By Robert Mullin

CAISO prices surged in the first quarter on falling hydroelectric output and increased costs for natural gas, the ISO’s Department of Market Monitoring told stakeholders Wednesday.

Speaking during a call to discuss the department’s quarterly market issues report, Amelia Blanke, manager of monitoring and reporting, noted that the ISO is accustomed to a pattern of lower prices in the first two quarters followed by rising prices later in the year.

“That was not the case in Q1 of this year,” Blanke said.

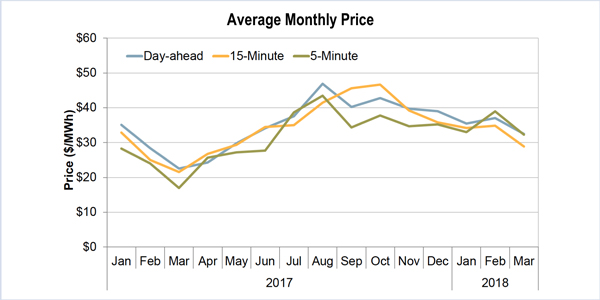

Average five-minute prices jumped 50% ($12/MWh) compared with the same period a year earlier, while 15-minute prices rose 20% ($6/MWh), putting prices close to levels seen last fall. Day-ahead prices were also up about $6/MWh during the quarter (See chart).

“One of the factors that influenced this include the availability of hydro generation,” Blanke said, adding that hydro output was just under half the level seen in the first quarter of 2017.

Despite heavy snowfall in March, snowpack in California’s Sierra Nevada mountains ended the winter at just 52% of normal. That was well short of the near-record snowpack many areas reported last year, which required dam operators to release water from reservoirs earlier than usual.

Increased congestion also provided a boost to Southern California day-ahead prices, adding about $2/MWh to average prices in the Southern California Edison area and $5/MWh in the San Diego Gas & Electric area. But the lack of congestion in the north helped reduce Pacific Gas and Electric prices by about $3/MWh.

Tight Gas, High BCR

Tight gas supply was the other key factor driving up power prices, Blanke said. PG&E Citygate gas prices were up 19% over the first quarter of 2017, while SoCal Citygate added 7%, continuing last year’s trend of rising gas prices. (See Gas Costs Drive Sharp Gain in CAISO 2017 Prices.)

“There was a higher frequency of high same-day gas prices and shortage conditions for gas in the southern part of our balancing area,” Blanke said.

Grid operations in Southern California are still hamstrung by limited gas supplies from the Aliso Canyon storage facility north of Los Angeles. As a result of market operations intended to preserve that supply, the ISO paid out $11 million in bid cost recovery (BCR) in February because of a cold snap — the highest BCR expense for any month since 2011, the Monitor said.

Limited gas supply in the SoCalGas system during a period of high gas demand led to both high regional gas prices and the reinstatement of Aliso gas cost scalars, both of which contributed to high real-time bid cost recovery in February, the DMM report said.

CAISO implemented the scalars — or price adders — in 2016 to help ensure that gas-fired generators can recover fuel costs in the face of potential price spikes stemming from the Aliso Canyon limitations. (See FERC Approves CAISO’s Aliso Canyon Response Plan Ahead of Summer.) When activated in the real-time market, the adders boost the commitment proxy gas cost calculation to 175% of the day-ahead gas reference price, while gas prices in the default energy bid calculation are set to 125% of the day-ahead price.

The Monitor has opposed the ISO’s reliance on the scalars, instead recommending the ISO develop the ability to update gas prices in real time.

“DMM believes that each use of the Aliso Canyon gas adders on default energy bids and commitment costs highlights the problems associated with the use of these adders,” the Monitor said.

The first problem, according to the DMM, is the delay in activating and deactivating gas adders in response to actual conditions.

The second problem is the mismatch between the gas price based on the adders and actual volatility over the same day, the Monitor said.

It noted that bid cost recovery payments totaled $5 million over Feb. 20-23, when SoCal Citygate prices were “significantly high.”

“These events also highlight the need for the ISO to develop the capability to update gas prices used in the real-time market based on same-day gas market price information available each morning, as recommended by DMM” in its comments to FERC after CAISO filed to extend its Aliso provisions. The ISO has defended its use of the adders as a needed, if imperfect, tool. (See Gas Adders a Necessary Tool, CAISO Says.)

Less Negativity

Blanke also pointed to the price impact of the “duck curve,” which illustrates the precipitous drop in net load at midday as solar and wind resources displace higher-cost fossil fuel generation. “As we have throughout last year, you see lower prices in the middle of the day — in all markets — than we do in the traditional off-peak hours,” she said.

But declining hydro output helped reduce the frequency of negative prices in the market, as prices slipped below zero in about 2% of 15-minute market intervals and 4% of five-minute market intervals, compared with 10% and 13%, respectively, a year earlier.

“This is highly correlated with a reduction in self-scheduled hydro generation,” Blanke said.

The DMM report noted that a “reduction in self-scheduled generation would result in increased bidding flexibility and reduce the likelihood of negative prices.

The report again called out an issue the DMM has flagged for nearly two years: the continued funding shortfalls stemming from the ISO’s congestion revenue rights auctions. (See Report Shows Continued Losses in CAISO CRR Auctions.) The Monitor pointed out that first-quarter CRR auction revenues came up $43 million short of payments made to the non-load-serving entities that purchased the rights at auction, compared with a $12 million shortfall a year earlier. It was the second largest shortfall for any quarter since 2015.

“Losses in the first quarter represent 38 cents in auction revenues paid to transmission ratepayers for every dollar paid out to auctioned rights holders,” the report said. “Total ratepayer losses from the congestion revenue rights auction since the market began in 2009 surpassed $770 million.”

FERC earlier this month approved the first stage of the ISO’s CRR rule changes, which will limit allowable source and sink pairs for CRR transactions to those that align with typical supply delivery paths. The changes also require annual transmission outage reporting to more closely match day-ahead models. (See FERC OKs Tighter Rules for CAISO CRR Auction.) While the DMM expressed support for the ISO’s rule changes as “an incremental improvement,” the report said it “continues to recommend that the auction process be replaced by a market for financial hedges based on clearing bids from willing buyers and sellers.”