By Amanda Durish Cook

Most transmission operators in the Western Interconnection are faced with choosing either CAISO or SPP to provide reliability coordinator (RC) services after Peak Reliability winds down its operations in late 2019. The Western Area Power Administration will go with both.

WAPA said Tuesday that it has selected CAISO’s new RC arm to serve its Sierra Nevada region after Peak’s closure, while its Rocky Mountain (RM), Desert Southwest (DSW) and Upper Great Plains (UGP) regions will use SPP’s RC services. (See Peak Reliability to Wind Down Operations.)

The Sierra Nevada region already functions as a transmission operator within the Balancing Authority of Northern California, which in July was the first BA in the West to announce it would sign up for CAISO’s RC services. (See CAISO Board OKs RC Rate Plan, RMR Change.)

The RM, DSW and UGP regions contain the Western Area Colorado Missouri, Western Area Lower Colorado and Western Area Upper Great Plains-West BA areas, respectively.

WAPA has in recent years been consolidating functions among its Interior West BAAs and said keeping those regions under one RC would avoid introducing “operational and compliance complexities.” It also noted that UGP is currently a transmission-owning member of SPP and is “fully engaged” in the RTO’s stakeholder process.

WAPA said the transition is dependent on SPP and CAISO becoming certified by NERC and the Western Electricity Coordinating Council as RC providers in the Western Interconnection. (See Sept. 4 Key Date for Potential Western RC Providers.)

In a Sept. 4 memo signed by Chief Operating Officer Kevin Howard, WAPA said the move could produce more benefits than Peak’s services: “Initial analyses have determined that SPP and CAISO should be able to provide reliable RC services comparable or superior to the services provided by Peak, and the costs for such services are expected to be lower than Peak’s.”

SPP will initially cap the charge for RC services at 5.5 cents/MWh, and CAISO estimates its services will cost anywhere from 3.4 to 4.1 cents/MWh depending on total load, according to WAPA.

WAPA’s regional offices promised Howard performance check-ins during and after the transition. “Given the dynamic nature of the situation and the need for ongoing analysis, each region will keep you informed of their progress. If any significant issues arise, we will bring those matters to your attention,” WAPA said. In a separate statement, Howard promised to work with neighboring utilities “to ensure an orderly transition to the SPP and CAISO RCs.”

WAPA said its switch to SPP could contribute to the creation of an organized Western market: “Participating in the SPP RC will preserve and facilitate options for the potential development of an organized electricity market in the West.”

At press time, neither CAISO nor SPP had provided a full list of customers taking their RC services. Representatives from both grid operators have said that they would not necessarily time announcements to Sept. 4 — the unofficial deadline NERC and WECC placed on Western BAs and transmission operators to declare their RCs. CAISO said it would only announce customers only as they sign agreements. In addition to BANC, Idaho Power and PacifiCorp have also committed to CAISO.

“At this time, announcements of entities committing to ISO RC services are being coordinated by the individual entities … since each entity has a different approval process and varying timelines, based on their specific business decisions and operations. We plan to share our customer list as agreements are signed,” CAISO spokesperson Anne Gonzales said in an email to RTO Insider.

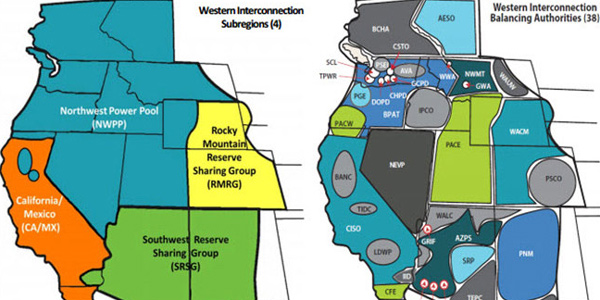

WECC last week told RTO Insider that it will provide a more complete list of Western Interconnection RC selections at its annual meeting on Sept. 11.