By Rich Heidorn Jr.

Kansas and Missouri regulators on Thursday approved Great Plains Energy’s merger with Westar Energy, the final hurdles in a stock-for-stock merger of equals with an equity value of about $15 billion.

Shareholders of Kansas-based Westar will own 52.5% of the combined company, with Missouri-based GPE, the parent of Kansas City Power & Light, controlling 47.5%.

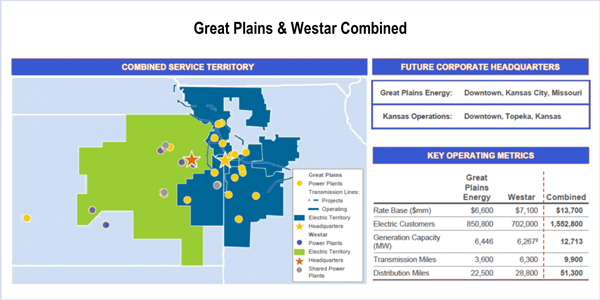

The new company, to be called “Evergy,” will have about 964,000 Kansas and 611,000 Missouri customers. The new company’s board will initially be composed of an equal number of directors selected by Westar and GPE.

The Kansas Corporation Commission approved the deal Thursday afternoon after the Missouri Public Service Commission cleared it in the morning.

“We appreciate that regulators and shareholders recognize the value in combining the companies,” said GPE Chairman and CEO Terry Bassham, who will be president and CEO of Evergy. Initially, the company will continue to serve its customers as Westar and KCP&L.

The Kansas commission approved the merger based on a March 2018 settlement agreement among commission staff, the Citizens’ Utility Ratepayer Board, Sunflower Electric Power, Mid-Kansas Electric, the Kansas Power Pool, Midwest Energy and solar developer Brightergy (18-KCPE-095-MER).

Westar and KCP&L retail electric customers in Kansas will receive one-time bill credits of $30.5 million and annual credits of $11.5 million from 2019 through 2022. Following their 2018 rate cases, KCP&L and Westar will be subject to a five-year base rate moratorium assuming their authorized return on equity is at least 9.3%.

The Kansas commission imposed an additional requirement that the companies develop an integrated resource plan process to “ensure the merger maximizes the use of Kansas energy resources,” it said in a press release.

The new company will maintain headquarters in both Topeka, Kan., and Kansas City, Mo., with the Topeka headquarters guaranteed for at least 10 years. There will be no involuntary severances because of plant closings, and the company’s 5,000 employees will receive compensation and benefits at current levels for at least two years.

The Kansas commission approved the deal over the objections of Kansas Electric Cooperative, which said the settlement did not address all its concerns.

Earlier in the day, Missouri regulators approved the deal, which provides initial bill credits of $29 million for their retail ratepayers.

“The merger will create a stronger combined company, with more customers, more geographic diversification, no transaction debt to complete the merger, and the prospect for higher earnings growth rates than either GPE or Westar would be able to achieve on a stand-alone basis,” the Public Service Commission said in its order (EM-2018-0012).

Kansas regulators last year pushed back on GPE’s original plan to buy out Westar, forcing the companies to recast the transaction as a “merger of equals.”

“It’s been a circuitous route to get here,” the Topeka Capital-Journal quoted PSC Chairman Daniel Hall as saying. “We had to fight through the jurisdictional issues, then we had to dismiss the case when our sister jurisdiction ruled it was not in the public interest and start all over again with this one.”

FERC approved the merger on Feb. 28 (EC17-171). (See FERC Greenlights Great Plains-Westar Merger.)

The deal is expected to close in early June. The company expects to rebalance its capital structure by repurchasing about 60 million shares of its common stock over a two-year period.

Great Plains stock closed Thursday at $19.75/share, up 1%. Westar shares ended the day at $54.58, an increase of 0.66%.