it essentially obviate the need for NYSERDA to do what they do now?”

“I think that it might obviate the need,” Carron said. “We should create a wholesale market solution that accomplishes as much of what we’re setting out to do with public policy as possible.”

Track 2 Issues and Scheduling

The task force also reviewed a plan for Track 2 of its work, which will deal with wholesale energy market mechanics — including “carbon leakage” and how to measure emissions — and interaction with other wholesale market processes.

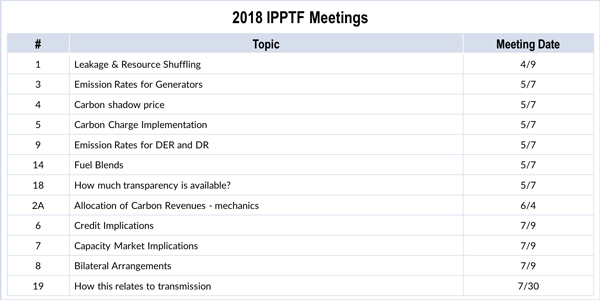

The plan lays out Track 2 meetings from April to July before the suggested Aug. 1 deadline for draft recommendations. The joint staff will present frameworks for Track 2 issues of each meeting and also left some meeting dates open to resolve thorny issues — such as leakage — that may require additional discussion.

Representing New York City, Couch White attorney Kevin Lang expressed concern about transmission being slated for discussion on July 30, just two days before the deadline for draft recommendations.

“Waiting until the end of July to talk about transmission is way too late,” Lang said.

IPPTF co-chair Nicole Bouchez, NYISO market design specialist, said the task force would consider earlier discussions on the subject but that it did not foresee the draft recommendations covering every issue.

In addition to transmission, Track 2 will also deal with leakage and resource shuffling; emission rates for generators; carbon shadow price; carbon charge implementation; emission rates for distributed energy resources and demand response; fuel blends; how much transparency is available; the mechanics of allocating carbon revenues; credit implications; capacity market implications; and bilateral arrangements.

The task force next meets Feb. 19 at NYISO headquarters.