By Michael Kuser

RENSSELAER, N.Y. — New York electricity market stakeholders on Friday reviewed three separate studies to evaluate the implications of a carbon charge in NYISO’s energy markets.

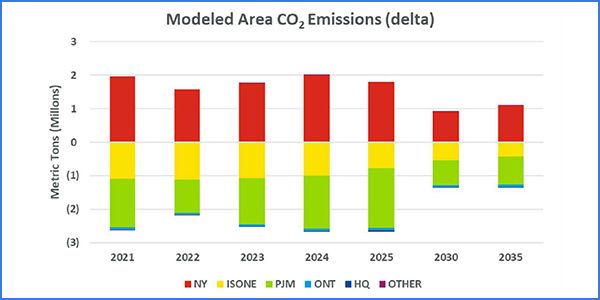

The reports by the Brattle Group, Daymark Energy Advisors and Resources for the Future (RFF) find similar reductions in systemwide carbon emissions from a carbon charge: less than 1 million metric tons, according to the ISO’s synthesis of the studies

Michael DeSocio, the ISO’s senior manager for market design, told the Integrating Public Policy Task Force (IPPTF) Nov. 9 that “all the analyses were generally supportive of each other.”

All three studies isolate the effects of a carbon charge by modeling both a “base case” without carbon pricing and a “change case” with carbon pricing, but they each differ in the years evaluated. The Brattle study evaluates effects in 2020, 2025 and 2030, while Daymark’s analysis evaluates 2021-2025, 2030 and 2035. The RFF analysis focuses solely on 2025. (See NY Details Carbon Charge on Wholesale Suppliers.)

Analytical Results

Daymark’s Marc Montalvo said that his group’s study found that “carbon emissions in New York are about flat. There’s not really a material change as a consequence of the introduction of the carbon charge.”

RFF’s Dan Shawhan said his group’s updated results show “a CO2 emissions reduction of 0.2 million tons in the simulated year, which is 2025, and that’s about 0.65%, so about two-thirds of a percentage point reduction in New York emissions. And I don’t disagree with the characterization that you could describe that as not a big change in emissions.”

Brattle’s Sam Newell agreed and said “a lot of what’s happening here is we’re comparing to a base case that already has in place the Clean Energy Standard and other mechanisms to reduce emissions.”

But both the RFF and Brattle studies say that a carbon pricing policy can also be expected to reduce emissions in ways not captured in the modeling.

The carbon charge is another way of accomplishing decarbonization with more dollars put toward a market-oriented approach, and less money relying on targeted programs, Newell said.

“In both cases there’s decarbonization, so it’s not a surprise that there’s not some major change in carbon with the introduction of this policy,” Newell said. “Directionally it’s going to be an improvement because it finances some low-cost forms of carbon abatement, and there are probably some long-term investment effects.”

All studies find higher statewide locational-based marginal prices resulting from a carbon charge, with increases most significant downstate. The Brattle analysis finds LBMPs would rise by less than the Daymark and RFF studies.

Differences in LBMP changes can be at least partly explained by differences in each study’s modeling of the market heat rate, and also in part by assumptions regarding the net social cost of carbon in each study, the ISO’s summary said.

The studies assume similar carbon charges through 2025, but the Daymark study finds LBMP impacts would increase from 2025 to 2035. In contrast, Brattle finds lower carbon charges in 2030 than 2025 because of assumed increases in the Regional Greenhous Gas Initiative price, resulting in carbon charges of $45.40/ton in 2030, compared with $57/ton in 2030 assumed by Daymark.

Brattle and RFF both find collected carbon revenues on the order of $1.5 billion per year; Daymark finds declining carbon revenues, falling from $1.4 billion in 2021 to $1 billion in 2035.

Stakeholder Requests

DeSocio presented an update on NYISO’s progress in meeting stakeholder requests for further analysis on certain points.

Analysis is under way on augmenting the Brattle analysis with 2022 results and considering the effects of carbon pricing on repowering and retention, and should be ready for discussion at the Nov. 26 task force meeting, he said.

The ISO also said it does not recommend following a stakeholder suggestion to lower the 2030 RGGI price estimate because such a move is not supported by analysis based on results provided to date, DeSocio said. As RGGI is adjusted downward both with and without carbon pricing, the other parts of the analysis approximately scale. Because the overall impact is near zero, the scaled impact is near zero.

To consider the consequences of no carbon pricing, including estimates of the costs of various buyer-side mitigation scenarios, and the consequences of NYISO’s AC transmission project in western New York, the ISO is still considering how it might structure such analyses and will update the IPPTF at its next meeting, he said.

Regarding the effects of a carbon charge on existing renewable energy credit contracts and future REC contracts, DeSocio said, “In our analysis to date, we are not suggesting that REC contracts go away. Certainly the price of a REC contract may go down because the carbon price is being realized and therefore the delta payment that a renewable resource is getting is less, but in the analysis so far, we haven’t shown that to go to zero.” (See NY Carbon Task Force Looks at REC, EAS Impacts.)

The Daymark study does not evaluate changes in REC and zero-emission credit prices stemming from a carbon charge, but it finds the following gross profit margin (revenue minus fuel costs) average increases: upstate nuclear plants 70%; upstate solar 48%; upstate wind 46%; downstate offshore wind 47%; and downstate solar 51%, according to the ISO synthesis.

The RFF analysis finds the carbon charge would reduce REC prices from $43/MWh to $24/MWh and would reduce ZEC prices from $14/MWh to $0/MWh in 2025.

The Brattle analysis finds the carbon charge would reduce ZEC prices from $25/MWh to $12/MWh in 2025, while REC prices would fall from $22/MWh to $3/MWh in 2020, $25/MWh to $7/MWh in 2025 and $28/MWh to $12/MWh in 2030.

The task force next meets on Nov. 26. It plans to announce a proposal to incorporate carbon pricing into the state’s wholesale market next month.