By Michael Kuser

RENSSELAER, N.Y. — The Integrating Public Policy Task Force (IPPTF) met for the last time on Monday before handing its final carbon pricing proposal to NYISO’s stakeholder governance process. The ISO will pick up work on the market design in January through its Market Issues Working Group.

The ISO and the New York Public Service Commission created the task force last October to explore ways to price carbon into the wholesale electricity markets to align them with state decarbonization policies, including the zero-emission credit program for struggling nuclear plants.

NYISO published the IPPTF Carbon Pricing Proposal on Dec. 7 after recommending it no longer include a mechanism that would make emissions-free resources with existing renewable energy credit contracts pay the carbon component of locational-based marginal prices (LBMPc). (See IPPTF Updates Carbon Charge Analysis, Treatment of RECs.)

Social Cost of Carbon

The key metric to be used in calculating a wholesale charge on emissions is the gross social cost of carbon (SCC), which the PSC would set “pursuant to the appropriate regulatory process,” according to the proposal. The state Department of Public Service based its calculations on that of the federal government’s Interagency Working Group on Social Cost of Greenhouse Gases.

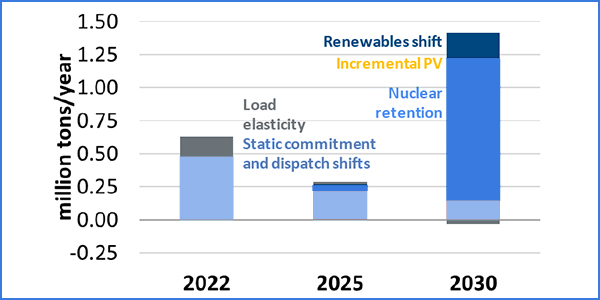

The Brattle Group projects that carbon charges will lead to incremental internal emissions reductions of 6% by 2030. Most reductions would come from price-responsive load, renewable shifts and possible nuclear retentions. | The Brattle Group

Couch White attorney Michael Mager, who represents Multiple Intervenors, a coalition of large industrial, commercial and institutional energy customers, asked whether there had been any discussions with state regulators about the timing of the PSC’s process

“I assume that the commission is not going to have any regulatory process on setting the social cost of carbon unless and until there’s a vote at the ISO, but doing it that way creates difficulties for stakeholders because then we’re being forced to vote on a carbon pricing proposal without having any guarantees on how the social cost of carbon will be set, how it will be updated [and] when it will be updated,” Mager said.

“The policy of the state of New York is very obvious, and I clearly stated where we got the social cost of carbon used in this analysis,” said Warren Myers, DPS director of market and regulatory economics. “There are no guarantees in life, but you sure have a heck of a lot of information.” (See NY Looks at Social Cost of Carbon, Modeling.)

“The ISO and DPS staff have had a few conversations on this subject” and continue to have conversations on how to structure the rules to accommodate the PSC’s ruling, said Michael DeSocio, NYISO senior manager for market design.

“At the end of the day, if there’s a public policy that establishes a value for carbon, that would be the value that we need to incorporate into the wholesale market,” DeSocio said. “How that value has been established is public policy. I don’t know that we’d create bookends for what the maximum or minimum should be.”

External Transactions

Under the proposal, suppliers would be expected to embed the carbon charge into their energy offers and would continue to receive the full LBMP and be debited their carbon charges during settlement. NYISO would calculate and publish the LBMPc to provide market transparency, adjust payments for import and export transactions, and allocate carbon residual revenues.

“As we discussed along the way, the ISO put forth a proposal that would allow imports and exports to continue to compete on a status quo basis with internal suppliers,” DeSocio said. “As we get experience with it, if we see there are ways to make it more efficient, let’s do that.”

Several stakeholders questioned how NYISO planned to deal with the possibility that FERC might not accept in full the impact of a state-mandated carbon charge on wholesale electricity rates.

“We’re looking at the potential in the very near future to have gigawatts of offshore wind coming into New England and PJM, so this concern may be on us much sooner than you think,” said Seth Kaplan of EDP Renewables. “I refer you specifically to the work done by the Massachusetts Department of Environmental Protection for implementation of the Global Warming and Solutions Act, where they got into this exact issue in terms of customers in Massachusetts that were buying clean energy and wanting to make sure that it was credited in the emissions mix.”

DeSocio said the ISO will release a forecast LBMPc an hour before real-time dispatch. “What we’re not going to do is guarantee that that forecasted price is what we’re going to charge you, and instead will charge you the actual price,” he said.

The New York Department of Public Service derived the gross SCC from the federal government’s Interagency Working Group on Social Cost of Greenhouse Gases. The expected RGGI price is based on the August 2017 base case forecast for RGGI prices (in dark blue). The light blue values are interpolated. | NY DPS

Update on Analysis Requests

DeSocio gave an update on NYISO’s actions on several stakeholder requests for additional analysis, saying it would not study using buyer-side mitigation as a replacement for carbon pricing.

“Seemingly small adjustments to assumptions have wild differences in what the analysis shows,” he said. “That tells us whatever number we put out, we know [it] will be wrong, and most likely will be wrong in a big way.”

“The reason we wanted to see this study performed is that part of the reason we’re here is because FERC is concerned with the impact state policies are having on the markets, specifically price formation,” said Matt Schwall of the Independent Power Producer of New York. “One of the tools FERC has in its box is mitigation. I don’t know what the likelihood is that FERC could subject state-supported resources to mitigation; I do know that’s an option, and that carbon pricing is one way to protect against that.”

Bob Wyman of Dandelion Energy referred to recent rulings by the PSC that will double New York’s existing 2025 storage goal to 3,000 MW by 2030 and require the state’s utilities to reduce building energy use by an additional 31 trillion British thermal units (TBtu) to meet an energy efficiency target of 185 TBtu by 2025. (See NYPSC Expands Storage, Energy Efficiency Programs.)

“It’s important to note that in that order [Case 18-M-0084], they called for 5 [trillion] Btus in savings from heat pumps,” Wyman said. “Increasing the price of electricity relative to gas and oil is going to discourage people from accomplishing that goal, as with any of the beneficial electrification stuff, if we have a single-sector carbon price. And that really should be taken into consideration.”

“Climate change is occurring, it’s clearly related to carbon dioxide emissions and it’s not tip-toeing in on little cat’s feet anymore; that time is past. It’s coming like a freight train,” Myers said. “As an economist, I am convinced that the most economical way to address this problem starts with — it may not be sufficient — but starts with a universal, economy-wide price on carbon.”

Myers said, however, that, “unfortunately, we do not currently have a federal government willing to work on such a universal, economy-wide carbon price. And the proposal we have here put forth by the NYISO is not that. Context matters, and the context here is that we are evaluating a single-state, single wholesale market carbon price.”

DeSocio said he expects stakeholders will be meeting on the carbon pricing proposal several times a month in the first half of the year and that the ISO will soon release a schedule for those meetings.