SPP stakeholders on Wednesday approved staff’s recommendation to remove American Electric Power’s 2-GW Wind Catcher Energy Connection project from the 2019 Integrated Transmission Planning’s (ITP) assessment scope.

The Markets and Operations Policy Committee approved the scope change by an 82.1% vote during a special conference call. Staff said the call was necessary to keep the ITP work on schedule to meet its planned completion in October 2019.

The change removes Wind Catcher, planned for near Tulsa, Okla., from two study futures. The MOPC had approved the scope earlier this year.

AEP canceled the $4.5 billion project in late July, one day after the Texas Public Utility Commission ruled against the proposal. (See AEP Cancels Wind Catcher Following Texas Rejection.)

Staff presented three options to the MOPC. The recommended option maintains the assessment’s timeline and makes use of the 215 resource hours staff has already put in.

Juliano Freitas, SPP’s manager of economic planning, said staff had already proceeded with the option to mitigate any schedule delays. He said the original assumptions included an expectation that Wind Catcher would be built; “thus it is appropriate to remove it and reduce the wind levels to be studied by a corresponding amount.”

The original scope included 32 GW of wind energy.

One other option was to continue the ITP without changing the model, with Wind Catcher acting as a “proxy” for other wind generation in the area.

The third option would have replaced the project with other wind sites, keeping the same 32 GW of wind.

MMU White Paper Proposes Capturing ESRs’ Opportunity Costs

The Market Monitoring Unit has published a white paper that proposes a framework for capturing the opportunity costs of electric storage resources’ (ESRs) mitigated energy offers.

The MMU produced the document to respond to FERC Order 841, which addresses electric storage participation in RTO and ISO markets.

MMU Manager Barbara Stroope said in an email to RTO Insider that ESRs are new technologies with costs that are “potentially quite different from traditional generation resources.” She said the paper provides “a solid theoretical foundation for the design efforts currently underway in SPP, and we think it can serve as the basis for a design that balances accuracy with simplicity.”

The white paper defines a mitigated energy offer as reflecting a generating resource’s short-run marginal production cost. Typically, the calculation derives from variables that include the incremental heat rate and fuel cost (where applicable), and variable operations and maintenance cost. The short-run marginal cost may also include the opportunity cost of foregone incremental generation when a resource’s ability to operate is limited.

“In the case of an [ESR], generating or charging at a given point in time may only be possible by forgoing profit opportunities later in the day or optimization period,” the MMU staff wrote, saying it’s “appropriate” to include the marginal opportunity cost in the basis for an ESR mitigated energy offer.

“The marginal opportunity cost of an ESR at any point in time is most accurately determined as the result of a dynamic optimization problem that considers the resource characteristics, state-of-charge and all future profit opportunities in the optimization period,” the MMU said.

Admitting that this approach could be “difficult or impractical” to implement in calculating a mitigated energy offer, the Monitor said a “reasonable approximation of this opportunity cost” can be determined for ESRs with relatively short charge and discharge times by “considering a simplified case to establish a lower bound of expected profits.” The lower bound would be represented by the maximum profit that would be earned if actual prices were realized as predicted.

“The approximation of marginal opportunity cost can then be determined by assessing the reduction in this expected maximum profit that may result from operating at a given point in time,” the MMU said.

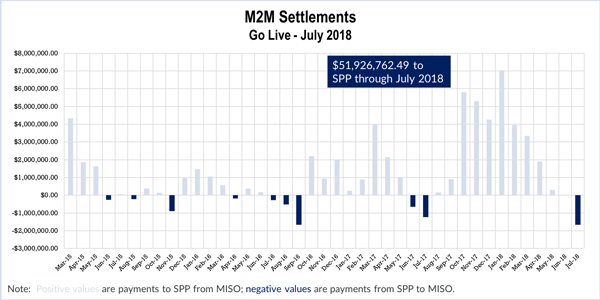

July M2M Payments in MISO’s Favor

MISO reversed 11 months of market-to-market (M2M) payments to SPP, incurring $1.7 million in its favor in July. The RTO has not been on the positive side of M2M payments since July 2017.

MISO and SPP outages in North Dakota and western Minnesota contributed to heavy loading on two temporary flowgates. The two constraints were binding for a combined 91 hours, accounting for slightly more than $773,000 in payments to MISO.

Temporary flowgates were binding for 416 hours in July. Six permanent flowgates were binding for 45 hours, leading to a little more than $15,000 in M2M payments in SPP’s favor.

July’s results reduced MISO’s M2M payments to SPP to $51.9 million since the two grid operators began the process in March 2015.

— Tom Kleckner