By Jason Fordney

California’s three large investor-owned utilities asked state officials last week to change the rules to protect bundled customers from being saddled with expensive long-term renewable contracts as others defect for increasingly popular community choice aggregators (CCAs).

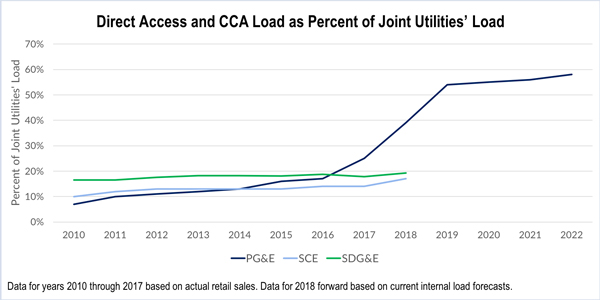

Much has changed in the state since CCAs were created in the wake of the California energy crisis of the early 2000s, the utilities argued. The CCAs didn’t start operating until 2010 but have pulled 40% of Northern California’s bundled load from Pacific Gas and Electric, and 35% of Southern California Edison’s retail load is in the process of CCA formation. The two utilities, along with San Diego Gas & Electric, filed a 363-page proposal with the California Public Utilities Commission. They noted that 85% of their load could move away by the mid-2020s.

“The combination of these two developments leaves high-cost, long-term renewable contracts in the IOUs’ bundled service customer portfolios that are far in excess of their need,” the utilities said. The situation has also brought the utilities’ procurement of large-scale renewable projects to a halt.

The cost of renewable power has decreased significantly since the legacy contracts were signed, which the IOUs say “transformed the renewables market consistent with state policy and commission direction.”

The more than 200 legacy contracts representing hundreds of millions in costs were the topic of a hearing at the Senate Energy Committee last summer, at which Chairman Ben Hueso expressed concern about creating an ungovernable system. (See California CCAs Spur Worry of Regulatory Crisis.)

The PUC got some pushback from CCAs in February when it fast-tracked new regulations for new and expanding CCAs over resource adequacy concerns. (See CCAs Oppose CPUC Decision, Process.)

The April 2 IOU proposal would restructure the power charge indifference adjustment (PCIA), which is meant to ensure that bundled customers are not affected financially by other customers deciding to join CCAs.

The IOUs had previously proposed that the benefits and costs of previous IOU procurement be allocated to customers for whom those assets had been procured or constructed, a process called the portfolio allocation methodology (PAM).

Despite their new proposal, the utilities “still support their original PAM proposal as being a viable and relatively straightforward methodology to implement to ensure an equitable and efficient allocation of benefits and costs among all customers should the commission wish to consider it,” they said.

The new proposal uses two allocation mechanisms: the “green allocation mechanism” (GAM) for renewable portfolio standard-eligible resources and large hydro, and a “portfolio monetization mechanism” (PMM) including gas, nuclear, non-pumped hydro and energy storage.

“The joint utilities’ proposal of combining the allocation of [renewable energy credits] and [resource adequacy] from RPS and large hydro-electric resources (GAM) with a cost-based allocation approach for other resources (PMM) balances the resource technology concerns of a number of CCA parties while ensuring compliance with state law and continued support of state policy objectives,” they said.

The IOUs proposed that all contracted and utility-owned resources subject to the current methodology be considered eligible for GAM or PMM.