RENSSELAER, N.Y. — NYISO has asked FERC to reject a complaint by the Independent Power Producers of New York (IPPNY) seeking to bar the ISO from allowing PJM resources to sell installed capacity into Zone J using unforced capacity deliverability rights (UDR) facilities (EL18-189).

Presenting the monthly Broader Regional Markets report, Rana Mukerji, senior vice president for market structures, told the Business Issues Committee on Wednesday that IPPNY incorrectly assumes that transactions across Zone J merchant transmission facilities (MTF) would be subject to curtailment on the same basis as non-firm service within PJM. IPPNY also has not shown that transactions across the Zone J MTFs are no longer deliverable to the New York Control Area interface, Mukerji said.

“Whether the Zone J MTFs have firm TWRs [transmission withdrawal rights] or non-firm TWRs makes no practical difference for curtailment purposes,” NYISO said in its Aug. 20 response to IPPNY’s July complaint. “It was therefore reasonable for the NYISO to conclude that the TWR conversions do not impact the deliverability of transfers across the Zone J MTFs.”

PJM filed its response Sept. 5, saying that curtailments necessary for reliability would happen concurrently between the merchant facilities and PJM load on a pro rata basis. (See Perceiving Lack of Support, NJ Seeking Bigger Voice at PJM.)

Strengthening Unsecured Credit Scoring Model

The BIC endorsed changes to NYISO’s unsecured credit scoring model following its first review of the methodology since 2009.

John Jucha, senior credit analyst for corporate credit, said that to qualify for unsecured credit, a market participant must meet financial, credit rating and on-time payment history requirements.

The review found that the model was still performing “within an acceptable range” overall but that the calculation of revenue/market capitalization was not a reliable predictor of default for public companies, Jucha said. It also found that size variables were not represented in the model despite their “strong predictive power.”

Rating all market participants — including corporates, financial institutions and government entities — on the same scorecard may mask differences between them, the analysis found.

Under the new model, the 12.7% weighting for revenue/market cap will be replaced with a measure of total assets. The ISO also will consider using third-party credit ratings for non-corporate segments such as municipalities and financial institutions. It will also create additional rules for the qualitative assessment of market participants to reduce subjectivity under the current “open-ended assessment.” Additional changes were made to automate data entry and improve model transparency.

The BIC vote urges the Management Committee to recommend the changes to the Board of Directors.

Revisions to OATT Attachment L

The BIC voted to recommend the Management Committee approve revisions to Attachment L of NYISO’s Open Access Transmission Tariff updating terms regarding transmission congestion contracts (TCCs).

Gregory R. Williams, manager of TCC market operations, said the updates to Section 18.1.1 (Table 1A) of Attachment L followed an annual review. Among the changes were revising contract expiration dates from Dec. 31, 2017, to Dec. 31, 2027.

The ISO will seek approval of the revisions at the MC meeting Sept. 26.

Updating 2017 CARIS Database

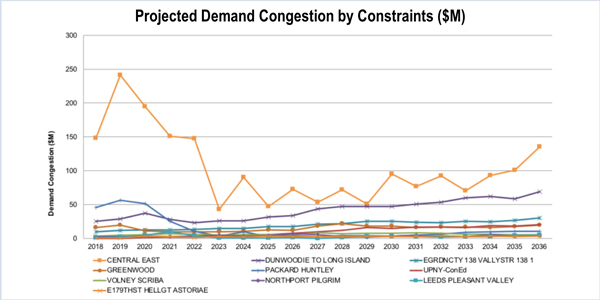

Senior Planning Engineer Chen Yang reviewed changes NYISO is making in its Congestion Assessment and Resource Integration Studies (CARIS) Phase 1 database for Phase 2 studies extending through 2036. The Phase 1 base case covers the years 2017-2026.

The Phase 2 base case, which will be used to evaluate regulated economic transmission projects and optional studies, incorporates retirements, additions and changes to in-service dates for more than a dozen generating facilities. The new model also reflects transmission capacity increases or other changes regarding six grid projects.

The ISO’s rules require it to review the changes with the BIC but do not require committee approval.

ISO to Begin Incorporating 100+kV Tx Facilities in Markets

Shaun Johnson, director of market mitigation and analysis, briefed stakeholders on a project to begin scheduling and pricing lower-voltage transmission in the day-ahead and real-time markets, beginning with four 100+kV facilities in November and 18 in December.

NYISO is the NERC transmission operator (TOP) for 230-kV and higher transmission in the state while the transmission owners are the TOPs for the lower-voltage system. The ISO helps the TOs manage constraints on the lower transmission lines through transaction curtailments, phase angle regulator adjustments, day-ahead reliability unit (DARU) commitments and other out-of-market actions, which can harm price formation efficiency and price transparency.

Johnson said the project will reduce out-of-market actions by allowing the market software to use more efficient solutions to thermal overloads when such solutions are available. It also will more accurately represent the cost in locational-based marginal prices to secure the system, he said.

NYISO’s Market Monitoring Unit, Potomac Economics, had recommended the move in each of its State of the Market reports since 2014, leading the ISO to publish a white paper on the topic in June 2017.

The MMU said that incentives to invest in resources on the 115-kV system in upstate New York are inadequate and that managing lower-voltage facilities through out-of-market actions has increased power supplier uplift payments and contributed to the need for cost-of-service contracts to keep older resources operating. At times, transfer limits on internal and external interfaces are reduced to manage 115-kV security.

LBMPs up 40% Year-on-Year

NYISO LBMPs averaged $42.56/MWh in August, up 7.5% from $39.58/MWh in July 2018 and nearly 40% higher than the same month a year ago, Mukerji said in his monthly operations report.

Year-to-date monthly energy prices averaged $46.37/MWh in August, a 30% increase from a year ago. August’s average sendout was 537 GWh/day, higher than 529 GWh/day in July and 477 GWh/day a year earlier.

Transco Z6 hub natural gas prices averaged $3/MMBtu, up about 10.5% from July and up 39.2% from a year earlier. Distillate prices climbed slightly compared to the previous month but were up 33.8% year-over-year. Jet Kerosene Gulf Coast and Ultra Low Sulfur No. 2 Diesel NY Harbor averaged $15.67/MMBtu and $15.36/MMBtu, respectively.

Total uplift costs and uplift per megawatt-hour came in higher than July, with the ISO’s 59 cents/MWh local reliability share in August up from 44 cents the previous month, while the statewide share dropped from -57 cents/MWh to -61 cents. Uplift, excluding the ISO’s cost of operations, was -2 cents/MWh, higher than -13 cents in July.

Thunderstorm alert (TSA) costs in New York City were 14 cents/MWh, down a third from 21 cents in July. TSAs are called when actual or anticipated severe weather conditions lead the ISO to reduce transmission limits on the UPNY-SENY interface, which often leads to severe congestion. Because a TSA may alter the capability of the transmission system in ways that are difficult to hedge in day-ahead markets, day-ahead prices reflect the probability-weighted expectation of infrequent high-priced events in the real-time market.

— Michael Kuser