By Michael Kuser

NYISO on Monday presented two options for pricing carbon emissions in the ISO’s wholesale market, saying the approach the ISO favors would not require changes to its commitment/dispatch software or the frequency of settlements.

“The cost of carbon will be known ahead of time, will be known to market participants,” said ISO staffer Nathaniel Gilbraith, who delivered the report to the Integrating Public Policy Task Force (IPPTF), which is jointly run by NYISO and the state’s Department of Public Service. The April 16 discussion was part of issue “Track 2” in the group’s five-track effort to price carbon emissions.

The ISO’s preferred approach would have suppliers embed the carbon charges into their all-in day-ahead and real-time energy offers, as they currently do with emissions costs under the Regional Greenhouse Gas Initiative.

Under the second approach, suppliers would submit emissions information for each segment of energy offers (start-up, no-load and incremental energy in dollars per megawatt-hour) with the ISO incorporating the information to calculate a carbon shadow price. It would require software changes. [Editor’s Note: An earlier version of this article incorrectly stated that neither approach would require software changes.]

Under both options, the ISO would dispatch units as it currently does to minimize production costs subject to system constraints. In either case, carbon charges might also need to be trued up, Gilbraith said.

The carbon price for generators subject to RGGI would be the social cost of carbon determined by the New York Public Service Commission minus the RGGI price. Generators not subject to RGGI, such as fossil fuel plants of less than 25 MW, would pay the full social cost.

The ISO could estimate emissions for the generators but would prefer to let suppliers self-report, said IPPTF co-chair Nicole Bouchez, NYISO principal economist. “We thought it made sense to have the companies who have the best information about their plants to do all that math instead of the ISO having to do, by necessity, approximations of it,” she said.

Another complexity is that emissions vary based on a plant’s heat rate, fuel type and where in the output range they are, she said.

“In order to really know the carbon output, you need to know the exact heat rate as well as the fuel that’s being used at that moment and what the carbon content of the fuel is,” Bouchez said. “Then there’s the question of start-up and no-load carbon emissions as well.”

Bouchez walked stakeholders through the ISO’s current bid and settlement process and how it might change under a carbon pricing regime.

Besides the current day-ahead and real-time market settlements, ““the carbon charge would introduce an additional generator settlement line item, which is based on the actual emissions that day times the applicable price in dollars per ton,” Bouchez said. “[This] gives the dollar carbon charges that would be charged to that generator, and that is based on the actual physical output of the plant.”

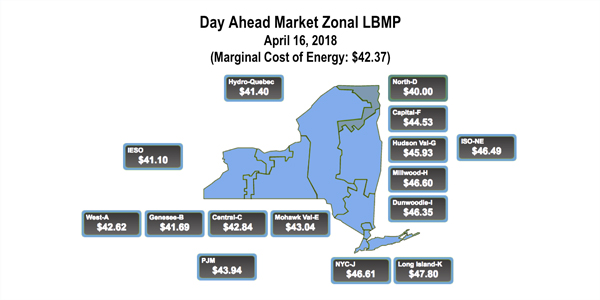

Loads would continue to pay the applicable locational-based marginal price (LBMP) for energy withdrawals. The process would also create a carbon charge “residual,” a dollar amount to be paid to load-serving entities to minimize the increase in retail electricity prices. The allocation of residuals will be discussed at a future task force meeting.

Price Transparency

Couch White attorney Michael Mager, who represents a coalition of large industrial, commercial and institutional energy customers known as “Multiple Intervenors,” asked what would be included in the market price. “Would the final market price be the LBMP plus carbon adder, minus the amount that’s passed back to load-serving entities? What would be transparent and public for every hour?”

Because many end-use customers have supplier contracts based on the market prices, “I think the customers are going to want to know that any money that’s passed back to LSEs at the wholesale level actually gets passed back to the consumers at the retail level, so I think they’re going to need transparency in terms of that price as well,” Mager said.

“The LBMP is still going to exist as the primary cost of a unit of energy,” Gilbraith said. “Similar to today, there are other associated charges, uplift or whatnot, that are allocated to loads. The joint staff team will be working through in June a proposal on how to allocate the carbon residuals back, and that’s a great issue to bring up in that venue, what data and what is made public through that process and at what level of granularity.”

Real-time Emissions

“These calculations are going to be done separately for day-ahead and real-time, and so all of this charging and reconciliation would be done separately for each market. Is that accurate?” asked Howard Fromer, director of market policy for PSEG Power New York.

“Day-ahead and real-time LMBPs will continue to exist as they do today, and so they will be developed based on day-ahead and real-time offers,” Gilbraith responded. “However, energy is only physically produced pursuant to a real-time schedule, so the only way a bill [for the carbon charge] will occur is … based upon a real-time schedule. … It’s based on actual, physical electricity production and the emissions associated with that production.”

The task force next meets on April 23 at NYISO headquarters.