FERC last week denied a complaint by SPP transmission owners that the RTO’s transmission zonal placement is unjust and unreasonable, saying the members did not meet their burden of proof to back up their claims (EL18-20).

The companies filed their complaint in October, arguing that a “loophole” in SPP’s Tariff forces customers within an existing zone to pay a share of the legacy costs for transmission lines newly integrated into the zone. That practice, the complainants said, runs counter to the “no legacy cost shift” protections SPP has established to prevent cost shifting between zones. (See SPP Tx Owners Take Zonal Placement Concerns to FERC.)

The TOs contended SPP’s zonal integration decisions create unjustified rate increases in the form of cost shifts between customers. They argued the Tariff is unduly discriminatory because the cost shift burden is not evenly distributed and the disparate rate treatment is not based on any differences in service or the customers.

The legacy TOs said SPP’s recent creation or expansion of multi-owner zones highlighted various notice and equity issues that did not exist in historical single-owner zones.

Kansas City Power & Light made the filing and was joined by American Electric Power (on behalf of subsidiaries Public Service Company of Oklahoma and Southwestern Electric Power Co.); City Utilities of Springfield, Mo.; KCP&L Greater Missouri Operations; Nebraska Public Power District; Oklahoma Gas & Electric; Omaha Public Power District; Southwestern Public Service; Sunflower Electric Power; Mid-Kansas Electric; Westar Energy; and Western Farmers Electric Cooperative.

The companies filed after failing to revise the Tariff to include a mechanism holding customers in an existing zone harmless from network integration transmission service rate increases of more than 2% or $1 million (whichever is lower). The proposal was rejected by both the Markets and Operations Policy Committee and the Board of Directors in July. (See SPP Board Rejects Changes to Tx Zonal-Placement Rules.)

The commission said that although it was denying their complaint, “this does not alter the rights that existing SPP transmission owners … have to represent their interests and take action to address cost shifts that may result from zonal integration.”

Pointing to SPP’s newly revised TO zonal placement process that sets notice and information-exchange requirements for potential new TOs, the commission said existing owners retain their ability to negotiate with the RTO and new owners about zonal integration issues and to design measures to mitigate potential cost shifts. (See “SPC Approves Zonal Placement Process Document,” SPP Strategic Planning Committee Briefs: July 13, 2017.)

In addition, parties can participate in SPP’s stakeholder process to develop and consider proposals to address this issue with more comprehensive participation by all stakeholders, FERC said.

SPP argued that not every cost shift resulting from placing a new TO in an existing zone is unjust and unreasonable. It said FERC has never taken a “rigid view” that rate impacts and cost shifts are universally and patently unjust and unreasonable, but instead “recognizes that matters of rate design involve judgment on a myriad of facts.”

The RTO asserted that its Tariff is not unjust and unreasonable because it does not require SPP to involve itself in evaluating and mitigating cost shifts. Those determinations are best addressed by the commission on a case-by-case basis, SPP said.

Proposed Tariff Revisions Set for Settlement

The commission set for settlement hearing SPP’s proposed Tariff revisions to add an annual transmission revenue requirement (ATRR) and implement a formula rate template for transmission service using South Central MCN’s facilities, when the utility acquires them and transfers their functional control to the RTO.

In an order related to the hearing, FERC also approved South Central’s purchase of transmission lines and related assets from the city of Nixa, Mo.

FERC said its preliminary analysis indicates that SPP’s proposed Tariff revisions “may be unjust, unreasonable, unduly discriminatory or preferential, or otherwise unlawful,” but it accepted and suspended them to become effective the first day of the month after South Central acquires the Nixa assets, subject to refund and the outcome of other ongoing proceedings before the commission.

The commission granted SPP’s waiver request of its regulations regarding cost-of-service statements, consistent with its prior approval of formula rates. However, it allowed the administrative law judge to provide for “appropriate discovery of such information.”

