By Michael Kuser

RENSSELAER, N.Y. — NYISO on Monday presented stakeholders details on how a carbon charge would affect locational-based marginal prices (LBMPs) and imports and exports.

The ISO’s market software will not automatically calculate a carbon component of LBMPs because the carbon charge will be included with fuel and other relevant costs when bid into the current structure. Instead, the ISO envisions calculating an after-the-fact estimate of the LBMP carbon impact, said Ethan Avallone, senior market design specialist.

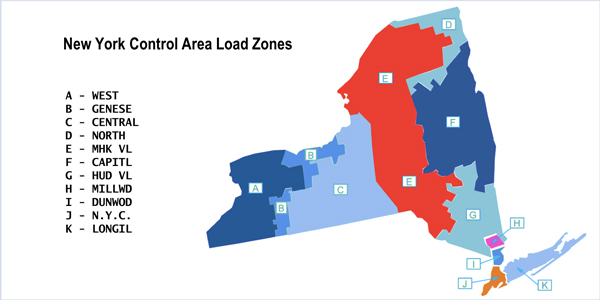

NYISO will report the estimated LBMP carbon impact for each of its 11 load zones, as well as for each external interface proxy bus.

“What information exactly we would use to make these calculations remains to be seen,” Avallone said at a July 9 meeting of New York’s Integrating Public Policy Task Force (IPPTF), the group charged with developing ways to incorporate the cost of CO2 emissions into wholesale energy markets.

“I think we would tie the emission rate to reference levels for the generation resources, so it would be close to the actual,” Avallone said. “But that’s why we say estimates, because it could differ depending on the mix of the fuel, etc.”

He added, “We’re considering whether the estimated LBMP carbon impact could be calculated and posted at a time granularity consistent with today’s LBMPs or if a different frequency would be more appropriate.”

IPPTF Chair Nicole Bouchez, NYISO’s principal economist, said the stability of the emission rates will determine how well the ISO can predict them and the consequences of estimates versus using a detailed cost breakdown.

Marginal Emission Rates

Several complications prevent NYISO from capturing the exact LBMP carbon impact, including the difficulty in identifying the marginal units because of product trade-offs (energy, spin, regulation), and time interval trade-offs involved in the ISO’s look-ahead for the next megawatt of supply, Avallone said.

“To me the big concern is that when you rank the marginal units in terms of costs, break up the costs for different units, that the CO2 component might vary or be rather erratic,” said Pallas LeeVanSchaick of Potomac Economics, the ISO’s Market Monitoring Unit. “First, that might be unnecessarily volatile, and secondly, it would gloss over the impacts of changes in commitment and other things that might not be marginal for one five-minute period, but they’re still marginal.”

Bouchez said, “Just to remind everyone, when we talk about marginal, we mean what unit would you be moving to serve the next megawatt of load, so the unit that is on a fixed schedule would not be the one that would be moved. … Pallas is also thinking a bit larger, which is do you actually change commitment to serve that next megawatt of load?”

Mark Reeder, representing the Alliance for Clean Energy New York (ACE NY), asked, “If a generator is in a zone, do you know how often the carbon on the margin on their bus would likely be quite different from what you get in terms of a zonal calculation?”

“The point to consider is that the generator at the bus that receives the carbon charge (impact in its bus LBMP) must pay the carbon charge for its emissions,” Avallone said.

Carbon Charge on External Transactions

NYISO staffer Nathaniel Gilbraith summarized the ISO’s proposal to rely on a “status quo” carbon pricing approach (referred to as Option 1) that would not consider the specific carbon content in energy trades from out of state. A second option under consideration would evaluate marginal emissions rates from out-of-state imports. (See NYISO Floats Carbon Pricing Straw Proposal.)

The ISO’s first consideration “was to avoid distorting import and export incentives, so that the goal here was to avoid creating a seam at the border where certain resources were compensated differently than others, which would result in a reshuffling of resources or fundamentally change import-export engineering,” Gilbraith said.

Representing New York City, Couch White attorney Kevin Lang said, “If what we’re trying to do is lower carbon emissions, then I’m not sure what the concern is about incentivizing more carbon-free imports into New York. In other words, we should be trying to create a level playing field for imports, just like what we’re doing in-state, where we’re trying to incentivize renewable resources.

“By trying to avoid the carbon character of imports and exports, you’re really creating an unlevel playing field, when what we are really trying to do is create a fundamentally competitive market with anyone to be able to compete on an equal basis.”

“I’d rephrase it as we’re trying to draw a specific border, and I think you would like to expand that border to include a broader set of resources that are potentially subject to the carbon pricing,” Gilbraith said.

Howard Fromer, director of market policy for PSEG Power New York, asked whether the complexity of calculating the marginal emission rate in neighboring areas is still the “driving reason” for the preference for this Option 1.

“There are several reasons why Option 1 is preferable and that’s one of the major ones,” Gilbraith responded.

Erin Hogan, representing the Department of State’s Utility Intervention Unit, said, “A generator that wants to export will have their carbon charge in the LBMP, but yet they’ll get a credit back at the border; so theoretically, if it’s equal, we could be exporting a significant amount of energy outside the state and … that would be the status quo.”

“That’s exactly right,” Gilbraith said. “If a generator is currently competitive with generation in an external control area and would like to export its power, let’s say in New England, it can do that today and they can profit on its relative efficiency compared to New England’s current system.”

“So then the drawback is not necessarily that it doesn’t incentivize cost-effective carbon abatement outside of New York, but that it also could limit the carbon abatement within New York,” Hogan said.

Warren Myers, DPS director of market and regulatory economics, said, “This has become focused on the technical aspect of the quantity of the emissions external to New York, and everybody’s just glossing over the fact that … it’s not just the quantity, it’s the value of carbon.

“In this proposal, New York state, not Pennsylvania, not Tennessee, not Massachusetts, would be saying how much each ton of carbon is worth,” he said. “To my mind, Option 1, for good or ill, minimizes the exporting of a New York state policy when it comes to interstate trade.”

Revised Charter

NYISO Senior Manager for Market Design Michael DeSocio presented a revised charter for the task force, which requires that all proposed analyses and their methodologies go through the ISO’s stakeholder process, starting at the Market Issues Working Group before going to the Business Issues Committee.

The task force next meets July 16 at NYISO headquarters to review draft recommendations for issue Tracks 2, 3 and 4 covering, respectively, wholesale energy market mechanics, policy mechanics and interaction with other state policies.