By Tom Kleckner

Great Plains Energy’s merger with Westar Energy in June has increased market concentration in the new company’s reserve zone, but it “is not necessarily a cause for concern at this time,” SPP’s Marketing Monitoring Unit said in its most recent quarterly State of the Market report.

The new company, Evergy, is the largest energy consumer in SPP, accounting for 19.7% of summer consumption, according to the Oct. 15 report, which covers June through August.

Evergy, American Electric Power (17.1%), Oklahoma Gas and Electric (11.6%) and Southwestern Public Service (10.2%) consumed almost 60% of the RTO’s total energy in the summer, pushing the market’s post-merger Herfindahl-Hirschman Index (HHI) above 1,000 at times, indicating a “moderately concentrated market.”

“If a continually increasing trend is observed in the future, it would require further analysis,” the report says.

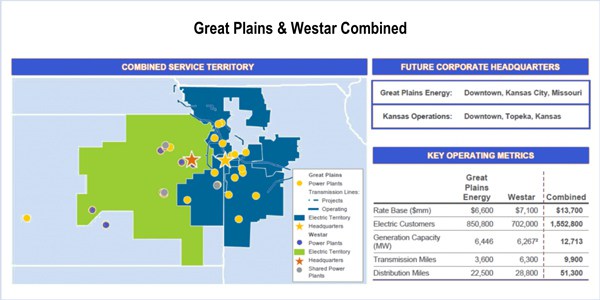

Evergy has 1.58 million customers in Kansas and Missouri. (See Westar-Great Plains Merger Wins Final Approval.)

The Evergy reserve zone’s average summer prices were below 2017 levels for July and August, at around $30/MWh and $25/MWh, respectively. June prices were more than $30/MWh, primarily because of higher temperatures and loads across SPP.

The report notes:

- Low energy prices, with summer prices averaging around $25/MWh;

- A continued decrease in intervals that experienced negative energy prices; and

- A decline in overall congestion across the footprint.

The report’s “special issues” section also reviews the market’s manual commitment process. The MMU said that while SPP operators have improved their consistency in coding and reporting manual commitments, they should add more detailed and consistent reasons for local, transmission, capacity and stagger commitments.

Noting that FERC Order 844 in April added market-transparency requirements for resource commitments, the Monitor recommended SPP report publicly all manual commitments. It also noted the high number of manual capacity commitments for ramping needs and renewed its call for a ramp product, saying it would be more effective.

The MMU will host a webinar on Nov. 8 to discuss the report.