SPP’s Market Monitoring Unit said last week that energy prices averaged about $23/MWh in the spring, despite higher loads.

The MMU’s quarterly State of the Market report also highlighted the recent merger between Westar Energy and Great Plains Energy, the parent company of Kansas City Power and Light, although its completion happened outside the report’s March-May range. (See Westar-Great Plains Merger Wins Final Approval.)

The Monitor said the combined company would have accounted for 19.2% of total system load over the period, making it the largest energy user in SPP’s market footprint. Additional information will likely be included in the summer report, MMU Executive Director Keith Collins said.

The report indicates that spring hourly average load was up 8% from 2017 — and 14% for May alone — as a result of abnormally high temperatures. Average day-ahead prices increased 13% to $23/MWh over last spring, while average real-time prices gained 10% to $22/MWh.

Spring’s average monthly gas price at the Panhandle Eastern hub was $2.14/MMBtu, down from $2.70/MMBtu in 2017. Gas prices in spring 2016 were $1.68/MMBtu.

Coal-fired resources continued to account for a smaller share of the RTO’s energy production at 37%. Wind resources accounted for almost 29% of generation, with nameplate wind capacity increasing to 17.7 GW by June, up from 12.8 GW at the end of May 2016.

The Monitor said occurrences of negative price intervals decreased from the winter period and last spring. This spring, prices were negative in just over 5% of real-time intervals, and just under 2% of day-ahead hours.

According to the report, overall congestion in the footprint has declined, with real-time intervals with a breached or binding flowgate dropping from 40% last spring to 20% this spring.

The Monitor recently conducted a study of day-ahead market congestion and auction revenue rights bidding behavior following complaints by market participants that were unable to obtain hedges in the ARR process. The study led to three main conclusions, the MMU said: Successful ARR nominations have decreased; the market’s overall need for hedges has increased; and nomination behavior has remained relatively consistent.

The growth in day-ahead congestion correlates with the overall increase in wind production, the Monitor said. It said the 28 GW of additional wind capacity planned in the generation interconnection queue will likely increase the need for hedging.

The MMU recommends “further review and consideration of the auction revenue right process by the RTO and stakeholders” going forward. It will host a webinar July 25 to discuss the spring report.

SPP Preps AECI Seams Project for 2nd Crack at FERC

David Kelley, SPP’s director of seams and market design, told the Seams Steering Committee on Friday that the RTO has performed additional analysis in order to gain FERC approval of a seams project with Missouri-based Associated Electric Cooperative Inc.

Kelley said staff intends to present “new evidence” on regional cost allocation to FERC in July or August. He said SPP will be presenting the avoided costs of regional projects — a metric the commission has already approved — and the reduced regional costs of day-ahead market uplift.

“We’re thinking we’re in really good shape,” said Kelley, who last met with FERC on July 12. “It’s been a little challenging to figure out a way to do regional cost allocation for a single project.”

SPP is trying to reverse FERC’s October rejection of cost allocation for the Morgan project, one of two potential seams projects with AECI. It consists of a new 345/161-kV transformer at AECI’s Morgan Substation near Springfield and the rebuild of a 161-kV line.

The other project, a 345-kV, 50-MVAR reactor at City Utilities of Springfield’s existing Brookline substation, has been included in SPP’s Integrated Transmission Planning Near-Term assessment that will be presented to the Markets and Operations Policy Committee and Board of Directors/Members Committee this month.

The Brookline project’s costs will be allocated under SPP’s normal processes, but Kelley said AECI wants to pick up its share. The two projects have a combined estimated engineering and construction cost of more than $18 million.

The SSC agreed to take a crack at developing a Tariff mechanism to allocate costs for seams projects. With no such mechanism in place, SPP has to take seams projects to FERC on a case-by-case basis.

SPP, MISO Discuss Jan. 17 ‘Big Chill’

The Regional Transfers Operating Committee (RTOC), a six-person committee that includes two representatives from SPP and MISO, met twice in June to discuss what Kelley called “The Big Chill,” the Jan. 17 event when unusually frigid weather forced MISO to initiate a maximum generation alert for its South region.

MISO exceeded its 3,000-MW regional dispatch limit on transfers between its North and South regions over the SPP transmission system for an hour and was forced to make emergency purchases from Southern Co.

Kelley said the RTOC reviewed the use of NERC’s transmission loading relief process during the event and processes for acquiring and delivering emergency energy. He said improved communications will be the key to preventing a recurrence and improving operations and reliability.

“Situations like Jan. 17 don’t just show up without advance warning,” he said. “We and MISO had multiple warnings days before. We feel, and MISO feels, we can do a better job of communicating in advance.”

The RTOC is an operating committee created by a 2016 settlement agreement between SPP, MISO, Southern and the Tennessee Valley Authority. (See SPP, MISO Reach Deal to End Transmission Dispute.) It will meet again in late July.

M2M Generates $397,428 in Payments to SPP in May

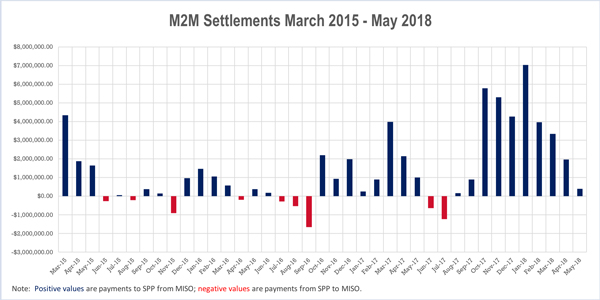

Market-to-market (M2M) payments between SPP and MISO dropped to $397,428 in May, the lowest amount since last August. However, it was also the 10th straight month, and the 18th of the last 20, in which the payments have been in SPP’s favor.

The RTO has incurred $53.7 million in M2M payments from MISO since the two began the process in March 2015.

Current and temporary flowgates were binding for 254 hours in May, SPP staff told the SSC.

— Tom Kleckner