By Tom Kleckner

Fast-moving Texas legislation that would give incumbent utilities the right of first refusal (ROFR) to build transmission projects in the state remains on the brink of passage, though its days may be numbered.

House Bill 3995, which was voted 11-0 out of the State Affairs Committee in April, was scheduled to be taken up by the House this week. However, the House adjourned May 3 without taking further action on the bill. It faces a May 9 deadline for passage.

Its companion bill, Senate Bill 1938, cleared the Senate on April 17, with all 31 members voting in favor. Because the bills are identical, should HB 3995 pass the House, it would only require the governor’s signature to become law — and become effective immediately, thanks to an “emergency rider.”

Texas officials often boast of the state’s 17-year-old deregulated electricity market as being the world’s best competitive market. It’s also the same state, opponents of the legislation note, where the $6.8 billion Competitive Renewable Energy Zone project resulted in 3,600 miles of high-voltage transmission lines being built in just five years.

“An ironic twist,” said Vera Carley, a spokesperson for GridLiance, a competitive transmission company that caters to public power agencies.

The bills would grant certificates of convenience and necessity (CCNs) to build, own or operate new transmission facilities that interconnect with existing facilities “only to the owner of that existing facility.”

GridLiance and other opponents of the legislation argue it would:

- Make it illegal for anyone other than incumbent utilities to build new transmission in Texas.

- Eliminate the Texas Public Utility Commission’s authority to license new entrants to build transmission assets and provide transmission services.

- Prevent public power utilities and cooperatives from choosing with whom they want to partner by limiting their choice to the local incumbent utilities.

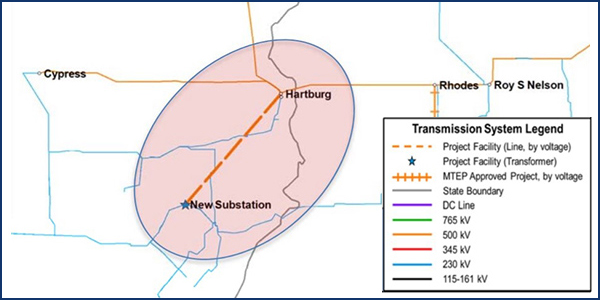

- Overturn the Hartburg-Sabine Junction 500-kV project, which MISO last year awarded to NextEra Energy Transmission (NEET). The PUC has yet to grant a CCN for the project, though FERC in March authorized NEET to recover all “prudently incurred” costs related to its investment in the project. (See NextEra Gains Incentive for Hartburg-Sabine Project.)

The bill’s opponents include the U.S. Department of Justice, which responded to an inquiry by Texas Rep. Travis Clardy by expressing concerns that the bills would “limit competition, thereby potentially raising prices and lowering the quality of service for electricity consumers.”

“By restricting the development of transmission facilities to local incumbents, H.B. 3995 can harm consumers by reducing or eliminating competition,” wrote Daniel Haar, acting chief of competition policy and advocacy in DOJ’s Antitrust Division. “Even if an incumbent is best-situated to develop a particular project, H.B. 3995 would likely reduce the competitive pressure on such incumbents to develop higher-quality, lower-cost transmission facilities.

“Furthermore, consumers may face higher electricity rates and less reliable service, as H.B. 3995 may limit construction of transmission that would increase the supply of generation available to serve a local territory or area,” he said.

‘Multitude of Benefits’

GridLiance is among those leading the charge against the legislation. In written comments filed with the State Affairs Committee, CEO Calvin Crowder said the bill would “deprive Texans … of the benefits of planned competitive transmission processes and would protect incumbent investor-owned utilities from competitive forces that drive project costs down.”

Crowder backed up his argument by pointing to a Brattle Group study of U.S. projects that found noncompetitive projects average 34% above initial estimates, while winning bids in competitive projects average 40% below estimates.

NEET Southwest won the Hartburg-Sabine bid with a $115 million bid, below MISO’s $122.4 million project estimate.

Aundrea Williams, president of NextEra affiliates NEET Southwest and Lone Star Transmission, said in testimony before the State Affairs Committee that the Florida-based company “supports preserving the PUC’s jurisdiction over [in-state] transmission projects.”

“The PUC … should not be forced to pick from an unnecessarily limited set of qualified transmission providers,” she said. “Options would be taken away from the PUC, and thus Texans would be robbed of the multitude of benefits that transmission-only utilities provide.”

Commission spokesman Andrew Barlow said simply, “The PUC will implement whatever legislation becomes law.”

Xcel Energy subsidiary Southwestern Public Service supports the legislation “because our ability to build and own transmission lines that connect to our regional system protects our customers’ best interests,” spokesman Wes Reeves said.

“We have a long history of building transmission lines at a lower cost to our customers, and we have the resources available to repair them quickly to ensure the reliability of the system,” Reeves told RTO Insider.

Xcel and SPS have an appeal pending before the Texas 3rd Court of Appeals that protests a prior PUC declaratory order saying there is not a ROFR in the SPS service area. (See Texas Commission Rejects SPS ROFR Request.)

Williams said utilities supporting the legislation have lost their arguments on competitive transmission awards wherever they have made them.

“They took a swing and lost at the PUC; they took a swing and lost in the courts; and they took a swing and lost in the markets,” she said. “Now, as a last resort, they are changing the rules of the game. They’ve already had their three strikes and are out. Their market design is not what is best for Texas.”

Point, Counterpoint

The legislation has resulted in a flurry of competing op-eds in Texas newspapers.

Former FERC commissioner Tony Clark weighed in on the debate with an op–ed in the Houston Chronicle calling for the bill’s passage, writing that there’s “scant proof” that FERC Order 1000’s competitive process would “benefit Texas consumers, employers or industry.”

“At worst, [Order 1000] does more harm than good, delaying investment in needed transmission projects,” Clark said. “The only verifiable results of the federal process? Bureaucracy, litigation and delay. It is a rule with high compliance costs, but few tangible results to date. That’s not competition; it’s just a regulation that does not work.”

Clark’s op-ed was rebutted by Allen Johnson, director of government affairs for Citizens Against Government Waste in D.C. Johnson’s counterpoint said the legislation is “clearly designed” to protect the incumbents at the expense of customers.

The legislation “would not only apply to any future transmission projects, it would overturn a competitively awarded transmission project,” he said. “Rather than receiving the lower prices that would be provided by the winning bidder, consumers would be stuck with the current transmission company. … This is plain and obvious corporate welfare.”

Bernard Weinstein, associate director of Southern Methodist University’s Maguire Energy Institute, took Clark’s argument a step further in the Dallas Morning News by saying the legislation is necessary because “a few companies and hedge funds are attempting to upend the system” by imposing Order 1000 on Texas.

That would open the state to federal regulation, Weinstein warned, overlooking the fact SPP and MISO already have footprints in Texas. The PUC and ERCOT, which would be responsible for implementing the bills, are not FERC-jurisdictional.

“Let’s not be seduced by the claim that so-called competition in transmission line development will mean a better deal for households and businesses. It won’t,” Weinstein said.

Williams responded with a letter to the Morning News. Identified only as “Aundrea Williams, Austin,” she charged that the legislation was prompted when NextEra “beat out the incumbent by tens of millions of dollars.”

“Supporters of the bill refuse to address the savings to Texans,” Williams wrote. “Make no mistake: Texans will have safe power either way, but their way costs a whole lot more. Texans deserve the best, and taking time to study the issue lets our representatives do that. Don’t let sore losers become winners — force them to do better.”