By Rich Heidorn Jr.

Exelon announced Tuesday it has signed an agreement to purchase the retail business of bankrupt FirstEnergy Solutions for $140 million in cash, an acquisition that would increase the number of customers for its Constellation unit by almost 50%.

The deal, which must be approved by the U.S. Bankruptcy Court for the Northern District of Ohio, would transfer FES’ retail electricity and wholesale load-serving contracts and other commodity contracts to Constellation.

In an 8-K filing, Exelon said it will close the deal in the fourth quarter if it is successful in a bankruptcy court-supervised auction. Either party can cancel the transaction if it is not complete by the end of the year.

FES filed for a Chapter 11 bankruptcy restructuring on March 31. (See FES Seeks Bankruptcy, DOE Emergency Order.) On Monday, FES filed a motion seeking approval for bidding procedures and scheduling an auction for Sept. 6, with bids due Aug. 23.

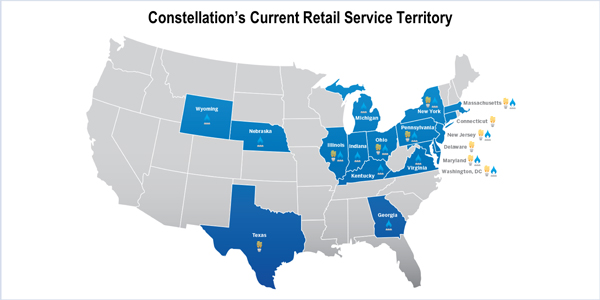

FES’ retail power business serves 900,000 commercial, industrial and residential customers in Michigan, Ohio, Pennsylvania, Illinois, Maryland and New Jersey.

“The purchase would leverage Constellation’s significant retail platform and is in line with our generation-to-load strategy, strengthening our position as the nation’s largest competitive energy supplier and bringing Constellation’s total customer base to more than 3 million residential and business customers across the continental United States,” Exelon said in a statement. “We would honor all existing retail customer contracts and look forward to offering newly acquired customers the same quality products and services that existing Constellation customers currently enjoy.”

FES said in a press release that it expects to receive a net of $280 million in cash from the transaction “subject to certain purchase price adjustments, including the return of cash collateral and collection of retained net working capital.”

“We believe this transaction is another important step in our restructuring plan,” said FES Chief Financial Officer Kevin Warvell. “If approved, we will work with Constellation to ensure the transition of customer accounts is seamless. During the sale process, our daily operations will continue as usual.”

FES hired Barclays Capital early last year in a bid to sell the assets but decided not to proceed after receiving initial proposals from eight suitors. The company said it abandoned the sale because the purchasers’ proposed terms “made it challenging” for the company to complete a deal outside of a bankruptcy proceeding.

Before entering bankruptcy in March, FES retained Lazard to handle an in-court divestiture. Lazard contacted 35 potential buyers, including “broadly focused financial investors, power- and energy-focused financial investors, strategic retail and power generation companies,” FES said.

The second effort yielded offers from six bidders in March, one of which was rejected because it did not include FES’ entire retail business. FES said it ultimately selected Exelon’s offer as the best, or “stalking horse,” bid.

Under the proposed auction procedures, a bidder challenging Exelon would need to offer an “initial topping bid” of $146.6 million, with subsequent bids in increments of at least $1 million. The auction will be canceled if no bids other than Exelon’s are received.

In a separate motion Monday, FES sought to file the unredacted sale agreement under seal to prevent it from disclosing the details of a mechanism that could adjust the purchase price and that allocated value by individual customer accounts. FES said disclosure of those details could reduce the ultimate purchase price.

Constellation serves residential customers in 17 states and D.C. after acquiring retail operations from Consolidated Edison in 2016 and Integrys Energy Group in 2014. (See Exelon’s Constellation to Buy Con Ed’s Retail Operation.)

FirstEnergy shares closed Tuesday at $35.39, up 0.2%. Exelon rose 0.76% to $42.17.