By Amanda Durish Cook

CARMEL, Ind. — MISO is accepting proposals for projects designed to relieve its increasingly costly North-South transmission constraint, but it is still zeroing in on an approach to evaluate submissions.

During a Thursday conference call to inform stakeholders about MISO’s expectations of design parameters, staff expressed hope that a viable candidate could emerge from a second round of proposals to relieve the constraint given recent changes to the RTO’s own outlook and the way it values the monetary benefits of large transmission projects.

The submission window for proposals will remain open until June 21. Once ideas are submitted, MISO will perform screening analyses through July to identify possible candidates. After performing more in-depth analysis and cost estimates, the RTO could announce a viable candidate by August.

MISO has added the Midwest-South interface as a constraint to be evaluated under its ongoing Market Congestion Planning Study (MCPS). (See MISO Takes Second Look at North-South Constraint.) Planning Manager Matt Ellis said the constraint was added at stakeholder request.

Ellis said the second look comes as MISO seeks to add a new benefit metric for market efficiency projects that reduce the costs of its settlement with MISO MEP Cost Allocation Plan Goes to FERC.) Ellis said the new metric could render some project candidates more beneficial than they appeared when MISO last studied the constraint in 2017.

The transfer constraints between MISO’s Midwest and South regions contributed to the RTO’s September and January emergency events, CEO John Bear said at an April 23 Informational Forum. He said MISO had adequate resources during both emergencies, but transmission constraints kept it from accessing them to relieve emergency conditions. He said a project could strengthen the RTO’s greatest asset: its footprint diversity. (See MISO Claims up to $3.9B in 2018 Benefits.)

Under the MISO-SPP settlement agreement, MISO pays SPP between $16 million and $38 million in base annual payments based on an annual available system capacity usage factor. Beginning next February, that amount is subject to a 2 to 4% escalation rate, depending on use.

“Fifteen years out, those payments could get pretty high,” Principal Transmission Planning Engineer Shane O’Brien told stakeholders.

O’Brien also said the agreement itself will soon be less certain. Starting Jan. 31, 2021, it may be terminated by any party with a year’s notice. Without a replacement settlement in place, flows would be limited to MISO’s original contract path.

“We could potentially have to revert back to 1,000 MW in the earlier direction,” O’Brien said.

MISO has also said that growing renewable use is set to increase flows on the contract path. By 2033, the RTO has found that interface flows could reach 8,000 MW north to south based on data from its Transmission Expansion Plan (MTEP) futures. Using the accelerated fleet change MTEP future, MISO estimates that its annual settlement payments might reach $70 million, although the other three futures limit costs to below $40 million per year.

In response to stakeholder questions, Ellis said MISO would evaluate the value of avoiding emergency declarations as an additional benefit metric for a Midwest-South transmission solution, even though emergency event reduction is not a Tariff-defined benefit metric.

Design Criteria

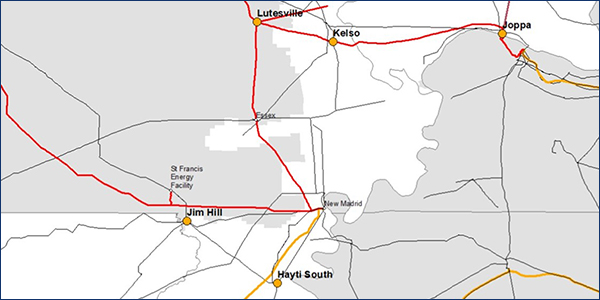

The RTO has said proposed projects must terminate on either side of the footprint at facilities owned by MISO transmission owners. However, solutions can have midpoints outside of the MISO system, O’Brien said. Transmission solutions can either increase capacity beyond MISO’s current regional directional transfer limits or eliminate portions of the contract path.

Transmission solutions can also address other transmission constraints in addition to the North-South interface to increase the overall benefits of a project and increase the odds of approval.

“Certainly, if folks are able to provide other benefits in addition to increasing capacity between the regions, that will make a project more beneficial,” O’Brien said.

However, MISO is not yet discussing how the costs of projects might be allocated.

WPPI Energy’s Steve Leovy asked if MISO would consider a transmission solution that might be shared with the neighboring Tennessee Valley Authority.

While Ellis said MISO would not foreclose on considering such an idea, he reminded stakeholders that it’s more difficult to evaluate hypothetical agreements against a solution wholly owned by a MISO member.

“We’d have to have some sort of more assurances. What that looks like, I don’t know,” Ellis said.

Missouri Public Service Commission economist Adam McKinnie asked how MISO’s special project submission window might interact with its ongoing interregional coordinated system plan (CSP) with SPP.

“I just don’t want people to have to submit projects twice,” McKinnie said.

Ellis said any projects submitted under the CSP will be evaluated separately by the RTOs first. In the unlikely scenario that a North-South transmission project also qualifies as an interregional project, it will not be overlooked, he said.