When adjusted for one-time gains and costs, the Houston-based company’s earnings came in at 46 cents/share, falling 4 cents short of Zacks Investment Research’s consensus.

Still, CEO Scott Prochaska said he was pleased with the results.

“While weather-related impacts affected first-quarter earnings, we remain confident in our anticipated 2019 full-year performance. Our utilities continue to benefit from strong customer growth and recovery mechanisms allowing for timely recovery of capital invested on behalf of our customers,” he said.

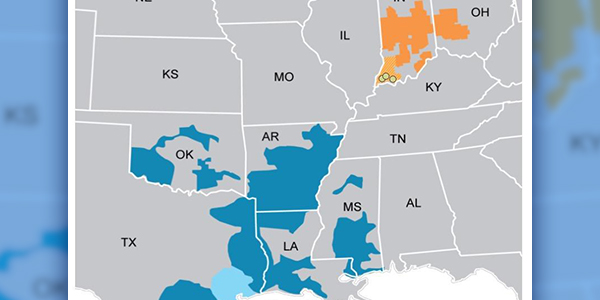

CenterPoint’s earnings excluded costs and other impacts of its $6 billion acquisition of Vectren. The Indiana utility, the acquisition of which was completed Feb. 1, reported a one-month operating loss of $9 million, which included $20 million in merger-related expenses.

The Indiana Utility Regulatory Commission recently recommended CenterPoint consider smaller-scale options instead of a proposed 700- to 850-MW combined cycle natural gas turbine, company officials said.

“The commission wants to see investment made in ways other than a bet on a single large plant,” Prochaska told investment analysts during a call Thursday.

CenterPoint’s share price closed Thursday at $29.25, down almost 4% from the previous close.

— Tom Kleckner