The Texas Public Utility Commission last week held off on giving its final blessing to $1.37 billion worth of transactions involving Oncor, Sharyland Utilities and Sempra Energy.

Handed a proposed order by Oncor the day before their Thursday meeting, the commissioners asked staff to bring a final order back to its May 9 meeting (Docket 48929).

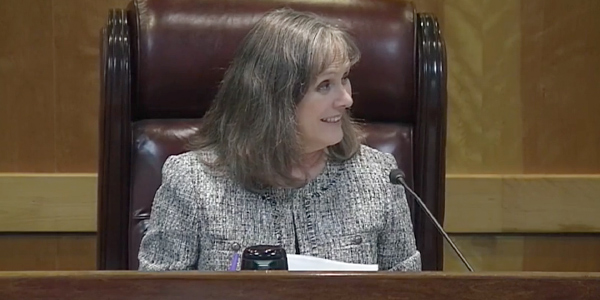

“I’m OK with going ahead and approving the settlement,” said PUC Chair DeAnn Walker, drawing assent from her fellow commissioners.

The commission’s final order will give Sempra a 50% stake in Sharyland Distribution & Transmission Services and Oncor ownership of Sharyland’s transmission-owning InfraREIT. The asset exchange will increase Oncor’s footprint in West Texas and “de-REIT” the Sharyland utility in South Texas. (See Oncor-Sharyland-Sempra Deals Inch Toward Approval.)

“We look forward to continuing the dialogue about the draft order,” Oncor spokesman Geoff Bailey said. “We continue to believe that Oncor’s proposed acquisition of InfraREIT is good for Texas, the ERCOT market and for Oncor.”

Oncor to Pay $432K Penalty

The PUC’s consent agenda included the approval of a settlement agreement between staff and Oncor that will result in the utility paying $432,000 in administrative penalties for 2017 feeder violations (Docket 48841).

Following an executive session, the commissioners also agreed to intervene in three FERC dockets:

- ER19-1503: MISO and Entergy Services’ proposed revisions to Entergy operating companies’ transmission formula rate templates.

- EL19-62: Springfield’s (Mo.) complaint against SPP over its pricing zone costs as a result of the RTO’s highway/byway allocation methodology. Springfield is asking FERC to “benefit-deficient zones,” like Springfield’s, from the methodology’s “unintended consequences.”

- ER19-1541: A proposed settlement agreement between MISO, its transmission owners and East Texas Electric Cooperative over the withdrawal and transfer of 38 MW of load and related assets from MISO to SPP.

— Tom Kleckner