NYISO and PJM last month jointly filed a request with FERC for a waiver of their joint operating agreement (ER18-2442), Rana Mukerji, ISO senior vice president for market structures, told the Business Issues Committee on Wednesday while presenting the monthly Broader Regional Markets report.

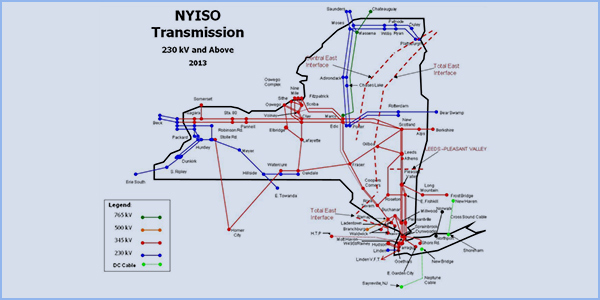

The waiver would permit the two grid operators to add the East Towanda-Hillside tie line as a market-to-market (M2M) flowgate. If granted, it will enable PJM to conduct redispatch operations to control flows to the more restrictive rating on the New York side of the line without violating the PJM Tariff for a limited time while the RTO and NYISO work to develop a permanent solution.

Mukerji also highlighted efforts to clarify the minimum deliverability requirements for external capacity from PJM into NYISO’s Installed Capacity (ICAP) market. The ISO will continue discussions of this topic with stakeholders at the Installed Capacity/Market Issues Working Group meeting this month, he said.

In August, the ISO briefed the BIC on proposed market design changes to improve the supplemental resource evaluation process for external capacity resources.

Improving Public Policy Tx Planning

The BIC approved revisions to improve the efficiency of the Comprehensive System Planning Process in the short term, including eliminating the requirement that the New York Public Service Commission issue an order before NYISO begins evaluating transmission solutions. Under the proposal, the PSC retains the ability to cancel or modify identified public policy transmission needs (PPTNs) prior to the ISO’s selection of the more efficient or cost-effective solution, which would halt the evaluation or result in an out-of-cycle process to address the modified need.

In one case, NYISO had to wait about five months before evaluating and selecting Western New York PPTNs, according to a report by Yachi Lin, senior transmission planning manager. Under the new process, the ISO would begin the process following completion of a viability and sufficiency assessment and if developers meet the necessary requirements to proceed.

NYISO has proposed related Tariff amendments and will seek approval from the Operating and Management committees this month before seeking board approval in November.

In addition, the ISO will clarify in the Tariff that the project description in the transmission interconnection application or interconnection request must match the description in the PPTN proposal or face rejection.

Technical Details

Within 60 days after a formal solicitation from NYISO, interested developers must submit both redacted and unredacted versions of their complete project proposal to satisfy the PPTN, submit identical proposals in the interconnection process and provide a nonrefundable $10,000 deposit and a $100,000 study deposit for each project.

NYISO will then post a brief description of the project proposals within five business days after the solicitation window closes.

The ISO will file the final viability and sufficiency report at the PSC, and within 15 days of the filing, each developer must confirm that it intends to proceed and agree to a system impact study.

Long Term

NYISO will present a long-term process design concept to stakeholders by the end of 2018 to improve its Local Transmission Owner Planning Process (LTPP); Reliability Planning Process (RPP); Congestion Assessment and Resource Integration Studies (CARIS); and Public Policy Transmission Planning Process (PPTPP).

Under the proposal, prior to issuing a formal solicitation, the ISO will hold a technical conference to get input from developers and interested parties on the application of selection metrics to the PPTN.

LBMPs Up 31% Year-on-Year

NYISO locational-based marginal prices averaged $38.70/MWh in September, down from $42.56/MWh in August but up 31% from the same month a year ago, driven by four days in early September in which the peak load topped 28 GW compared with no such days in September 2017, Mukerji said in his monthly operations report.

Year-to-date monthly energy prices averaged $45.75/MWh in September, a 29% increase from a year ago. September’s average sendout was 458 GWh/day, lower than 537 GWh/day in August and 437 GWh/day a year earlier.

Transco Z6 hub natural gas prices averaged $2.75/MMBtu, down about 8.3% from August and up 21.5% from a year earlier. Distillate prices climbed slightly compared to the previous month but were up 23.3% year-over-year. Jet Kerosene Gulf Coast and Ultra Low Sulfur No. 2 Diesel NY Harbor averaged $16.21/MMBtu and $16.08/MMBtu, respectively.

Total uplift costs and uplift per megawatt-hour came in lower than August, with the ISO’s 37-cent/MWh local reliability share in September down from 59 cents the previous month, while the statewide share climbed from -61 cents/MWh to -48 cents. Uplift, excluding the ISO’s cost of operations, was -11 cents/MWh, lower than -2 cents in August.

The Thunderstorm Alert (TSA) cost in New York City was 33 cents/MWh, more than double the 14 cents in August.

— Michael Kuser