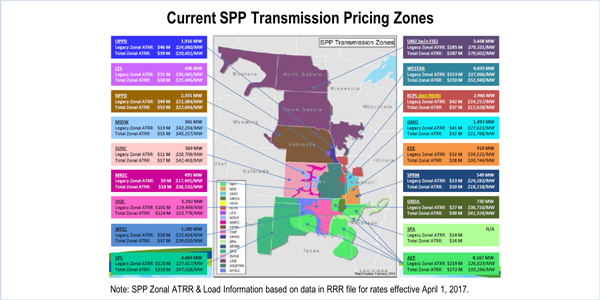

SPP filed its request in October, proposing to incorporate South Central’s previously accepted formula rate to populate the utility’s ATRR with certain Nixa transmission facilities. SPP said the assets, about 10 miles of 69-kV lines and associated infrastructure, interconnect with its system in the Southwestern Power Administration (SPA) and City Utilities of Springfield pricing zones, but are not included in SPP rates.

The RTO proposed placing the Nixa assets and their associated ATRR in the SPA zone, using the revised zonal placement process. The Nixa assets would be the first facilities subject to the revised process.

FERC noted that South Central’s formula rates and implementation protocols are the subject of several ongoing proceedings before the commission, and that the utility has also filed a request for rehearing or clarification.

“Accordingly, certain provisions of South Central’s previously approved formula rate template and implementation protocols could change based on the outcome of those proceedings,” FERC said.

AEP, KCP&L, Sunflower, Mid-Kansas, Westar and Xcel Energy took issue with SPP’s rate-impact analysis under the new process.

The TOs argued that SPP’s calculation of a 46% rate increase “appears to be a simple comparison of total zonal ATRR before and after South Central’s integration.” They said that because network service rates are based on ATRR and load ratio share, it would be necessary to evaluate the ATRR and any associated changes in load to accurately determine the rate impact.

The TOs also contended that the rate impact on existing customers in the SPA zone “is further obfuscated” by the fact that Nixa’s load transitioned to SPP network service in June 2017, but the transfer of facilities and recovery of their ATRR through zonal rates would not occur until a later date.

SPP argued that it did not fail to calculate the impact of adding load because South Central is not a load-serving entity and the Nixa load had already begun service in the zone. That meant there was no change in load associated with the assets’ integration, the RTO said.

Responding to a complaint that it “did not provide sufficient evidence” of the assets’ actual rate impact in the SPA zone, SPP said it provided the information “directly to each SPP transmission customer” in the zone during the zonal-placement process.

South Central, a transmission-only SPP member, said it intends to transfer functional control of the facilities to the RTO once the transaction closes. The facilities will be incorporated into the utility’s ATRR in its zone.

FERC found the transaction to be in the public interest because:

-

-

- It does not involve the transfer of generation facilities or the combination of transmission facilities with affiliated generation in the same market, and thus would not have an adverse effect on competition;

- It would not have an adverse effect on rates, as potential rate increases in the SPA zone would be attributable to incorporating the Nixa facilities, not the change in ownership; and

- It would not have an adverse effect on regulation. The commission said it found no evidence that either state or federal regulation will be impaired by the transaction, and noted that no party alleges that regulation would be impaired by the transaction and no state commission has requested that FERC address the effect on state regulation.

-

South Central said the ATRR for transmission service using the Nixa facilities will be recovered pursuant to its formula rate from SPP ratepayers in the zone. Nixa currently recovers its costs to own and operate the assets directly from retail customers through a bundled rate that includes its costs for generation, transmission and distribution service.

The utility acknowledged that “there will be a ‘rate impact’ in the broadest sense” because of the new arrangement but said that the zone’s customers will see only “very small” increases in their rates, pointing to an estimated annual difference of $87,000 between its ATRR and Nixa’s ownership. It said those increases will be offset by the transaction’s benefits.

South Central is a subsidiary of GridLiance, a competitive transmission company that collaborates with public power utilities. The Nixa municipality serves more than 9,000 retail customers.