By Michael Brooks

VALLEY FORGE, Pa. — PJM stakeholders appeared resigned to a unilateral FERC filing by the Board of Managers, despite an all-day meeting last week on the RTO’s proposed price formation rules.

PJM staff and stakeholders Friday discussed the details of several changes to reserve pricing under development as part of a comprehensive package of revisions sought by the board by Jan. 31.

Stakeholders gave plenty of feedback on PJM’s proposals during the almost seven-hour meeting of the Energy Price Formation Senior Task Force, as well as those from the Independent Market Monitor, James Wilson of Wilson Energy Economics and the D.C. Office of the People’s Counsel. But there appeared to be a general acceptance among attendees that there would not be consensus on any of the proposals at the Jan. 24 meetings of the Markets and Reliability and Members committees.

The meeting room was silent when Dave Anders, PJM director of stakeholder affairs and chair of the task force, solicited opinions on polling the proposals at the task force’s next meeting Jan. 11.

“I’d be shocked” if the committees passed any proposal in a sector-weighted vote, said Susan Bruce, representing the PJM Industrial Customer Coalition.

Anders also revealed that, after several private discussions, stakeholders are in more disagreement than previously thought about certain components of the package, such as the consolidation of Tier 1 and Tier 2 synchronized reserve products. Voting on individual components was also swiftly ruled out by the task force, as approval of certain elements in one could be contingent on elements in others.

Without stakeholder approval, the board would file PJM’s proposal with FERC under Section 206 of the Federal Power Act, which would require it to demonstrate that the RTO’s current rules are unjust and unreasonable — a higher threshold than under Section 205, which merely requires showing the proposed rules would be just and reasonable. (See PJM Board Demands Action on Energy Price Formation.)

Including the Jan. 11 meeting, the task force will meet three more times before the next MRC/MC meetings, with Anders aiming for votes on the proposals Jan. 17 and reviewing the results of the votes Jan. 23.

“Something passing at the MRC is highly unlikely,” said Adrien Ford, director of RTO and regulatory affairs for Old Dominion Electric Cooperative. “So, getting more granular info would be helpful.”

“Granular info” was exactly what staff provided Friday, unlike the task force’s previous meeting Dec. 14, in which staff presented a general outline of their initial work. (See PJM Moving Quickly to Make Board’s Price Formation Deadline.)

PJM’s proposed changes to its operating reserve demand curve (ORDC), which would be applied to all reserve products, not just synchronized reserves, engendered the most controversy at the meeting.

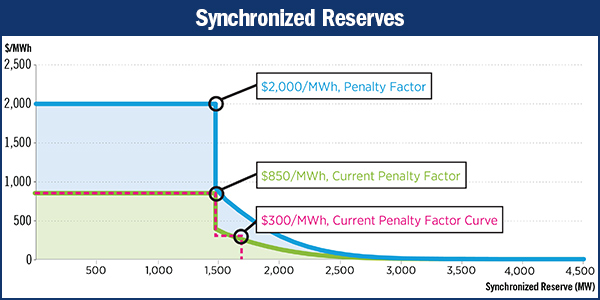

Under the proposal, the so-called “penalty factor” in the ORDC would increase from $850/MWh to $2,000. The penalty factor is the price paid to resources for meeting the RTO’s minimum reserve requirement (MRR) during a shortage.

‘Willingness to Pay’

The changes are intended to reflect consumers’ willingness to pay for some level of reserves, including reserves beyond the minimum requirement, said Adam Keech, PJM executive director of market operations.

Stakeholders took exception to this. “Those are fighting words” to industrial customers, Bruce said. She questioned the basis for PJM to opine that the ORDC appropriately reflects what a customer would be willing to pay to procure another megawatt of reserves, given the range of projected price increases.

“You’ve dropped all assertions of marginal reliability,” said Wilson, consultant for consumer advocates in several states and D.C. “We have no evidence the customer is willing to pay that much for reserves. The customer cares about lost load, so the marginal value of reserves depends upon the likelihood that firm load would have to be shed if we have only that level of reserves.”

“It’s misleading to say, ‘customers’ willingness to pay,’” said Catherine Tyler of Monitoring Analytics, the IMM. “Operators may be willing to take more expensive actions than customers are willing to pay for.”

As a compromise, the D.C. OPC’s Erik Heinle proposed a two-step penalty factor: maintaining the current $850 figure for reserves up to the MRR and increasing to $2,000 for the last 500 MW of reserves.

Wilson said the OPC’s curve is better than PJM’s, as it associated the penalty factor with a low reserve level.

Staff also explained how they would align the reserve products, which would introduce the ability to procure primary reserves (those able to respond within 10 minutes) in the day-ahead market and secondary reserves (10 to 30 minutes) in the real-time market.

There was some debate about whether to allow virtual trading of reserve products to arbitrage in the two markets. Wilson said he could imagine “phantom” shortage pricing in the day-ahead market when the situation in the real-time is better, and virtual trading would help alleviate that. Keech, however, responded that the ORDCs for each of the markets will not be different enough to necessitate virtuals, but that staff would consider it.

Staff are also considering whether there needs to be a synchronized requirement for secondary reserves, as there is with primary reserves. That will likely be among the topics discussed at the next meeting, along with other details of the market alignment.