The Public Utility Commission of Texas last week approved a settlement agreement reducing AEP Texas’ annual revenue requirement (ARR) by $27 million, largely to reflect last year’s federal income tax legislation (Docket No. 48222).

AEP Texas agreed to reduce the revenue requirement in its distribution-cost recovery factors (DCRFs) to $55.6 million, with AEP Central’s ARR cut by $21.2 million and AEP North’s by $5.8 million.

Commission staff, the Alliance for Retail Markets (ARM) and several cities served by AEP signed on to the agreement. Texas Industrial Energy Consumers and the Office of Public Utility Counsel did not sign the agreement, but they are not opposed to it.

The changes, effective Sept. 1, reflect the reduction in the federal income tax rate from 35% to 21%.

The commissioners approved similar settlement agreements filed by CenterPoint Energy (Docket 48226) and Oncor (Docket 48231).

CenterPoint, which requested an ARR of $82.6 million effective Sept. 1, agreed to $42.4 million, rising to $63.7 million in September 2019, reflecting other tax changes.

Oncor agreed to a DCRF based on an ARR of $15.2 million, also effective Sept. 1. The utility had requested an ARR of $19 million.

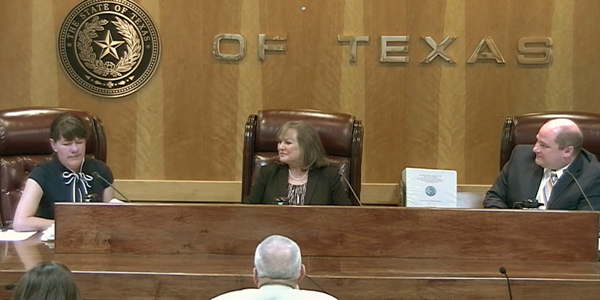

PUC Chair DeAnn Walker expressed reservations with the AEP settlement during the commission’s Aug. 30 open meeting, noting that state statutes require DCRF adjustments “be applied by the electric utility on a systemwide basis.” She pointed out that the commission’s 2016 approval of the merger of AEP Texas Central and AEP Texas North into AEP Texas required the company to maintain separate divisions with separate rates, riders and tariffs (Docket 46050).

“Systemwide rates would require a rate that is in effect for the entire AEP Texas system,” Walker said, pointing to the settlement agreement’s separate DCRF rates for AEP’s Central and Northern divisions.

AEP legal counsel Melissa Gage said the company’s interpretation of the law “wasn’t intended to mean systemwide in terms of AEP Texas as a whole, but on a division basis.”

Steve Davis, representing ARM, agreed with AEP’s interpretation and said the case posed “an odd situation.”

“It’s kind of hard to make it all fit correctly,” he said. “You have the statutory language, then you have the commission’s order in the merger case, which talks about separate rates” until some point in the future, he said. “Maybe there’s a path in future DCRF cases to follow to get to where you want to go.”

The commissioners saved further discussion on the proceeding for their closed session, which apparently eased Walker’s concerns. “I’m fine with moving forward,” she said afterward.

Commissioner Arthur D’Andrea pointed out the DCRF order is temporary, as AEP Texas is scheduled to file a full rate case in May. AEP Texas’ 8.96% rate of return last year was below that authorized by the commission during its last rate proceeding, according to the company’s 2017 earnings monitoring report.

Hearings Set for AEP Texas Legal Cases

AEP Texas also figured in two orders on the commission’s consent agenda.

The PUC first approved a procedural schedule for AEP’s bid to recover about $415 million in system restoration costs for 2017’s Hurricane Harvey. The schedule includes a Nov. 13-14 hearing before an administrative law judge (Docket 48577). AEP has proposed using a portion of its excess deferred taxes created by last year’s federal tax legislation to reduce the system restoration costs it will recover from consumers.

The commission also approved a procedural schedule in the company’s dispute with Rio Grande Electric Cooperative over which utility will serve certain customers in a Uvalde subdivision (Docket 47186).

An ALJ ruled on Rio Grande’s request for a cease-and-desist order in June, finding that AEP lacked the authority to serve some, but not all, of the customers in the disputed area. The case is of interest to retailers because Rio Grande’s service territory is not open to retail competition while competition was introduced in AEP’s footprint in 2002.

The procedural schedule for the second phase of the case includes a hearing to be held Oct. 31.

Commissioners Grant CCN to Tx Project — and Pole

The commission granted AEP Texas and Brazos Electric Power Cooperative a certificate of convenience and necessity for a jointly owned transmission line after the parties agreed to name a pole marking the midway point between them (Docket 47691).

Under the CCN, the two companies will each construct and operate half of the 138-kV transmission line southeast of the Texas Panhandle. The 20-mile line will connect Brazos’ Gyp switching station to AEP’s expanded Benjamin substation.

The utilities have yet to determine which one will own the pole, which represents a new interconnection point between the two. After jokingly offering to paint the pole two different colors, the utilities’ legal counsel took advantage of free time during the commissioners’ executive session to agree on a name for the pole: Gyp-to-Benjamin Terminus.

“We thought long and hard about the name but came up with what’s written there,” AEP’s Jerry Huerta said, as the commissioners stared quizzically at their documents.

The project will cost an estimated $20 million. No word on how much the terminus pole will cost.

Entergy Texas Gets OK for 230-kV Line

The commissioners also granted a CCN to Entergy Texas for a proposed 230-kV line north of Houston (Docket 47462). The line is one element of a MISO western region project identified in its 2015 Transmission Expansion Plan that will provide economic benefits to MISO South. It will be between 33 and 45 miles long and cost up to $140 million, depending on the final route. Entergy plans to energize the line in June 2020.

October Workshop to Review ERCOT’s Summer Performance

The commission will hold a workshop in late October to review ERCOT’s market performance this summer (Project 48551). The workshop is intended to be an open meeting, with all three commissioners attending.

The commission in March directed ERCOT to exclude reliability unit commitments from online reserve capacity used in the calculation of the operating reserve demand curve price adder. It said at the time that further market design changes would be examined after an analysis of the market’s summer performance.

Luminant Accepts $1.1M Penalty for 2015 Violations

The PUC on Aug. 17 approved a settlement agreement with Luminant, in which the generation company agreed to pay a $1.1 million administrative penalty for violations in 2015. Luminant was fined for telemetering a down ramp rate of zero for 15 quick-start units when they were operating near full capacity for four days that summer, preventing ERCOT from dispatching the units down.

— Tom Kleckner