By Michael Kuser

RENSSELAER, N.Y. — NYISO continues to propose a cost-levelizing approach for allocating carbon charge residuals to load-serving entities, it told New York’s Integrating Public Policy Task Force (IPPTF) and stakeholders on Monday.

The ISO’s preferred approach would have suppliers embed the carbon charges into their all-in day-ahead and real-time energy offers, as they currently do with emissions costs under the Regional Greenhouse Gas Initiative, as it presented to the task force in April. (See NY Task Force Briefed on Carbon Charge Mechanics.)

The June 4 allocation discussions were part of issue Track 2 in the group’s five-track effort to price carbon emissions into New York’s wholesale electricity market.

Progress Review

IPPTF Chair Nicole Bouchez, the ISO’s principal economist, reviewed the task force’s progress in meeting almost weekly every Monday over the past eight months. She said the group is on track to deliver by December either a proposal to incorporate the cost of carbon into the wholesale market, provide a detailed schedule to complete the proposal next year or notify the task force if it concludes that the plan is not viable.

A draft proposal is slated to be delivered Aug. 1, Bouchez said.

“It is absolutely critical that we move quickly to get to a point of either this is going to happen or this is not,” said Mark Younger of Hudson Energy Economics. “We need clarity on that as soon as possible so that if it’s not going to happen, we can proceed with other things that will.”

Couch White attorney Kevin Lang, representing New York City, asked why stakeholders needed to move quickly.

“Because we have a serious problem with a substantial mismatch between public policy actions and our markets, and it is causing severe damage in our markets,” Younger said.

“No, that’s your view that there’s a mismatch,” Lang said. “The [Public Service Commission] is adhering to its public policy, which it has every legal right to do. You may not like the result, but that doesn’t mean we need to move very quickly on this issue, which is not yet fully developed.”

Fair Cost Burden

Locational-based marginal prices would increase according to the emissions rate of the marginal, price-setting resources — the marginal emissions rate (MER).

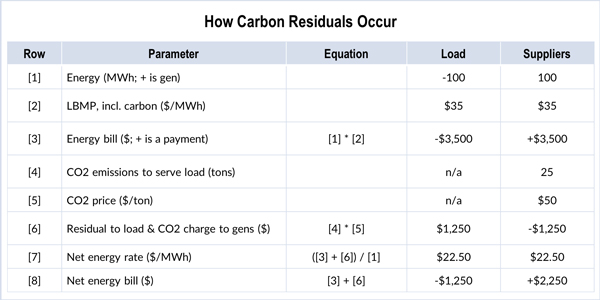

“As a result of load paying the full LBMP for their energy withdrawals, and suppliers not receiving the full LBMP for their energy generation — then being charged for their carbon emissions — there is an imbalance between bills and credits,” said ISO staffer Nathaniel Gilbraith. “This imbalance is what we’re calling a residual, and it’s going to be returned to loads using one of the methods we discuss today.”

The ISO’s presentation Monday detailed three approaches to allocation of residuals: load ratio share, cost levelizing and proportional allocation, with the latter two based on the carbon effect on each zone’s LBMPs.

The load ratio share results in all LSEs receiving the same refunds on a dollar-per-megawatt-hour basis, causing greater differences in the net cost of carbon pricing. On the plus side, it would provide LSEs with price signals more reflective of the carbon intensity of their consumption.

Cost levelizing produces the most similar cost burden in terms of dollars per megawatt-hour of carbon charge, but it also limits the differential price signal to reduce consumption, Gilbraith said. Zones with high MERs would not necessarily see an incentive to reduce consumption relative to those with lower rates.

Proportional allocation would return carbon charge residuals to all LSEs based on the proportional effect carbon prices have on their gross energy payments. It would return more revenues to LSEs facing higher dollar-per-megawatt-hour cost impacts but would not go as far as levelization.

The ISO said this provides some balance between economic efficiency and equity of cost burden by maintaining some of the differential price signals to encourage reduced consumption and emissions.

In its 2025 base case analysis, the ISO said downstate LSEs would face the highest net increase in energy payments (carbon payments minus residuals) under the load ratio share (8.93 cents/kWh) and the lowest under levelizing (8.96 cents/kWh).

The impact on upstate would be reversed: 6.57 cents/kWh under load ratio and 6.71 cents/kWh for levelizing.

Gilbraith added that the analysis did not cover allocation by LSEs to retail customers, which would be under PSC jurisdiction.

Lang said he understood not considering retail allocation but noted that the ISO assumed that a carbon charge would affect the price of renewable energy credits, which is entirely under PSC jurisdiction. “So why are you picking and choosing which area of PSC jurisdiction you’re going to intrude into and which parts you’re not?” he said.

Michael DeSocio, the ISO’s senior manager for market design, said the ISO is working “to make sure that if a market-based carbon pricing effort like this would move forward, that future determination of RECs and other products like that could be adjusted to consider that alternative. … We’re filing comments [with the PSC] regarding ORECs [offshore wind RECs] on how a contract structure could work with a carbon pricing mechanism [to] minimize any double compensation.”

Topics for discussion include whether residuals allocated to an LSE should be allowed to exceed that entity’s gross carbon payments and what criteria stakeholders are looking for in terms of equity vs. cost burden.

Status, Schedules

The ISO in May began running the task force, which it set up last year in partnership with the state’s Department of Public Service.

The straw proposal assigned to issue Track 1 was delivered on April 30 and reviewed by stakeholders May 14, and therefore will be closed, said Bouchez.

Track 2 focuses on the market mechanics of a carbon charge and has so far had the broadest range of topics covered of any track, Bouchez said. The IPPTF will discuss the track on June 18 and July 9, and the schedule has five open Mondays through October in case the group needs more time on it.

Track 3 covers how a carbon charge should be set and adjusted for the Track 5 customer impacts analysis. No additional work has been scheduled on Track 3 since DPS staff and a stakeholder both presented recommendations for setting the carbon charge, which is ultimately the responsibility of the PSC.

Track 4 focuses on a carbon charge’s interactions with other state policies and programs, and there is no additional work currently scheduled. The group plans one more meeting on Track 5 customer impacts analysis before starting the base modeling work. The group will also meet to review assumptions used in the “dynamic change case” analysis, with stakeholder review in September and October, Bouchez said.

The task force next meets June 18 at NYISO headquarters to address Track 5 assumptions and scenarios on customer impacts, and wholesale market processes under Track 2.