By Robert Mullin

CAISO is asking FERC for expedited review of a revised proposal to protect electricity ratepayers from funding shortfalls in the ISO’s congestion revenue rights market.

The ISO filed the revision Monday after FERC last month rejected an earlier plan to eliminate full funding of CRRs and instead scale payouts to align with revenue collected through the day-ahead market and congestion charges (ER18-2034). (See FERC Rejects CAISO Congestion Revenue Scaling Plan.)

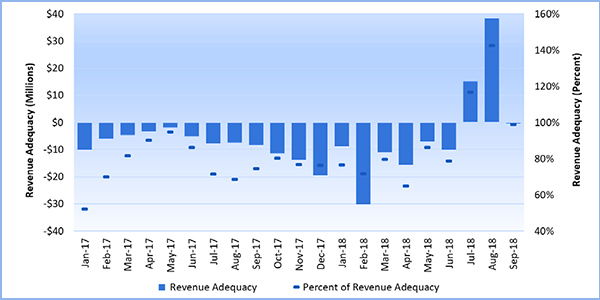

CAISO’s most recent filing notes that CRR revenue shortfalls have continued into this year, and it urged the commission to quickly approve the revised plan to relieve ratepayers from paying costs for fully funding CRRs in 2019. The ISO’s Department of Market Monitoring has estimated that CRR revenue shortfalls — which are allocated based on power consumption — cost California ratepayers about $100 million a year.

Under the scaling plan FERC rejected on Sept. 20, CAISO proposed to compare the CRR auction revenue and revenue from counterflow CRR holders for each constraint to the payments due to prevailing CRR holders for the constraint. When it does not collect enough revenue to pay prevailing flow CRRs the full value for an interval, the ISO would have reduced the payments proportionally.

The plan called for scaling only the payments to holders of CRRs in the prevailing flow direction, while not scaling the payments due from counterflow CRR holders on the same constraint. The ISO contended that discounting counterflow CRRs would increase revenue insufficiency because those CRRs help fund prevailing flow CRRs.

In denying CAISO’s proposal, the commission noted that it “has long held that counterflow and prevailing flow CRRs should be netted against one another such that the expected net value of two obligation CRRs of equal megawatts from A to B and B to A will be equal to zero.” The commission added that “we continue to believe that a symmetric approach is just and reasonable, while an asymmetric approach has not been shown to be just and reasonable.”

FERC also pointed out that the proposal would have the “undesirable” effect of reducing transparency in the CRR market.

“Market participants could face difficulties valuing a counterflow hedge relative to a prevailing flow hedge, since one would be discounted while the other would not,” the commission said.

In its Oct. 1 filing, CAISO acknowledged that its revised proposal relies on “essentially the same methodology” found in its prior proposal, with one “important” modification: a provision to net CRRs with both prevailing flow and counterflow CRRs within a holder’s portfolio before scaling the payment to that holder.

“In this Tariff amendment, the CAISO proposes a methodology that ensures that a CRR holder with a prevailing flow CRR from A to B can offset its obligation by holding a counterflow CRR from B to A,” the ISO said. “The CAISO proposes to first net a CRR holder’s portfolio of obligation CRRs of prevailing flow and counterflow CRRs with modeled flows on a particular constraint. After it nets these flows, the CAISO then would implement the same procedure it previously proposed through which it would scale CRR payments based on day-ahead market congestion revenue collected on individual constraints.”

CAISO said that it was addressing the commission’s concerns by creating “a procedure through which it can ensure a CRR holder’s modeled flow in both the prevailing and counterflow direction on a specific constraint offset each other.” It contended that complete symmetrical treatment of CRRs would prevent it from addressing the CRR funding issue by Jan. 1, 2019, because it would require greater redesign of software enhancements already underway to support the rejected proposal.

“The CAISO is able to follow the commission’s guidance without a major redesign with the proposal it submits here today because it can net the prevailing flow and counterflow a CRR holder’s CRRs place on a constraint upstream in the process and then feed that information into the scaling methodology the CAISO developed as part of its original CRR Track 1B proposal,” the ISO said.

CAISO contends its proposal “completely addresses” the concerns spelled out in the commission’s Sept. 20 order.

“Because the CAISO’s proposal is just and reasonable and it can be implemented by Jan. 1, 2019, it is unjust and unreasonable to force the CAISO and market participants to have to deal with the risks of revenue inadequacy for another year,” the ISO said.

CAISO asked that FERC set a shortened comment period ending no later than Oct. 11 and issue a ruling by Nov. 9.