By Michael Kuser

RENSSELAER, N.Y. — Stakeholders expressed some skepticism last week as the Analysis Group revealed the outline of a new study underway to provide insights into pricing carbon in NYISO’s markets.

The ISO surprised stakeholders in February when it announced it had commissioned Analysis Group to supplement the Brattle Group’s foundational study in order to finalize a pricing scheme. (See NYISO Commissions New Social Cost of Carbon Study.)

Susan Tierney, a senior adviser with Analysis Group, allayed their concerns with poise and humor as she told the Installed Capacity/Market Issues Working Group on Thursday that she and colleague Paul Hibbard “had some ideas for additional things that we didn’t think were captured in the Brattle report, starting with macroeconomic or co-benefits, known as extra-market activities,” and second, discussing “some reasonable but less conservative assumptions.”

The firm plans to present preliminary findings and discuss with stakeholders the study approaches by the end of the month, present initial analysis results in mid-May, and prepare a white paper and companion technical report by the end of May, Tierney said.

A task force created in October 2017 by NYISO and the New York Public Service Commission worked for more than a year developing a carbon pricing proposal. In December it turned the proposal and final details over to the ISO’s stakeholder process. (See IPPTF Hands off Carbon Pricing Proposal to NYISO.)

Stakeholders Question

Stakeholders were quick to tell Tierney that it’s not easy to put together a carbon pricing report in a couple months and contribute to a policymaking process that’s been going on for nearly two years.

“Is this going to be something unbiased that looks at both sides of the issue, or just looks for benefits that Brattle might have missed?” said Couch White attorney Michael Mager, who represents Multiple Intervenors, a coalition of large industrial, commercial and institutional energy customers. “Will you not look for costs and co-damages; effects on jobs; manufacturing; emissions in other states?”

“We want to do credible analysis, so of course we look at pluses and minuses, positive and negative impacts,” Tierney said.

Couch White attorney Kevin Lang, representing New York City, reacted to a presentation slide with a photo of the city skyline in haze, and captions that said most emissions reductions will be “downstate” and that the greater metropolitan area has the 10th worst ozone air quality in the U.S.

“Your assumption that New York City will benefit from improvements in air quality is flawed, as Brattle acknowledged that carbon pricing would not reduce fossil fuel-based generation in the city, and that what Brattle termed ‘downstate’ included Zone F [the capital region and upper Hudson River Valley],” Lang said.

Tierney said she probably conflated the terms, but she insisted that they were not redoing or critiquing the Brattle report, and that they would indeed be looking at statewide co-benefits — and negative impacts.

“Co-benefits is a term used in Washington for things that are not the intended effects of a policy,” Tierney said. “When looking at employment impacts, for example, we know we can’t just count up the new jobs without considering the jobs that might be lost.”

Erin Hogan, representing the New York Department of State’s Utility Intervention Unit, said the study should allow stakeholders to understand the net employment impacts, not gross impacts.

Mark Reeder, representing the Alliance for Clean Energy New York, said the final Brattle report noted that a carbon charge would induce steam unit repowering downstate, which could benefit public health by improving the air quality in New York City.

Brattle cited analysis by the ISO’s Market Monitoring Unit, Potomac Economics, that said steam unit repowering might already be economically feasible, and Tierney said they will base their assumptions on the issue on further analysis expected from the Monitor.

Renewables and Tx

The new study also will examine employment and other macro impacts of a carbon charge on New York’s economy, including reduced imports of fossil fuels.

“It is not going to be a general equilibrium model,” Tierney said. “We want to see if we can come up with a credible list of things that would be retired, or added to the system, or would otherwise have a meaningful impact on it.

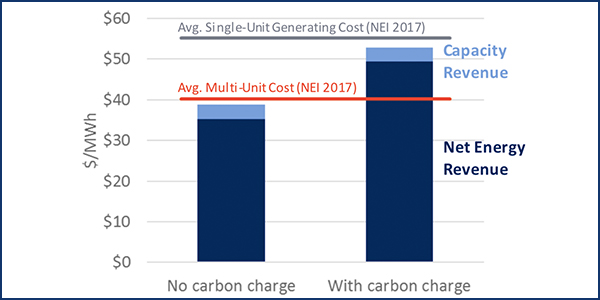

“The Brattle study examined whether there would be more or fewer zero-carbon resources as a result of carbon pricing, mostly focused on nuclear,” she said, “including the enormous cost implications of” replacing the capacity and energy of those existing zero-emissions and nuclear resources, were they to retire.

“One key assumption in the Brattle analysis was that the state would simply be able to execute on its goals of putting in thousands and thousands of renewable resources,” she said. (See IPPTF Updates Carbon Charge Analysis, Treatment of RECs.) “We want to explore the role of carbon pricing in enabling the accomplishment of those important goals.”

Reeder said it would be beneficial to measure the effect of carbon pricing on the retention of existing renewable resources, such as a wind turbine with a contract that expires in 2025, and that analysis so far has not put any dollar value on the impact of carbon pricing on the deployment of energy storage, so it also “would be great to fill that gap.”

Mark Younger of Hudson Energy Economics said that “pricing carbon would signal incentive to build new transmission, which is important if you don’t have benefits downstate without added transmission.”

Lang said he had been talking about the need for transmission for two years, and “to understand the effect of carbon pricing on building transmission would be great.”

David Clarke, director of wholesale market policy for the Long Island Power Authority, asked about the cost-effectiveness of the Regional Greenhouse Gas Initiative as an alternative model against which to assess the cost-effectiveness of carbon pricing, which he said would be a good way to measure its impact on carbon abatement.

“We did look at the revenues question, but layering on top of that the incredibly complex question of cost-effectiveness would be … somewhat outside the scope of pricing carbon dispatch,” Hibbard said.

Analysis Group will use data from the modeling runs performed for the Brattle study to assess the impact of a carbon price on demand for natural gas, Tierney said, adding that it had no plans to pursue additional Multi Area Production Simulation (MAPS) runs.

One stakeholder suggested that one or two new MAPS runs might be reasonable and cost-effective now that some base assumptions from the Brattle study are possibly out of date, including the expected in-service date of the delayed AC Public Policy Transmission projects. (See NYISO Public Policy Tx Revisions Approved.)

“I have no objections to additional data or information,” Hibbard said.

Fuel Security Study

Analysis Group also presented the preliminary outline of a study commissioned by NYISO to assess winter fuel and energy security for the New York Control Area.

Hibbard reviewed the proposed input assumptions and sources of data that would feed into the fuel security model, along with alternative assumptions and system stress scenarios. Data used are a mix of those publicly available and internal to the ISO, with preference given, where possible, to assumptions previously vetted with stakeholders.

The purpose of the analysis is not to predict the future but instead examine different scenarios, he said.

The plan is to follow up on the assumptions, data and scenarios by mid-April and present the initial findings by late April. Analysis Group will present final findings and initial recommendations in June ahead of a presentation of final recommendations in July.