By Michael Kuser

RENSSELAER, N.Y. — A new NYISO study will examine the energy market and reliability implications of a grid being transformed faster by public policy than by market forces, stakeholders learned Monday.

Nicole Bouchez | © RTO Insider

“We are addressing the reliability, resilience and flexibility needs of the grid transitioning to a greener New York,” Nicole Bouchez, NYISO principal economist, told the Installed Capacity/Market Issues Working Group during an April 15 meeting that discussed the study’s outline.

New York state policies will add large volumes of zero variable-cost resources to the market, with 15,000 MW of new intermittent resources expected to lead to the retirement of 4,000 to 6,000 MW of conventional generation over the next decade, the outline said.

“We’re trying to figure out what has been done and what needs to be done, so we want stakeholder feedback,” Bouchez said.

The ISO will release the first draft of the study May 22 for discussion on May 30, ahead of the Board of Directors’ June meeting, followed by another draft at the end of August to help inform the board’s strategic planning meeting in September, she said.

NYISO thinks the market needs appropriate investment signals to attract, retain and operate new and existing resources while avoiding additional out-of-market compensation.

“The goal here is not to get ourselves into an RMR [reliability-must-run] world,” Bouchez said. “We will be looking at market revenue sufficiency; I think in many ways that’s the most ambitious part of this whole paper.”

Transitional Roles

David Clarke, director of wholesale market policy for Power Supply Long Island, asked about the transitional role of carbon pricing.

“There are ways carbon pricing can lead to short-term carbon savings,” Clarke said. “The big question is, ‘Can the state count on the market to achieve its goals?’ Is there a robust market structure that can reliably get you to 2040?”

Bouchez said the ISO sees the situation differently; the state is the one achieving its clean energy goals, with the wholesale market trying to accommodate the changes while remaining effective. (See NYISO Seeks to Refine Carbon Price Equation.)

Erin Hogan, representing the New York Department of State’s Utility Intervention Unit, asked the ISO to provide more precise definitions of the state’s goals. The study refers to a carbon-free grid by 2040, for example, when in fact the current announced target is a carbon-neutral grid, which is not the same thing, she said.

Raj Addepalli, representing the Alliance for Clean Energy New York, asked whether the ISO knows of anyone in the world with experience fully operating a system on resources with no variable costs and how markets can be structured in such a scenario.

Bouchez noted California has been thinking about the topic somewhat longer than New York but has not yet figured it out.

Miles Farmer of the Natural Resources Defense Council asked if the ISO has plans to address the inconsistency between its market mitigation rules and the state’s announced plan to pursue 100% emissions-free resources. He contended mitigating state-supported resources does not make sense with “a state-driven market entry model.”

“We will be looking at the mitigation rules and their compatibility with the desire of the state to have programs that value different attributes,” Bouchez said.

The ISO also announced April 23 as the date for a second presentation by Analysis Group on the outline of a new study to provide additional insights into pricing carbon into NYISO’s wholesale electricity markets. The firm’s Sue Tierney and Paul Hibbard will present initial analysis results May 14, and the ISO expects to post the final results by the end of May. (See Analysis Group Presents NYISO Carbon Pricing Study Plan.)

Fuel Security

NYISO also said Monday it will take a second look at assumptions being used in a separate study commissioned to assess winter fuel and energy security for the New York Control Area.

Hibbard presented additional details on the study, reviewing weather and natural gas market assumptions.

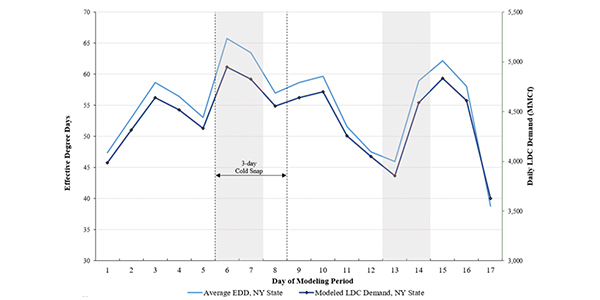

“The 17-day cold snap from last year is used in the new model, but it also includes three days from an older and more severe cold period,” he said.

Graph shows degree days and local distribution company natural gas demand for the 17-day modeling period to be used in the fuel security study. | NYISO

Based on review of local distribution company documents, Hibbard said essentially all pipeline export capacity from New York to New England is assumed to be under firm contract to deliver flowing gas or transport stored gas, with 889 MMcfd of natural gas available for electric generation after accounting for retail gas demand in New York, equivalent to roughly 5 GW of electricity generation under severe cold conditions.

Hogan asked what kind of validation process Analysis Group used “to make sure [it was] in the ballpark with results.”

“We’re trying to see where the risks are to the electric power system based on natural gas supply constraints, not the worst-case or best-case scenario,” Hibbard said.

Wes Yeomans, the ISO’s vice president of operations, said, “Remember, on the supply side, we’re going to have Indian Point out and no coal. … Things will be different in 2023 from what they were in earlier forecasts.”

One stakeholder mentioned the importance of considering the impact of energy storage on fuel demand, given the state’s programs to help finance development of 800 MW of new energy storage resources. (See NYPSC Expands Storage, Energy Efficiency Programs.)

Weather assumptions for the fuel security study will now include data from a previous 3-day severe cold snap. | NYISO

“We likely will not change base assumptions in the initial scenario but will address storage and various other stakeholder concerns in the scenarios and as part of the findings of the analysis,” Hibbard said.

Analysis Group currently expects to present initial findings of the energy security study in May, additional findings in June and final results in July.