By Michael Brooks

NERC on Tuesday warned that faster-than-expected coal and nuclear plant retirements could jeopardize reliability if grid operators are not prepared.

“If these retirements happen faster than the system can respond with replacement generation, including any necessary transmission facilities or replacement fuel infrastructure, significant reliability problems could occur,” NERC said in a special reliability assessment report. “Therefore, resource planners at the state and provincial level, as well as wholesale electricity market operators, should use their full suite of tools to manage the pace of retirements and ensure replacement infrastructure can be developed and placed in service.”

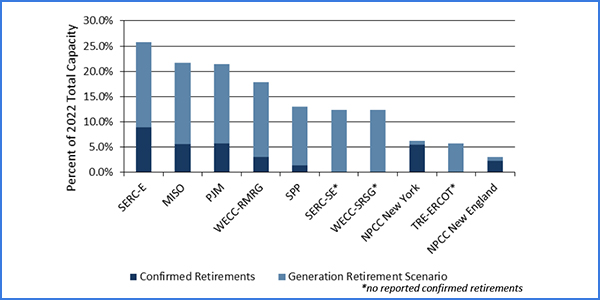

Calling it a “stress test” of the bulk power system, the organization used data from the U.S. Energy Information Administration to identify generators set to retire through 2025 in 10 areas where coal-fired and nuclear generation make up a significant portion of the resource mix. It then analyzed the impacts of those generators retiring earlier, in 2022.

The analysis found four areas — SPP, SERC-East, WECC-RMRG and WECC-SRSG — in which currently planned generation resources would not be sufficient to make up for the accelerated retirements. NERC determined this by comparing projected planning reserve margins for 2022 under the scenario to projected peak load levels for the year. The organization used data from its 2017 Long-Term Reliability Assessment to determine projected reserve margins under currently confirmed retirements through 2022, to which it factored in the accelerated retirements. It also used the LTRA to determine the projected peak loads.

‘Unlikely’ Scenario

Both the report and John Moura, NERC director of reliability assessment and system analysis, repeatedly emphasized that the analysis was not a prediction.

“I think it’s really important that stakeholders understand that this is a stress-case scenario,” Moura said in a conference call with reporters Tuesday morning. “We’re not necessarily making any recommendations or calls for any additional financial support beyond that which market operators think are required. We completely acknowledge that the scenario as tested is unlikely.”

He noted the organization also analyzes the impacts of geomagnetic disturbances and simultaneous, highly coordinated physical and cyberattacks on the grid. “These are things that we don’t believe will happen, but we think it’s instructive, when we break a system, to understand what are the potential mitigations and see how to get it working.”

“NERC’s stress-test scenario is not a prediction of future generation retirements nor does it evaluate how states, provinces or market operators are managing this transition,” the report says. “Instead, the scenario constitutes an extreme stress-test to allow for the analysis and understanding of potential future reliability risks that could arise from an unmanaged or poorly managed transition.”

Moura also noted that the report doesn’t criticize capacity markets or out-of-market subsidies. “We’re simply saying that these tools need to be monitored and tested in planning,” he said.

Fears of Politicization

NERC was criticized by some stakeholders, including FERC Commissioner Cheryl LaFleur, in early November, when it briefed its Members Representatives Committee on a draft of the report. They feared it would be politicized, and that the press and public would misunderstand it as a warning of things to come. (See LaFleur, Stakeholders Anxious over NERC Retirement Study.)

“Policymakers and regulators should not interpret this study as justifying interventions to artificially retain unprofitable power plants, as these actions deter the economic transition in the power generation fleet, undermine innovation and raise costs to America’s businesses and families,” Devin Hartman, CEO of the Electricity Consumers Resource Council, said in a statement Tuesday.

“As NERC itself states, the report looks at unlikely scenarios that go far beyond either announced or projected power plant retirements to determine at what point there might be some risk for reliability,” said Jeff Dennis, general counsel for regulatory affairs at Advanced Energy Economy. “The report does not provide evidence of any imminent threat to the reliability of the bulk power system. Nor does it suggest that competitive wholesale energy markets aren’t up to the job of ensuring reliability as the resource mix changes.”

The report “relies on too many extremes to be enlightening about real-world grid reliability,” the Natural Gas Supply Association said.

At FERC’s open meeting Dec. 20, LaFleur repeated her criticism, saying the report has a “fundamental flaw” in assuming baseload retirements beyond that currently anticipated but only counting new resource that have been announced. “So there’s an asymmetry in what’s coming out and what’s coming on,” she said. “It’s like saying, ‘What if I gave up 45% of my income and I kept my expenses the same. … You’d have a mismatch by definition.”

LaFleur said it was “noteworthy” that even under NERC’s extreme scenario “there’s not that many resource problems [that] pop up.”

“It’s a big deal … making sure we have enough resources in the future,” she concluded. “But I think we have to make sure that we rely on fact and not projections.”

NERC spokesman Marty Coyne declined to respond to LaFleur’s comments. “We don’t have anything further to say other than what’s in our media release,” he said.

Speaking to reporters after the open meeting, FERC Chairman Neil Chatterjee said he thought “NERC put a lot of work into it, and it was a thorough document. It is one data point amongst many, and I think as it pertains to our actions here at the commission and our resilience docket, my colleagues and I will analyze the myriad of data points that we have before us.”

Tuesday’s report did not include a detailed analysis of natural gas infrastructure; however, NERC said “additional midstream natural gas infrastructure could be required” to respond to early retirements.

In a November 2017 assessment, NERC had recommended industry consider the loss of key natural gas infrastructure in their planning studies under NERC reliability standard TPL-001-4. (See NERC: Natural Gas Dependence Alters Reliability Planning.)

Although NERC sees risks to increasing dependence on renewables and gas-fired generation, Tuesday’s report said that “successfully managed, the changing resource mix can provide … potential benefits to reliability and security of the BPS. Less reliance on large, centralized generation stations and greater use of dispersed networks comprised of smaller diversified generation resources can provide operating and planning flexibility. Additionally, some fuel assurance risks diminish with the changing resource mix. The effects of adverse weather on coal stockpiles or fossil fuel resupply infrastructure may be reduced when natural gas pipelines supply a greater proportion of the generating fleet. Attaining reliability enhancements associated with the changing resource mix is possible when the different challenges to fuel assurance and [essential reliability services] are addressed.”

Recommendations

NERC included several suggestions to stakeholders, regulators and policymakers in the report, among them a recommendation to incorporate fuel assurance analyses in generator retirement assessments. This would mean factoring in fuel supply infrastructure, new infrastructure requirements for replacement resources, and firm vs. non-firm fuel delivery contracts.

It also recommended that regulators and policymakers consider ways to speed up approvals of infrastructure. “When a generator’s planned retirement is delayed to allow for completion of transmission system upgrades, expedited regulatory proceedings can help minimize the delay,” the report says. “Where more natural gas generation is needed, more natural gas pipeline capacity will likely also be needed.”

But Moura also noted that the report doesn’t make any specific recommendations for the four areas identified by the report as being at risk under the scenario. “We have a lot of confidence in how these areas plan their systems,” he said.