By Christen Smith

Naive, overconfident staff and underlying market flaws allowed a small trading shop to amass the largest portfolio of financial transmission rights in PJM history without the collateral to back it up, an independent review concluded on Tuesday.

The RTO’s Board of Managers commissioned a special report on the GreenHat Energy debacle in October, just four months after the company defaulted on 890 million MWh of FTRs and racked up $100 million (and counting) in losses.

The review concluded PJM staff ignored red flags about the company’s assets and exhortations from other members about the portfolio’s financial shortcomings — a failure of protocol that CEO Andy Ott said “needs to change.”

“PJM needs to get better,” Ott told RTO Insider. “Quite frankly, we’re just not used to this type of behavior from a market participant.”

Independent Review

The board hired three consultants to focus on the RTO’s role in enabling the default, handing off the task to Robert Anderson, Neal Wolkoff and Arleigh Helfer. Anderson serves as executive director of the Committee of Chief Risk Officers, whereas Wolkoff has consulted with the U.S. Commodity Futures Trading Commission and has held leadership positions at the New York Mercantile Exchange and the American Stock Exchange. Helfer is a litigation attorney based in Philadelphia.

“It is clear what a significant outlier GreenHat was,” the report reads. “GreenHat’s trading pattern was conspicuous in that its positions were far larger and of longer tenor than those of other financial participants in the FTR market.”

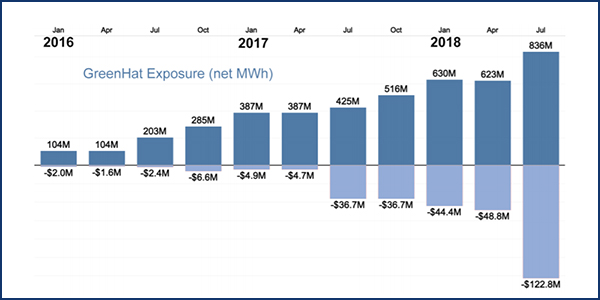

The report tracked a four-year timeline of events, beginning with GreenHat’s 2014 entry into PJM despite “a questionable history,” followed by unchecked growth in FTRs that more than doubled each year between 2016 and 2018, as well as warnings from at least four other market participants who estimated the portfolio was short by as much as $40 million. It ended with the company defaulting on a $624,000 collateral payment last June.

“Long tenor of a financial position is riskier than a near-term duration because less is known about the distant future than the near future, and more events can intervene to affect the value of a position over time,” the report said. “GreenHat’s portfolio was very risky because of its size and the length of time the positions would be open and subject to market forces before settlement.”

GreenHat, which listed its address as a UPS store in Coronado, Calif., was owned by two traders who previously gained notoriety as participants in J.P. Morgan Ventures Energy Corp.’s scheme to manipulate the Doubling Down – With Other People’s Money.)

FERC Commissioner Richard Glick said in January the commission must investigate participants who willfully manipulate the market through fraud and escape any sort of punishment, thereby perpetrating their schemes on other RTOs. “That investigation should consider the full extent of our existing authority under the Federal Power Act and whether any legislative action is needed to ensure the commission has the authority to preclude these individuals from continued participation in wholesale electricity markets,” Glick said. “I hope this is an issue we can address in the months ahead.”

The consultants also determined a flaw in PJM’s methodology for calculating collateral adjustments created “counter-intuitive” and “sometimes directionally incorrect” collateral requirements. The faulty approach meant even as GreenHat’s portfolio became increasingly risky, its collateral requirements actually shrank, leaving healthier portfolios to essentially subsidize the entire FTR market, the report found.

The report’s authors noted that “best practices incorporate forward information to determine collateral requirements for market participants. In contrast, PJM’s assessment of risk was based entirely on historical, or backwards looking, information.” They recommended PJM require use of mark-to-auction values from more frequent auctions, include long-term FTRs in monthly or bimonthly auctions, and base collateral on forward-looking metrics to better capture risk.

PJM Response

Ott said the RTO takes the report’s deep criticisms “very seriously,” announcing Tuesday a list of reforms it will implement immediately, starting with the hiring of a chief risk officer — someone with the knowledge and experience to prevent such calamities from befalling the market again.

“We realize we need to get better at credit risk management,” he said.

PJM will also review and revamp its credit risk assessment and monitoring procedures, as well as facilitate stronger coordination between PJM’s markets, credit/finance and legal groups, and the Independent Market Monitor.

“We expect this report will provide the momentum to move these issues forward,” Ott said in a press release Tuesday. “PJM will work with our members and federal regulators to examine changes recommended by the report designed to strengthen the regulation of our FTR market. It is our job to make sure this never happens again.”

Ott said federal regulators identified issues with PJM’s credit risk management practices in 2010, but stakeholders expressed reluctance over the potential costs of implementing a more sophisticated system.

Independent reviewers confirmed a 2007 FTR default by Tower Research Capital spawned recommendations on how to improve risk management policies and market surveillance, including increasing the frequency of auctions, limiting positions based on participant’s capital, basing collateral on forward-looking metrics and shortening the time period of settlement for outstanding charges.

After lengthy discussions, stakeholders agreed only to the latter recommendation. The review blames PJM staff for not effectively communicating the critical necessity of the other suggested changes.

“This is something where we have to look at ourselves and what we could we have done better and there’s plenty there,” Ott said on Tuesday.

Ongoing Fallout

At the Market Implementation Committee meeting on Feb. 6, PJM CFO Suzanne Daugherty told members that a FERC order to rerun the July 2018 FTR auction to liquidate GreenHat’s positions could add $250 million to $300 million to the $186 million the RTO had earlier projected the default would cost members. (See PJM: FERC Order Could Boost GreenHat Default by $300M.) On Tuesday, the commission issued a tolling order giving it more time to rule on PJM’s rehearing request on the issue (ER18-2068).

“We recognize the shortcomings identified in this review,” Ott said. “PJM takes the cost of this default very seriously, and we are committed to reforms that better protect market participants in the future.”

The review faults “dismissive” attitudes from the PJM executive team and flawed legal advice regarding the RTO’s ability to revoke GreenHat’s trading rights after concerns grew over its projected losses. Daugherty acted on her own authority in 2017 when she halted the company’s ability to participate in future FTR auctions — held in June and December each year — before reversing her decision three weeks later, fearing possible Tariff violations and legal repercussions.

Daugherty, who retired as CFO last month, had declined to say whether her departure was related to the GreenHat fallout. (See PJM CFO Retiring in Wake of GreenHat Default.) Tuesday’s report better illuminated her role in the debacle, noting she and other PJM staff put too much faith in verbal and written agreements with GreenHat guaranteeing the company held $100 million in assets and would receive a $62.2 million payout from two bilateral contracts.

“If PJM knew its customer better, PJM may have recognized these instances as red flags indicating the GreenHat pledge agreement may have actually been a sham before signing,” the report said. “These red flags may have helped PJM to conclude that GreenHat did not have an asset worth $62 million to pledge and assign.”

Ott said Tuesday other organizational changes lie ahead for the RTO but declined to comment on the status of specific staff members, noting there “is certainly a need to strengthen different departments.”