By Michael Kuser

RENSSELAER, N.Y. — A carbon charge would only slightly impact New York’s wholesale energy prices over the coming decade, with any increase offset by benefits, a new report commissioned by NYISO says.

“If you add a carbon charge, LBMPs are going to increase, and they do,” said Sam Newell of the Brattle Group, who on Monday presented a draft study of carbon pricing impacts to the state’s Integrating Public Policy Task Force (IPPTF). The analysis is based on the ISO’s straw proposal issued in May.

“The effect of higher LBMPs on customer costs, however, is partially or fully offset by several factors,” Newell said. “Customer credits from emitting resources offset about 60% of the price increase, then you’ve got other potential benefits such as lower prices for renewable energy credits (RECs) and zero-emission credits (ZECs), increased value of transmission congestion contracts, a shift of renewable resources to regions with higher CO2 emissions to displace and other changes to the supply mix.”

The Sept. 17 discussions were part of issue “Track 5” in the group’s five-track effort to price carbon emissions. Brattle will present the final version of its customer impact analysis to the IPPTF on Oct. 15.

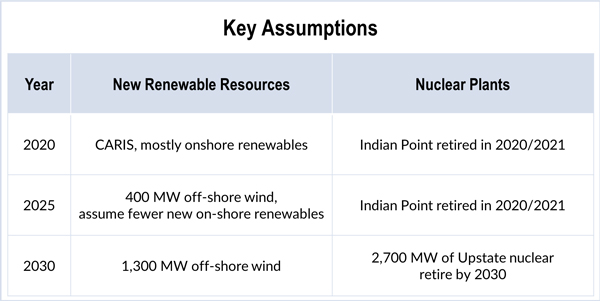

Key Assumptions

The study’s base case scenarios cover 2020, 2025 and 2030, and the study projects the carbon charge will spur the highest cost early on: a 2.2% increase in 2020, followed by a 0.04% increase in 2025 and a 0.01% decline at the end of the next decade.

The base cases reflect “most likely” conditions, supply and demand conditions and existing policies, including the Clean Energy Standard and Regional Greenhouse Gas Initiative, Newell said.

The conclusions are similar to those of the first Brattle Group report, released in August 2017, on pricing carbon into generation offers and reflecting it in energy clearing prices. The main difference between the two reports is that now Brattle has studied three years (2020, 2025 and 2030) and has used GE-MAPS to model the effects of carbon charges on unit commitment, dispatch, prices, settlement and emissions, Newell said.

Several stakeholders wanted to know more about the assumptions used in the report and asked if the ISO would make a more technical report available.

“Nothing is secret,” Newell said.

IPPTF Chair Nicole Bouchez, the ISO’s principal economist, confirmed all data, methodologies and key assumptions would be made available to stakeholders as soon as possible, with an expected availability date around the beginning of October.

Andrew Antinori, senior director of the New York PowerAuthority’s (NYPA) Market Issues Group, said it did not make sense to focus on the higher price increase listed for 2020 ($0.38/kWh) because NYISO recently concluded carbon pricing would not be implemented any earlier than the second quarter of 2021.

Antinori asked if the price would be lower if the study started with 2022, the first full year, but Newell would only say the price increase for that year would fall between those of 2020 and 2025.

NYPA Concerns

Mark Reeder, representing the Alliance for Clean Energy New York, said NYPA sales should be accounted for in the study because many of its customers pay a low non-market price. Therefore, an increase in NYISO market price doesn’t translate into a one-for-one increase in the prices paid by NYPA’s end users.

Warren Myers, DPS director of market and regulatory economics, said, “Whenever we first saw a waterfall chart, NYPA was so complicated, one of our first concerns was we wanted to see a consistent set of analyses of non-NYPA customers.”

The study assumes all customers are fully exposed to the LBMP, so it overstates customer costs to the extent NYPA does not, Newell said. “We didn’t include [NYPA] because it would have been quite messy to try to account for it.”

Mark Younger of Hudson Energy Economics said, “NYPA also does market-based sales for a certain amount of energy, and doing this creates a windfall for a state agency, which presumably goes to New York State residents,” possibly to be used for their benefit.

“Our analysis did not consider any special effects on NYPA,” Newell said.

Couch White attorney Michael Mager, who represents Multiple Intervenors, a coalition of large industrial, commercial and institutional energy customers, said profits on market-rate sales would likely incent more such sales, not more low-cost contracts for industrial customers.

Antinori said, “It’s not fair to say ‘windfall’ when discussing NYPA revenues as if no other generator gets such a benefit from a carbon charge.”

Mager said the study might be overstating savings on REC prices: “You identified this in your original report, that it’s not one-to-one price savings.”

Newell said, “There are a number of ways to structure this so there’s no risk on suppliers and you get one-on-one benefits to renewables … We’re using load forecasts that decline by six terawatt hours every five years.”

Environment and Reliability

Tariq Niazi, ISO senior manager and Consumer Interest Liaison, was scheduled to present an analysis of consumer impacts from a carbon charge but got bumped from the lineup due to the length of time spent on the Brattle study.

According to the report, to be presented at next week’s IPPTF meeting, adding a carbon charge would reduce CO2 emissions approximately 3% by 2030 and cause only limited fuel switching; most emission reductions would result from dynamic effects such as renewable shifts, nuclear retention and price-responsive load.

The report also says pricing carbon would spur investment in renewables, supporting reliability, and the ISO intends to develop a calculation using marginal units to estimate the LBMP carbon impact.

Bouchez informed stakeholders of a revised task force schedule, which foresees the presentation of a carbon pricing proposal and recommendations on Dec. 17. The task force next meets Sept. 24 at NYISO headquarters.