By Christen Smith

A battle over the future of the financial transmission rights market looms for PJM as stakeholders dig into the causes behind the GreenHat Energy default and consider ways to prevent such an event from ever happening again.

In one corner, the Independent Market Monitor, the Organization of PJM States Inc. (OPSI) and some RTO staff believe reforms should extend beyond credit and risk management policies to the FTR market structure itself, as suggested in the PJM-commissioned review of the conditions that allowed the situation to unfold. (See Report: ‘Naive’ PJM Underestimated GreenHat Risks.)

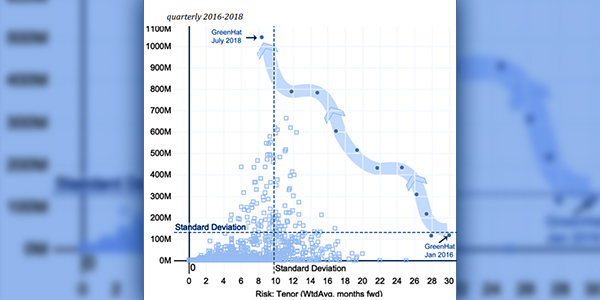

In the other corner, stakeholders and staff argue the FTR market structure remains sound and is vital to keeping costs low for consumers because it allows market participants to appropriately hedge congestion risk. Their interpretation of the independent probe concludes that failures in PJM’s credit and risk management practices and unresponsive leadership allowed this small, unknown trading company to amass the largest portfolio of FTRs in RTO history in just a few short years — more than doubling the positions held by the second-largest market participant that had been building its folder for at least a decade.

The Energy Trading Institute stands in favor of keeping FTRs around. In a white paper released Wednesday, the policy group urged the PJM Board of Managers to ignore overtures from the Monitor and OPSI to reform the market, insisting the groups are just trying to distract from the real causes of the default.

“What matters for consumers is getting the lowest price possible in the competitive retail markets or standard offer/default service auctions where consumers actually lock in the cost of their electricity,” said Noha Sidhom, ETI executive director. “By eliminating or reducing FTRs, OPSI and the Market Monitor would significantly increase the risk premium needed by retail service providers to serve customers in their specific locations.”

PJM Monitor Joe Bowring said Monday that modifying the existing structure — including increasing auction frequency, reducing the number of paths to auction and eliminating long-term FTRs — would help return the FTR market “to its fundamental purpose.”

“The current path-based FTR market is inconsistent with LMP and the payment of congestion in a network system,” he said. “Congestion is simply the difference between what load pays and generation receives as a result of transmission constraints.”

In particular, Bowring noted the generator-to-generator path to auction could be eliminated because LMP provides appropriate price signals and the right incentives for location and operation of generating units.

“All congestion belongs to load because load is the source of all congestion revenue,” he said. “Generators do not pay congestion. Generators appropriately receive LMP at their location. FTRs were not designed to ensure that generators receive a higher price than their LMP.”

Sidhom counters that only the “granular and diverse” nature of FTR products provide market participants with enough confidence to protect themselves against congestion risk and diversify their portfolios. Eliminating paths to auction will distort prices and raise risk premiums, she said.

“Limiting the availability of such paths for purchase in the FTR market will limit the load-serving entity’s ability to more exactly target and prevent its exposure to that constraint,” she writes in the ETI white paper, noting that the generator-to-generator path has proved invaluable to the growing share of wind and solar resources coming online. “If you eliminate a generator-to-generator path, the wind generator would be forced to face the financial exposure of its FTR against a load node, zone or hub, when wind output is low. This would be a far less effective and riskier hedge for the wind plant.”

Bowring argued current market design forces load to accept whatever prices FTR buyers offer, which leaves them collecting about 80% of the congestion revenue owed to them — a share that drops even further for long-term FTRs. He recommends that PJM first assign congestion revenue to load and then allow LSEs to sell these rights as FTRs at an agreed-upon price.

“PJM can decide how to structure that auction,” he said. “As with the current FTR auctions, any participant could buy such FTRs including generators and speculators.”

Deeper Review

In a May 24 letter to the board, OPSI President Michael Richard supported a deeper review of FTR market structure, noting that current rules “lack adequate financial protection for load.” The organization declined to comment on the contents of the ETI white paper.

Chairman Ake Almgren said in a June 7 response letter that the PJM board shares OPSI’s view of the importance of reviewing FTR products, but he noted it’s beyond the purview of the recently formed Financial Risk Mitigation Senior Task Force. (See PJM Stakeholders OK Risk Management Task Force.) He said the board instead expanded the charter of the Audit Committee to include direct supervision of risk management and that PJM continues to “actively recruit” for a senior level executive to lead the process.

“The task force is charged with assessing credit risk mitigation and management and not general market design,” he said. “However, we expect the task force will consider whether credit risk can be appropriately mitigated by steps to simplify existing FTR products and increase the frequency of FTR auctions.”

The task force began work last month to consider changes to credit and risk management requirements, market rules, membership qualifications and the stakeholder process in response to an independent probe of the default that uncovered structural flaws. PJM wants stakeholders to form solutions and make recommendations for Tariff and Operating Agreement revisions to the Markets and Reliability Committee and board by the end of year.

“We are committed to examining whether our current FTR product offerings present risk management challenges that outweigh the overall benefits,” Almgren concluded. “However, at the same time, we cannot delay taking actions that might offer near-term opportunity to mitigate immediate risk exposure. Before embarking on broader market design changes, PJM will retain experts, as we have in the past, and our Market Monitor will be an integral part of that process.”

PJM spokesperson Jeff Shields said Monday that RTO management agrees with several of ETI’s points and disagrees with others, though the board will respond “in the near future” and consider stakeholder feedback when deciding what reforms to recommend to FERC.

“As is typically the case with letters to the board, the issues in play are contentious, with strong feelings on all sides of the debate,” Shields said. “PJM and its membership are underway with a comprehensive assessment of better ways to mitigate and manage FTR credit risk.”