By Rory D. Sweeney

Winter is coming — or at least it will be coming again — and the PJM Board of Managers wants at least some energy price formation restructuring by then.

In a letter to stakeholders released on Thursday, the board acknowledged the heavy lift that implementing staff’s original price formation white paper might entail, but it said there is consensus between PJM staff and the Independent Market Monitor on changes to improve reserve pricing. The letter directs staff to identify changes that can be implemented for next winter and “respectfully requests stakeholders to deliberate timely” so that the revisions can be completed by the third quarter, in time for FERC approval for winter 2018/19. (See “Additional Reserves Needed?” PJM MRC/MC Briefs: March 22, 2018.)

“We have been informed that PJM staff and the IMM agree that PJM should implement a 30-minute reserve product in real time to comport with the current day-ahead scheduling reserve product, address issues with the current implementation of the synchronized reserve market, implement a more dynamic establishment of reserve requirements so as to better capture operator actions taken to maintain reliability, and enhance the operating reserve demand curves used to price reserves during reserve shortage conditions,” the board wrote.

“Given the level of agreement between the IMM and PJM staff, the board believes that this more targeted issue may present an excellent opportunity for the stakeholder community to come together and demonstrate that the PJM stakeholder process can deliver thoughtful and timely consensus action.”

Dual Issues

The board reiterated its position that energy and reserve market pricing issues must be examined because “there are times when operators commit resources to ensure reliability but these commitments are not reflected through market clearing prices such that those prices can be suppressed and result in undesirable outcomes.”

The energy market issue has been the focus of the Energy Price Formation Senior Task Force, which is considering the revisions proposed in PJM’s white paper as part of a wider stakeholder analysis. (See “PJM Pushes Price Formation Plan,” FERC, RTOs: Grid Performed Better in Jan. Cold Snap vs. 2014.)

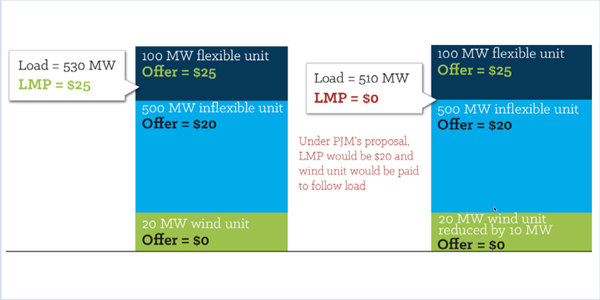

“The board is well aware of questions stakeholders have raised regarding this proposal. The board has listened to stakeholders and appreciates that changes to the LMP calculation require careful consideration,” the board wrote.

It also notes that FERC is already considering PJM’s proposal to apply integer relaxation to fast-start resources as part of its fast-start pricing docket (EL18-34). (See FERC Drops Fast-Start NOPR; Orders PJM, SPP, NYISO Changes.)

In recent PJM stakeholder meetings, the reserve market issues have become the central focus.

“We are hopeful that on an issue such as this one where there appears to be ample, empirical evidence that a market design change is needed, where there is significant alignment between PJM staff and the IMM concerning the need for change, and where there is clear direction as to the nature of the improvement required, such timely consensus can be achieved,” the board wrote.

It asked that the remaining issues be resolved by the first quarter of 2019 so they can be approved and implemented by the summer of 2019.

“Such timely action, if it can be achieved, will reinforce confidence in the ability of the stakeholder process to deliver timely consensus solutions,” the board wrote.