By Rich Heidorn Jr.

Vistra Energy said Monday it closed its acquisition of Dynegy following a FERC order concluding the $1.7 billion deal raised no competitive concerns (EC18-23).

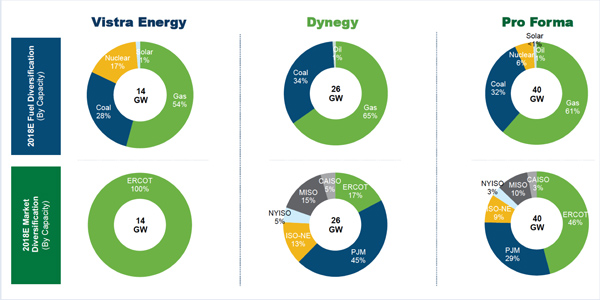

The all-stock deal will create a power generation and retail giant owning 40 GW of capacity and serving nearly 3 million customers, mainly in ERCOT, PJM and ISO-NE. FERC’s April 4 approval was the last regulatory step required to complete the deal, which had already been cleared by regulators in New York and Texas.

| Vistra Energy

Dynegy’s combined cycle gas turbine fleet and geographically diverse portfolio were a big attraction for Vistra, which owns 18,000 MW of generation capacity in ERCOT. Dynegy’s 27,000 MW will give it the following market shares in these organized markets:

- CAISO: 2.96% (2.16% after accounting for capacity under long-term contracts).

- ISO-NE: 12.1% (Rest of Pool zone); 11% (Northern New England zone).

- MISO: 0.3%.

- NYISO: 4.6%.

- PJM: 6.9% (RTO-wide); 3% (MAAC locational deliverability area); 7% (PPL LDA).

FERC has no jurisdiction over the combined company’s generation in ERCOT. The Public Utility Commission of Texas declined a staff recommendation that it require Luminant, Vistra’s generation arm, to divest itself of at least 1,281 MW of capacity to keep the post-merger Vistra below the statutory cap of 20% of ERCOT installed capacity. (See Texas PUC Conditionally Approves Vistra-Dynegy Merger.)

FERC rejected a protest by Public Citizen, which argued that the applicants’ horizontal competitive analysis should have included generation owned by Dynegy’s major shareholder, Energy Capital Partners. Public Citizen noted that ECP is seeking to acquire Calpine.

| Vistra Energy

But the commission ruled ECP’s generation did not have to be included in the analysis after its action in January to reduce its stake in Dynegy from 14.88% to 9.9%, below the 10% threshold that imputes control. ECP’s post-transaction ownership of the combined Vistra entity will be 1.7%, FERC said. “As such, under the commission’s regulations, Dynegy will not be affiliated with ECP, nor under its control,” FERC said.

The commission also said the Dynegy acquisition would not have an impact on vertical competition, saying the only transmission facilities controlled by the applicants in commission-jurisdictional markets aside from generator interconnections are Smoky Mountain Transmission — 86 miles of transmission connected to the Duke Energy Carolinas and Tennessee Valley Authority systems — and Electric Energy, six 8-mile-long parallel generation tie lines. Both provide service under commission-approved open access tariffs.

In related orders Thursday, FERC also set hearing and settlement procedures to review the reasonableness of the reactive service rates for Dynegy’s Illinois Power (ER16-233-001, EL18-133) and 15 other subsidiaries (ER15-1641, et al.).

Vistra CEO Curt Morgan’s executive team, including Chief Operating Officer Jim Burke and Chief Financial Officer Bill Holden, will lead the combined company, based at Vistra’s headquarters in Irving, Texas. The new board is expected to have 11 directors: the current eight members of the Vistra board and three members from Dynegy’s board.