By Michael Kuser

RENSSELAER, N.Y. — NYISO stakeholders on Monday debated the need to consider the improbable: that a proposed carbon pricing scheme could occasionally leave New York electricity consumers paying into the carbon revenue account rather than drawing from it.

ISO staff prompted the discussion with a proposal for responding to such an event in the wholesale market.

“In the unlikely circumstance the carbon residual is negative, the Tariff will include rules for allocating these carbon residual shortfalls to” load-serving entities, Ethan D. Avallone, NYISO senior energy market design specialist, told the Market Issues Working Group.

The total carbon residual represents carbon charges collected from internal generators plus those collected from imports, minus carbon payments to exports, he said. Wheel-through transactions are netted out of the total. (See NYISO Looks at Carbon Charge Tariff Impacts, Residuals.)

A negative residual would occur when carbon payments exceed carbon charge collections, which could arise when an emitting resource is on the margin while much of the energy being delivered is being provided by zero-carbon resources, Avallone said. Dispatching that marginal emitting resource for export would trigger a payment to the resource, but the ISO wouldn’t be collecting charges to cover that payment in the interval.

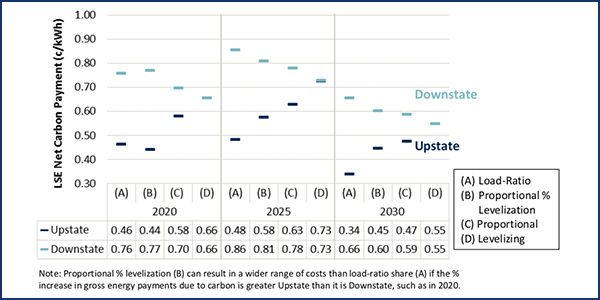

To ensure that benefits are spread equitably across the state, NYISO has recommended allocating carbon charge residuals proportionally to consumers across all zones, Avallone said. But in instances when it must cover a potential negative balance in the residual account, the ISO is proposing to allocate costs back to load based on load-ratio share.

Avallone said the load-ratio share methodology makes more sense than a proportional one in dealing with negative residuals. It would prevent piling additional costs on load zones with higher locational-based marginal prices and also avoid further cost shifts.

Load in zones with higher prices will already bear a higher impact from the carbon charges in their energy payment. If the proportional carbon allocation were used, those zones would also carry a higher proportional burden for a negative residual, Avallone said.

Statewide Issue

“It’s important to note that any shortfall would be a statewide issue, because the calculation includes both imports and exports,” Avallone said.

NYISO’s principal economist, Nicole Bouchez, explained that renewables tend to be on the margin upstate, but that the negative residual phenomenon would become a statewide issue when no emitting generators are producing, an emitting resource is marginal and exports are occurring, which is unlikely with the current generation fleet.

“Over time, as you get more and more renewables, it might happen more often,” Bouchez said.

Asked if the ISO had done any analysis on the shortfall issue, Avallone replied, “No formal analysis; just the observation that it is possible to be a net exporter today around midnight when you have many renewables on.”

Mark Reeder, representing the Alliance for Clean Energy New York, said the analysis could be done with data from previous multiarea production simulation runs.

“You’d have to have downstate having almost no carbon emissions to have the shortfall situation arise,” Reeder said.

Upon implementation, the ISO would expect the “majority of hours” to see a credit to load, calculated on an hourly basis, Avallone said, but some stakeholders did not like the fuzziness of the term.

Mark Younger of Hudson Energy Economics pointed out that there would be carbon revenues both from emitting resources on the margin and those running at minimum load. He said NYISO had “undersold” the statistical improbability of getting a residual shortfall, which would require payments to exports to exceed the carbon revenues from all resources in the market, an unusual occurrence. The ISO would need to show a hypothetical example of potential negative residuals occurring when exports are coupled with generators running at minimum carbon generation, he said.

NYISO’s schedule for carbon pricing calls for discussing calculating its impact on LBMP and identifying marginal units on Feb. 15, Tariff revisions on Feb. 28 and March 18, and carbon bid adjustment for opportunity cost resources on March 4. Opportunity cost resources represent carbon-free resources able to store energy and structure their bids to achieve delivery schedules during the most economic periods of the day. (See NYISO Plan Revises Treatment of Carbon-Free Resources.)