By Michael Kuser

RENSSELAER, N.Y. — The NYISO working group charged with shepherding carbon pricing into New York’s wholesale electricity market kicked off its efforts Tuesday by taking up the issue of how import and export transactions would be handled under the pricing scheme.

A task force created in October 2017 by NYISO and the New York State Public Service Commission worked for more than a year developing a proposal to price carbon into wholesale markets. Last month, it turned the proposal and final details over to the ISO’s stakeholder process. (See IPPTF Hands off Carbon Pricing Proposal to NYISO.)

Ethan D. Avallone, NYISO senior energy market design specialist, showed the Market Issues Working Group (MIWG) several hypothetical transactions, pointing out that his examples “had to be extreme to show the effects of under- or overestimating the real-time carbon charge.”

A carbon charge or credit would apply only to transactions that actually flow in real time, and to external transactions such that they compete with internal resources and each other as if the ISO was not applying a carbon charge to internal suppliers — that is, on a status quo basis, Avallone said. (See NYISO Plan Revises Treatment of Carbon-Free Resources.)

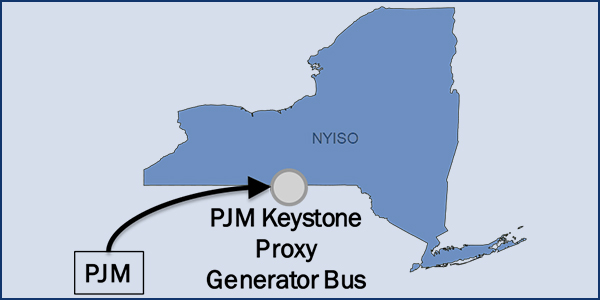

A market participant intending to import into the New York Control Area (NYCA) will sell power at the proxy generator bus for the applicable control area in the NYISO market. | NYISO

To calculate locational-based marginal prices, the examples in the presentation focused on prices at one NYISO proxy generator bus located outside the New York Control Area to represent a typical bus in an adjacent control area. There may be more than one proxy generator bus at a particular interface with a neighboring control area to enable the ISO to distinguish the bidding, treatment and pricing of products and services at the interface.

Imports into the NYISO market are paid the proxy generator bus price for the applicable external control area. For example, an import with costs of $40/MWh in the PJM market could sell at the $50 PJM Keystone Proxy Generator Bus price in the NYISO market for a potential net revenue of $10/MWh.

Several stakeholders at the meeting said they wanted better real-time data from the ISO, possibly using a unit-specific, rather than aggregated, approach.

“The reason we landed on this more aggregated approach is because we wouldn’t be able to tell whether a unit-specific one is representative,” Avallone said, adding that the fundamental question about what approach to take had been fully aired in the stakeholder process last year.

Seth Kaplan of EDP Renewables, the largest wind generator in the state, said his company had no position on the matter but suggested the ISO ask for market proposals for a unit-specific approach from those who were advocating one.

Howard Fromer, director of market policy for PSEG Power New York, offered that the ISO could provide day-ahead carbon data to help traders to better ascertain the right carbon adder in order to plan their bids.

“We would settle on the real-time LBMP,” Avallone said in explaining the ISO’s choice not to provide day-ahead data. “We have discussed recalculating LBMPs for a historical time period as if there were a carbon component [c] included [in order] to get an approximation of LBMPc in real time.”

Michael DeSocio, the ISO’s senior manager for market design, said energy traders were already “using some model, some heat rate model. Now you just have to add in a carbon adder, so it’s not much different from what you do today.”

Fromer said it would take some time to digest the detailed examples, and that his company wants to see carbon pricing move ahead, but it’s “likely to have some impact on scheduling” as traders are “being forced into guesstimating on the day-ahead LBMPc.”

Scott Leuthauser, manager of regulatory affairs and business development for H.Q. Energy Services (U.S.), read a prepared statement saying his company opposes applying the carbon charge, as proposed, to external transactions because it creates additional risks for them. External resources have no control over NYISO carbon emissions and no way of physically hedging against the risk, he said.

“As we have said before, it is better for traders to assess and bear the risk,” Avallone said.

The MIWG next meets Jan. 22 to review Tariff sections impacted by a carbon adder.

New Zone J Operating Reserves

NYISO is speeding up the stakeholder process in order to implement by June a Zone J (New York City) reserve requirement and procure 500 MW of 10-minute reserves and 1,000 MW of 30-minute reserves, the MIWG learned Tuesday.

Ashley Ferrer, NYISO energy market design specialist, told the working group that creating a Zone J reserve region and associated reserve requirements can provide more efficient scheduling and procurement of resources, as well as location-specific market price signals.

The ISO is considering the appropriate operating reserve demand curve for the zone’s reserves and will present its proposed pricing as part of further discussions regarding the proposal, Ferrer said.

NYCA operating reserves with Zone J | NYISO

Establishing a separate Zone J operating reserves requirement was originally recommended in the 2017 State of the Market report and later in the 2018 Management Response to an assessment by Analysis Group of wholesale market options regarding performance assurance.

The ISO will present market design and associated Tariff revisions to stakeholders this month and next, with the Business Issues and Management committees slated to vote on the proposal in March. Assuming stakeholder approval, the ISO would submit the proposal to the Board of Directors in April and file Tariff revisions with FERC seeking approval to implement in June.