By Michael Kuser

RENSSELAER, N.Y. — NYISO on Monday recommended its carbon pricing proposal no longer include a mechanism that would make emissions-free resources with existing renewable energy credit contracts pay the LBMP carbon component.

The ISO’s clawback proposal “creates a distortion in the market … that places the ISO in the position of picking winners and losers, which is not where we want to be,” Michael DeSocio, the ISO’s senior manager for market design, told the Integrating Public Policy Task Force (IPPTF) on Monday. (See NY Carbon Task Force Looks at REC, EAS Impacts.) The ISO initially proposed the idea to reduce the potential for REC resources to receive double payments for their lack of emissions.

DeSocio noted REC payments are not solely linked to carbon abatement or avoidance but are primarily intended to support renewable resources. Withholding the LBMPc from resources with existing RECs would increase the uncertainty in the value and potential cost of such contracts going forward and also create a disconnect between the wholesale market price and payment to the resource, he said.

Double Payment Issue

Multiple stakeholders expressed concern about the potential for double payments, with ratepayers paying for both REC contracts and an unforeseen bonus or windfall for holders of such contracts that pre-date the existence of a carbon charge.

“As much as there could be a concern with costs … we don’t view this as a problem with the design,” DeSocio said. He estimated the possibility for between $30 million and $60 million in such payments in an overall program representing a few billion dollars, whether through the state’s Clean Energy Standard alone or with carbon pricing.

The $60 million estimate is an upper bound of any double payment, said Sam Newell of the Brattle Group.

One of the motivations for RECs “was to develop a new way of getting energy… So did you pay a little extra to help pave the way for the much larger amounts of clean energy the state plans to procure? Maybe. That was part of the purpose,” Newell said.

Newell also pointed out carbon pricing was being contemplated at the time some of the existing REC contracts were signed. “To what extent did the REC prices get discounted accordingly? Were they willing to take a little bit lower price in a competitive process because they saw some upside from some future carbon prices?”

“It’s not very accurate to just blithely call it a double-payment issue,” said Warren Myers, director of market and regulatory economics at New York’s Department of Public Service. “We’ve heard from a lot of parties about what they have to go through to get financing and the hedges they sign, so to say that generators are going to get double paid is a misstatement … What the ISO proposed, while well-intentioned, was a remedy that was worse than the malady.” (See NY Task Force Talks LBMPc, Residuals, Hedge Effects.)

Brattle Updates

Newell presented the task force with updated analyses on carbon price effects, including the outcome if NYISO’s AC transmission project in western New York — the two components for which are now before the ISO’s board — does not get built by 2024 as the study projected.

The study assumes the projects would be built by 2023 to provide 350 MW of increased transfer capability across the Central East interface, while they could actually provide as much 875 MW of increased transfer capability, he said.

“So what would happen if these projects weren’t there at all?” Newell asked. “Then you would just see a little more bottling in upstate and less LBMP upstate from a carbon charge, and the opposite downstate … If you get the full 875-MW increase in transfer capability, the state would be a little more uniform than we modeled with only a 350-MW increase on Central East.”

2022 Scenario

While the study motivation and scope remain unchanged, “we also did the updated [modeling and pricing software] runs to look at a 2022 scenario, as requested by stakeholders, and to look at what the market would look like if a carbon charge was implemented,” Newell said.

Brattle’s analysis continues to show minimal retail price impacts from a carbon charge, with the strongest impact in 2022 — the year of implementation, when consumer bills are projected to increase by 1.6%, mainly due to the retirement of Indian Point nuclear plant coupled with no AC transmission upgrades in service and a doubling of renewables upstate.

The biggest observation is relative to both the retail rate and the generation component of the rate, Newell said.

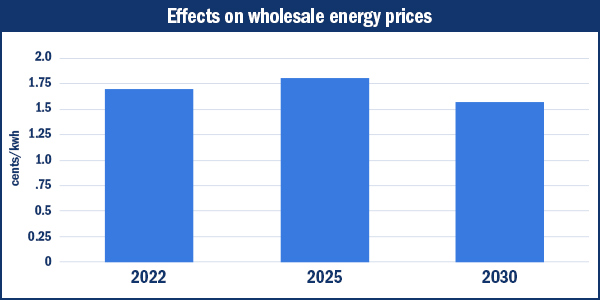

“If you look at the graph, it’s visually not far off the zero point, so that’s the main conclusion, with a little bit of a trend over time towards more benefit,” he said.

However, wholesale prices are expected to register their largest carbon cost impact — $17.60/MWh — in 2025, with an estimated carbon charge of $49/ton.

Nuclear Retention

Brattle also revised its projections of the retention of nuclear generation in 2030, increasing its assumption from 450 MW to about 850 MW of the 3,300 MW of upstate capacity.

The Public Service Commission approved the zero-emission credit program in 2015 to prevent the premature retirements of three New York nuclear power plants, Exelon’s FitzPatrick, Ginna and Nine Mile Point. (See Appeals Court Upholds NY Nuclear Subsidies.)

Newell said a carbon charge could boost the net revenues for upstate nukes and prompt owners of units in good physical condition to apply for license extensions.

The study assumes Nine Mile Unit 2 will remain under any case, while it considers the other three units to be at risk of retirement.

“You can see that there’s a fairly good case for some likelihood of retaining some of these plants,” he said.

Why Price Carbon?

Why even do carbon pricing, Newell asked.

“I really see two closely related reasons. One that we’ve talked about a lot is that you provide a price signal that directly signals to the market how to operate in such a way that cost-effectively reduces carbon and how to invest in such a way… where you avoid the most emissions, that’s where the biggest rewards go,” he explained.

Another major factor — harmonizing state policies and wholesale markets — has not been emphasized enough, Newell said.

“I’m talking about this from the perspective of somebody who works nationally and is seeing a lot of conflict on these issues,” Newell said. “And [I’m] seeing an opportunity for New York ISO and New York state to address this issue more successfully than the rest of the country and to be a leader in this regard.”

The IPPTF will next meet on Dec. 17 at NYISO headquarters to consider the final draft carbon proposal, which will be posted by Dec. 7.