By Michael Kuser

ISO-NE’s 2018 Regional Electricity Outlook released Wednesday reiterates concerns about fuel security that were detailed in a separate report published by the RTO last month.

In a joint preface to the outlook, ISO-NE CEO Gordon van Welie and Board of Directors Chair Philip Shapiro said “the biggest challenge to the reliability of the grid is the lack of fuel infrastructure to supply the fleet of natural-gas-fired generators.”

The RTO’s Operational Fuel-Security Analysis examined 23 fuel-mix scenarios and concluded that power shortages because of inadequate fuel would occur in 19 of them by winter 2024/25, which would require emergency actions such as voluntary energy conservation and involuntary load shedding. (See Report: Fuel Security Key Risk for New England Grid.)

Shapiro and van Welie also cited further emission restrictions on oil-fired generators “and the reality that older oil and nuclear generators are becoming less economically competitive and may retire before the region has added sufficient new energy sources to replace them.”

The outlook pointed to the recent cold snap that hit the region from Dec. 26 to Jan. 7, during which “constrained pipeline capacity resulted in substantially higher natural gas and wholesale electricity prices, leading to less expensive oil and coal power plants operating instead of the usually competitive natural gas-fired generation.”

Oil supplies at plants around New England declined rapidly over the two-week cold spell as gas prices spiked and dual-fuel plants switched to oil, but the RTO avoided serious reliability issues thanks to LNG shipments. (See FERC, RTOs: Grid Performed Better in Jan. Cold Snap vs. 2014.)

Testifying before the U.S. Senate Energy and Natural Resources Committee on Jan. 23, van Welie said that since 2000, oil- and coal-fired generation’s share of ISO-NE’s power production has fallen from 40% to less than 10%, while natural gas has risen from 15% to about 50%.

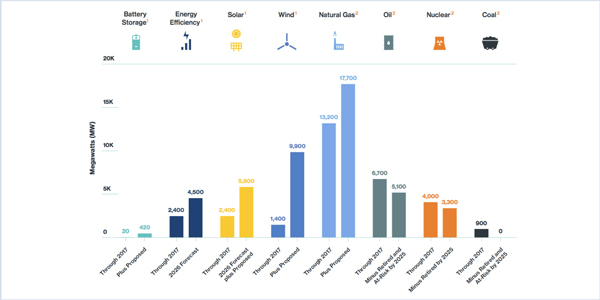

The outlook noted that wind power last year for the first time surpassed natural gas for the volume of generation seeking interconnection in the RTO’s queue. About 4,000 MW of that proposed wind would be located offshore of Massachusetts, with most of the remaining 4,500 MW slated for Maine.

“Because of the large distances from some of the proposed onshore wind power projects to the existing grid, major transmission system upgrades will be needed to deliver more of this power from this weaker part of the system to far-away consumers,” the report says.

As the amount of wind and solar power continues to grow, in part driven by state policies, the RTO last month proposed a new two-stage capacity auction, Competitive Auctions with Sponsored Policy Resources, to enable its Forward Capacity Market to accommodate state policy-sponsored, clean-energy resources in the wholesale market while maintaining a viable economic model for existing power plants. (See CASPR Filing Draws Stakeholder Support, Protests.)

The RTO also says it’s keeping an eye on the increased adoption of electric vehicles and electric heating in New England as states in the region pursue decarbonization goals.

“The ISO plans to start working with regional stakeholders to quantify the impact of the states’ decarbonization policies on long-term demand so that we can understand their potential effects on the power system and reflect these in future Regional System Plans,” the report says.