By Christen Smith

Three nuclear plants facing early retirements in Pennsylvania and Ohio would keep wholesale energy market net-load payments lower — in most cases — if they stay online, a PJM analysis released Tuesday concluded.

But there’s one caveat: The study’s projections don’t include the costs of potential subsidies.

That point is an important one for critics of out-of-market payments designed to prop up certain forms of generation. Supporters argue, however, that nuclear power’s benefits of reliability and zero-carbon emissions make it stand apart and deserve special consideration.

“The PJM report confirms that consumers and the environment benefit by preserving existing nuclear plants and replacing aging, carbon-intensive coal generation with new renewables and natural gas,” said Paul Adams, spokesperson for Exelon, owner of the nation’s largest nuclear fleet — including the soon-to-be shuttered Three Mile Island near Harrisburg, Pa. The company’s attempt to make the plant profitable through a state-imposed subsidy failed in that state’s legislature last month. (See Exelon to Close Three Mile Island.)

Adams said the report reaches the same conclusions of multiple other analysts and consultants that found “retaining the nation’s existing nuclear plants is the cheapest way to maintain environmental progress and would cost consumers billions less than allowing them to retire.”

But it seems lawmakers and regulatory bodies in both Pennsylvania and Ohio have remained unconvinced that extending the lives of nuclear plants overrides the need to maintain a competitive wholesale electricity market. Both the Pennsylvania Public Utility Commission and the Ohio Consumers’ Counsel requested the PJM study to better grasp the cost and emissions impacts of retiring reactors at Beaver Valley, Davis-Besse and Perry nuclear plants as proposals to enact subsidies for all three still pend before lawmakers.

“It was counter to logic when FirstEnergy Solutions testified in the Ohio House of Representatives that electric consumers would pay more if its antiquated nuclear plants are shut down,” said J.P. Blackwood, spokesperson for the OCC. “PJM’s findings for consumer savings from power plant competition confirm that a competitive generation market is better for millions of Ohio consumers than charging them for bailouts and subsidies under House Bill 6.”

PJM Simulations

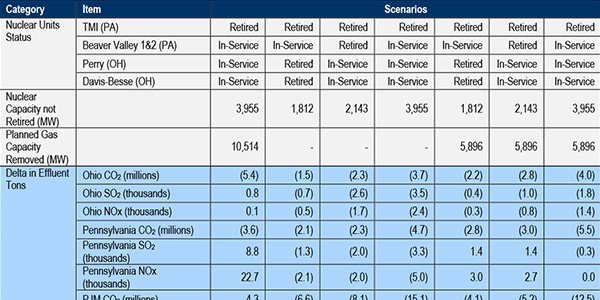

PJM obliged the requests by creating six scenarios against which to compare what the RTO considers its base case: all three plants retire, and scheduled gas and renewable generators with an in-service date of 2023 come online, reducing net-load payments by $1.6 billion. Carbon dioxide emissions would likewise decrease by 4.3 million tons, while nitrogen oxide and sulfur dioxide emissions would fall by 37,900 tons and 18,200 tons, respectively, the analysis concluded.

Should all three nuclear plants stay operational and new generation enters the market as planned, net-load payments would decrease by an additional $474 million from the base case. In Pennsylvania, emissions of CO2, NOx and SO2 would decrease from the base case by 4.7 million tons, 5,000 tons and 3,300 tons, respectively. In Ohio, the additional emission reductions total 3.7 million tons, 2,400 tons and 3,500 tons, respectively.

The results are similar — net-load savings increase and greenhouse gas emissions decrease — when either just Beaver Valley or the Ohio plants stay online, PJM found.

Tom Becker, a spokesperson for FirstEnergy Solutions, the bankrupt company that owns Davis-Besse and Perry, said Wednesday that the simulations confirm that their plants provide valuable benefits to Ohio, including $30 million in annual state and local tax revenues, a diversified resource mix, 4,300 jobs and 90% of the state’s zero-emission energy.

PJM went a step further, however, and modeled the impact of a 50% reduction in new gas-fired generation coming online as a reaction to nuclear subsidies entering the market.

If all three plants remain operational and planned gas projects decline by half, net-load payments would decrease by $91 million from the base case.

“This is because the retention of all the nuclear plants and their associated energy production is sufficient to offset the impact of the reduced new entry,” the study noted. “This reduction in customer payments, however, is not netted against the cost of a potential subsidy to consumers in a particular state.”

Under that scenario, carbon emissions would likewise plummet from the base case by more than 9.5 million tons in both states combined with smaller decreases in NOx and SO2.

If either state retires their plants while the other’s stay online, however, net-load payments increase from the base case by between $164 million and $240 million. Emissions would still decrease in Ohio, but Pennsylvania’s NOx and SO2 emissions would both rise, because of the reliance on less efficient coal-fired generation in the absence of new gas units.

Joe Bowring, PJM’s independent market monitor, said Thursday the latter scenarios — losing only a few of the plants and at least half of the planned gas generation — are far more likely than the other simulations.

“Those models are a lot more realistic,” he said. “I would have discounted the new gas units even more than 50% [to account for impacts of potential subsidies].”

Subsidy Plans Alive in Both States

It’s not clear how PJM’s analysis will move the needle — if at all — in the state legislatures, where plans to subsidize all the plants still remain active.

Ohio’s proposed Clean Air Program was still pending before the Senate as of Wednesday, one week after the lower chamber approved the controversial measure to effectively gut the state’s renewable portfolio standards in favor of ratepayer fees for FirstEnergy’s nuclear plants. (See Ohio Plan Subs Nuke, Fossil Fuels for Renewables.)

Meanwhile, a bill to expand Pennsylvania’s Alternative Energy Portfolio Standard to include nuclear power languishes in the House Consumer Affairs Committee while lawmakers tend to the annual budget, due June 30. The delay meant the bill couldn’t save TMI, but state officials said that doesn’t mean the issue is dead. (See Nuclear Subsidies Still on the Table in Pennsylvania.)