By Michael Kuser

NYISO is floating a proposal that would incorporate the cost of carbon into the ISO’s wholesale market by debiting each energy supplier a uniform carbon emissions charge as part of its settlement, eschewing an alternative approach that would levy region-specific charges for imports.

“The process we envision is very similar to how we handle invoicing today, where load-serving entities (LSEs) are debited the locational-based marginal price (LBMP), and now the LBMP will have a carbon price effect,” Michael DeSocio, the ISO’s senior manager for market design, told New York’s Integrating Public Policy Task Force (IPPTF) Monday.

The May 14 discussions were part of issue “Track 1” in the group’s five-track effort to price carbon emissions, which required development of the straw proposal.

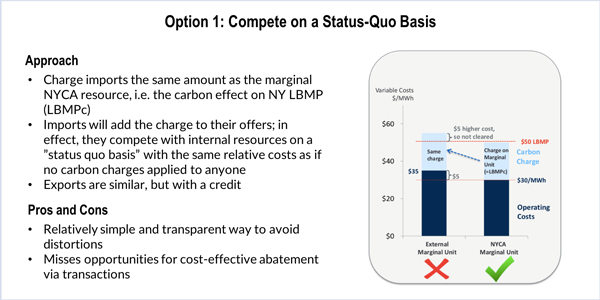

The ISO’s proposal relies on a “status quo” carbon pricing approach (referred to as Option 1) that would not consider the specific carbon content in energy trades from out of state. A second option under consideration would’ve evaluated marginal emissions rates from out-of-state imports.

Both options appeared in a Brattle Group presentation to the task force last month, with Brattle favoring Option 2’s more aggressive approach to external transactions. But DeSocio said choosing the second option of “color-coding megawatts” outside New York would be too complicated. (See NY Carbon Task Force Discusses Seams, ‘Leakage’.)

DeSocio said the ISO is not aware of all supply positions outside the New York Control Area and whether there are offtake positions from one external generator to some external load. That means the energy from a source external to NYISO could be coming from a coal plant in Michigan, for example.

“I don’t have the tools to guarantee that what I’m getting is getting the right attributes assigned to it,” he said.

Rather than try to develop all those tools, which would cost time and money, the ISO is attempting to keep market participants on an even playing field to avoid making a trade into or out of New York harder, or create a bigger barrier to entry, DeSocio said.

Imports will add the charge to their offers, in effect competing with internal resources on a “status quo basis” with the same relative costs as if no carbon charges applied to anyone. Exports are similar but with a credit.

“We think Option 1 does a nice job of keeping the carbon price self-contained and easy to manage,” said DeSocio. “We think it’s a reasonable approach that offers a lot of the same benefits without a lot of the complexity.”

Allocating Residuals

The straw proposal foresees LSEs being debited the LBMPs, “but then the LSEs would be credited all of the collections that we refer to as the carbon charge residuals from the suppliers that are emitting,” said DeSocio. “So, there’s a debit, and a credit, but at the end of the day on the invoice there’s only one charge, and that is the net of the two. That’s the concept.”

In allocating carbon charge residuals, the ISO chose to levelize the net impact so that customers across the state would end up paying the same rate, consistent with carbon affecting everyone and also with how other decarbonization policies are applied to rates, he said.

“There is an externality to the wholesale competitive market,” said DeSocio. “That externality has to do with environmental attributes, including the cost of carbon. There’s money being spent outside of the competitive market to try to deal with decarbonization. So, the goal of the carbon price would be to incorporate that externality to the maximum extent possible into the competitive market as directly as possible.”

Howard Fromer, director of market policy for PSEG Power New York, said that with the increasing number and scale of state solicitations for clean energy, offshore wind and energy storage, state agencies and regulators should make their contract language capable of accommodating a possible carbon charge.

“The numbers are mounting quickly, so if you don’t do something soon to avoid double-dipping, you’ll run into problems,” Fromer said.

Social Cost of Carbon

The straw proposal says the New York Public Service Commission (PSC) would set the gross social cost of carbon (SCC) in dollars per ton of CO2 emissions “pursuant to the appropriate regulatory process.” (See NY Looks at Social Cost of Carbon, Modeling.)

Representing a coalition of large industrial, commercial and institutional energy customers called the Multiple Intervenors, Couch White attorney Michael Mager said, “If carbon pricing were to be implemented under the straw proposal, one of Multiple Intervenors’ concerns would be how the social cost of carbon (SCC) gets set and updated.”

Mager said his clients could not accept the SCC being subject “to update and modification at any time by the PSC in its discretion.”

“It’s one thing if there’s something that’s set by schedule or set by certain parameters, like the annual demand curve update where it’s a formula, everyone knows it, it’s set in advance, and it gets changed in a non-controversial manner,” Mager said.

“This is a little bit of public policy and a little bit of wholesale market, which is territory that we haven’t dealt with too often,” said DeSocio.

DeSocio suggested the ISO’s public policy transmission process could offer guidance on how to proceed.

“It will be helpful to have more of an understanding of what any process would look like for setting [SCC], especially if we were to consider moving forward with including the cost of carbon in the wholesale market,” said DeSocio.

David Clarke, director of wholesale market policy for Power Supply Long Island, asked what would happen if FERC or the federal government decides a lower cost of carbon is appropriate and asserts authority over the rate used under the Tariff.

“We’re kicking around a sixty some-odd dollar per ton number, but what if FERC comes back and says the number’s twenty bucks, or FERC comes back and says the number is three dollars?” said Clarke.

“Certainly, if FERC [were] to develop some policy regarding how to value the cost of carbon in a wholesale market, we would need to take a step back and think about that,” DeSocio said. “At the moment, we’re unaware of any such policy.”

He added that in using a state-supported SCC, the ISO wants to make sure its “incorporation is stable and provides robust market signals” for investment decisions.

The task force had its own charter on the agenda Monday but deferred serious discussion of it until the stage of discussing next steps — around July 9, when the path forward should be clearer. The overall study results are scheduled to be presented in September.

The task force next meets May 21 at NYISO headquarters to address issue “Track 5” assumptions and scenarios on customer impacts, including wholesale customers.