By Tom Kleckner

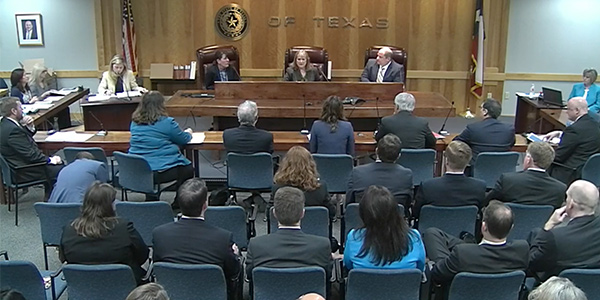

A combined $1.37 billion worth of transactions involving Oncor, Sharyland Utilities and Sempra Energy all but gained regulatory approval last week following a brief hearing on the merits before the Texas Public Utility Commission.

The commission reviewed a stipulated settlement among the three companies and seven other parties, complimenting them on the agreement. The proceeding has been placed on the agenda for the PUC’s open meeting Thursday (Docket 48929).

“It took a lot of work to get here and compromise on everybody’s part,” PUC Chair DeAnn Walker said. “Thanks for bringing us something that is a very good solution to this situation.”

“I’m largely content with [the settlement],” Commissioner Arthur D’Andrea said.

The settlement agreement resolves all issues in a complex series of deals announced by the parties in October, with Sempra buying a 50% stake in Sharyland Distribution & Transmission Services and Oncor acquiring transmission owner InfraREIT. An exchange of transmission assets would increase Oncor’s footprint in West Texas and “de-REIT” the Sharyland utility in South Texas. (See Sempra, Oncor Deals Target Texas Transmission.)

Oncor, Sharyland and Sempra filed for approval with the PUC in November.

Approximately 260 miles of InfraREIT’s transmission system were previously owned by Oncor. They were exchanged for Sharyland’s distribution system as part of a 2017 rate case settlement. (See Texas PUC OKs Settlement in Oncor-Sharyland Asset Swap.)

“This is a rare opportunity for us to acquire assets in ERCOT. Assets don’t come up for sale very often,” Oncor General Counsel Matt Henry said. The assets “happen to be not only on our border but overlapping our existing transmission footprint. As everyone knows, West Texas is absolutely going nuts. We’re excited about the deal from a commercial standpoint.”

The PUC’s approval would mean Oncor will become responsible for building the infrastructure needed to accommodate Lubbock Power & Light’s move from SPP to ERCOT.

“Based on the stipulated language, Oncor would be stepping into the shoes of Sharyland and nothing would slow it down,” said Cody Faulk, an attorney representing LP&L.

PUC staff, the Office the Public Utility Counsel, Alliance for Retail Markets, Steering Committee of Cities Served by Oncor, Texas Energy Association for Marketers, Texas Industrial Energy Consumers and Hunt Consolidated were parties to the agreement. ERCOT, the city of Lubbock, Golden Spread Electric Cooperative and the Texas Cotton Ginners Association do not oppose the revised stipulation.

California-based Sempra acquired an 80% interest in Oncor early last year in a $9.45 billion all-cash buyout. (See Texas PUC OKs Sempra-Oncor Deal, LP&L Transfer.)

Sempra’s legal counsel, Ron Moss, said the company wants to be part of Texas’ “vibrant utility industry.”

“The proposed transaction represents the next step,” he said.