By Michael Brooks

FERC on Thursday rejected financial stakeholders’ request for rehearing of its Feb. 20 ruling reducing the number of bidding nodes for virtual transactions (ER18-88-002).

The commission also upheld its rejection of PJM’s proposal to allocate uplift to up-to-congestion transactions (UTCs) as it does to increment offers (INCs) and decrement bids (DECs) (ER18-86).

Virtual Transaction Nodes

The commission said that XO Energy and the Financial Marketers Coalition merely rehashed arguments they had made against the node reduction proposal. (See FERC OKs Slash in Virtual Bidding Nodes for PJM.)

The changes reduce by almost 90% the number of bidding nodes, limiting INCs and DECs to those where either generation, load or interchange transactions are settled, or at trading hubs where forward positions can be taken. They also barred UTCs from zone, extra-high-voltage and individual load nodes. The changes reduced the number of INC/DEC trading nodes from 11,727 to 1,563, and UTC nodes from 418 to 49.

FERC did accept PJM’s request to change the effective date for the changes from Jan. 16 to Feb. 22, 2018. PJM said it intended to make the changes prospectively and that in its Dec. 22 response to a deficiency letter the RTO had neglected to change its requested effective date. PJM said the January date would be disruptive to the market, as it would have to remove all virtual transactions at points no longer eligible for bidding and re-execute the day-ahead market.

Commissioner Cheryl LaFleur issued a partial dissent, repeating her assertion that PJM had not justified reducing nodes for UTCs.

“As I stated in my partial dissent, I believe that UTCs provide value to the market and that reduced granularity in their use is a move in the wrong direction,” she said. “I would, however, be open to other solutions more targeted to the specific problems that PJM has identified.”

Uplift for UTCs

PJM complained that in its Jan. 12 rejection of the RTO’s uplift proposal, FERC dismissed the proposal outright, without setting it for hearing, or considering parts of the proposal separately. (See FERC: PJM Uplift Proposal for UTCs Falls Short.)

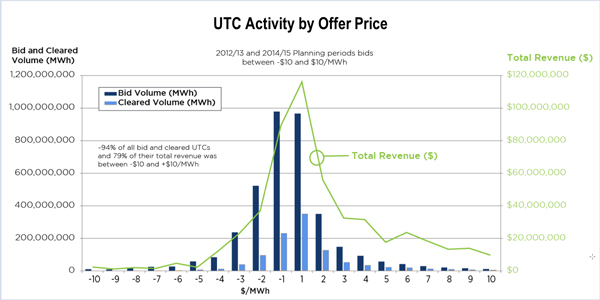

PJM claimed that, unless its filing was deficient, the commission could only accept the proposal or suspend it for hearing. But FERC said it was under no obligation to set the proposal for hearing. The RTO failed to demonstrate that the proposal would result in just and reasonable rates under Federal Power Act Section 205, the commission reiterated, “as it proposed to treat different financial transactions, with differing characteristics and effects, as if they were the same.”

However, FERC did reverse itself to accept PJM’s proposal to exclude internal bilateral transactions from uplift calculations, which the RTO said the commission should have considered separately. The commission directed PJM to submit a compliance filing in 30 days implementing the change.

PJM can still propose a different way to allocate uplift to UTCs, as FERC had dismissed the proposal without prejudice. “We also note, however, that any such hypothetical, future filing must address the concerns noted above, including the commission’s concern with PJM’s proposal to allocate uplift to a UTC as though it were two separate transactions, an INC and a DEC,” the commission said.